- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 14, November 4 - November 11)

Welcome to Vol. 14 of Keyed In, the official Consortium Key newsletter!

Who would’ve guessed crypto would be responsible for the biggest rally of the US election cycle??

Last week we saw a market-wide pump following election day as traders begin to position themselves for a fresh regime in Washington. Faces were melted, shorts got demolished, BTC hit fresh ATHs, and CTMC jumped nearly 20%.

But wait, there’s more! Call now to receive 1 BTC for the low price of $88K, courtesy of the double digit rally since this week’s open ☎️

**Offer remains available at participating locations while supply lasts!** 😉

Expecting a wild week ahead with CPI and PCE data, but there’s plenty to cover in the meantime, so let’s key in!

TODAY’S MENU:

🐂 Bernsteins Bulls - Top Crypto Picks

🇺🇸 FORT GOX - US Bitcoin Reserve

🏦 ADA.GOV - Charles Hoskins Crypto Office

☕️ Fresh T/A, and more!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

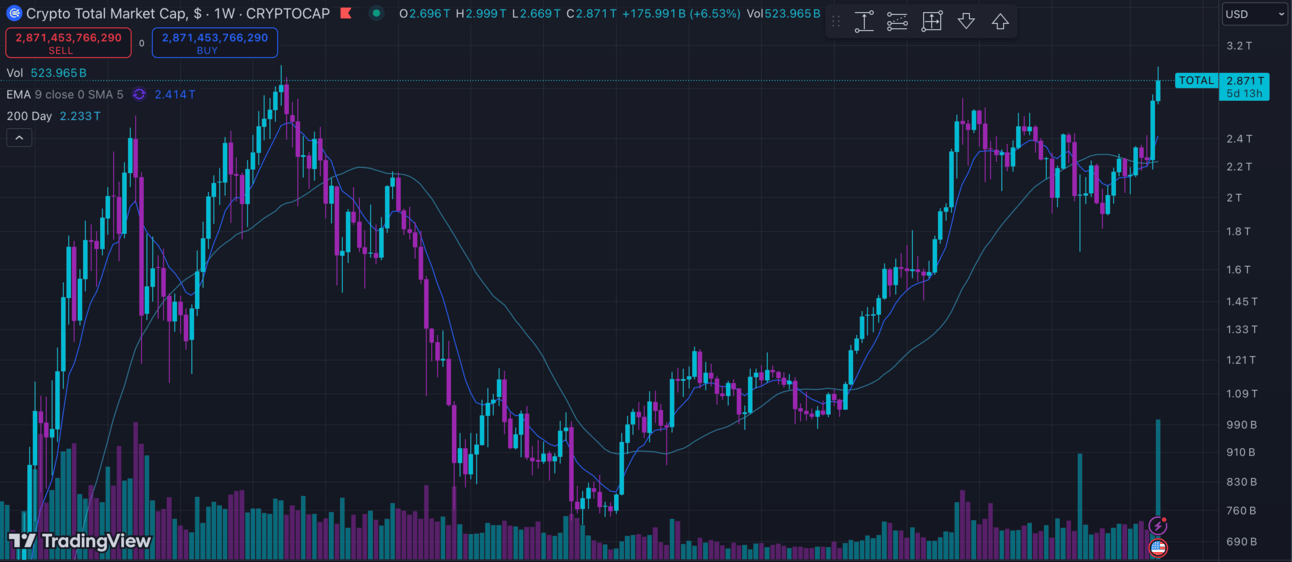

CTMC O:2.248T H:2.749T L:2.182T C:2.696T +447.149B (+19.89%) V:139.078B

CTMC had a neck-breaking week following the US election, gaining nearly 20% and reaching the highest levels seen since November 2021. Cascading liquidations totaled a mind-numbing $2.8B throughout the week. ETFs put up a record $1.3B in net inflows with the help of a record $1.36B added Thursday alone. The index outperformed its equity counterparts considerably (DJI +4.31%, SPX +4.66%, NDQ +5.41%), all three of which saw a series of fresh ATH’s leading up to Friday’s close.

This week’s open saw extended rallies across the board, culminating in a record $3 trillion total market cap across crypto assets. Retracement has been largely nonexistent. The $3T level marked the ultimate peak of the previous cycle, setting the stage for a date with destiny as we move into the latter half of November’s trading.

🐂 BERNSTEINS BULLS - TOP CRYPTO PICKS

Bernstein research published a report on Monday giving a major endorsement to the crypto sector amid the market wide pump to start this week’s trading. The analysts recommended clients “buy everything you can”, highlighting continued bullish sentiment despite the double digit rally we’ve seen since the election. Obviously this advice should be take with a grain of salt for those of us in the memecoin space, but sentiment is clear regardless.

Analysts attribute market strength to Washington’s fresh political climate, “pushing asset managers, brokers, and private investors alike to reconsider their crypto exposure as optimism grows across the market.” The report set a BTC price target of $200K by 2025, still expecting “ETH, SOL, and other digital assets to outperform BTC over the next 12 months.” Bernstein’s Digital Assets Basket features Arbitrum, Optimism, and Polygon—a clear endorsement for plays in both DeFi and scalability.

🇺🇸 FORT GOX - US BITCOIN RESERVE

Following the reelection of former President Donald Trump, US Senator Cynthia Lummis reaffirmed her plans to create a strategic US National Bitcoin Reserve. The BITCOIN Act, first proposed in July, would direct the US Treasury to acquire 1 million BTC over 5 years to support USD against debasement. The reserve also aims to slash national debt in half by 2045 and position the US as a leader in financial innovation.

The proposal has been backed by politicians on both sides of the aisle along with key figures in the industry, including Michael Saylor and Pierre Rochard, the VP of Riot Platforms. With republicans having likely secured both the US house and the Senate, the odds of the bill’s passing have significantly improved. Lummis has long been an advocate for BTC—the full breakdown of the bill can be found here.

WE ARE GOING TO BUILD A STRATEGIC BITCOIN RESERVE 🇺🇸 🇺🇸 🇺🇸

— Senator Cynthia Lummis (@SenLummis)

5:05 PM • Nov 6, 2024

🏦 ADA.GOV - CARDANO’S CRYPTO OFFICE

As rumors swirl surrounding his potential appointment as Trump’s Crypto Advisor, Cardano (ADA) founder Charles Hoskinson announced plans to establish a policy office in Washington, DC. Aimed at building bipartisan support for crypto-friendly regulations, Hoskinson hopes to work with lawmakers to advocate for clear, common-sense regulations for the industry.

Since the announcement and amid the rumors, ADA has rallied nearly 75%. The token has returned to the coveted top 10 list, and reached the highest levels since early April. Notably, ADA saw a similar breakout 193 days after BTC’s 2020 halving—suspiciously close to its current breakout just 201 days after the halving in April. Hoskinson aims to have the office open by January of next year. While many outlets are reporting a high possibility of his appointment in the upcoming administration, no announcements have been made from official sources.

“Crypto policy should be written by the American people, the American crypto industry, and well-meaning lawmakers who are willing to take the time to listen,”

LOCKING IN:

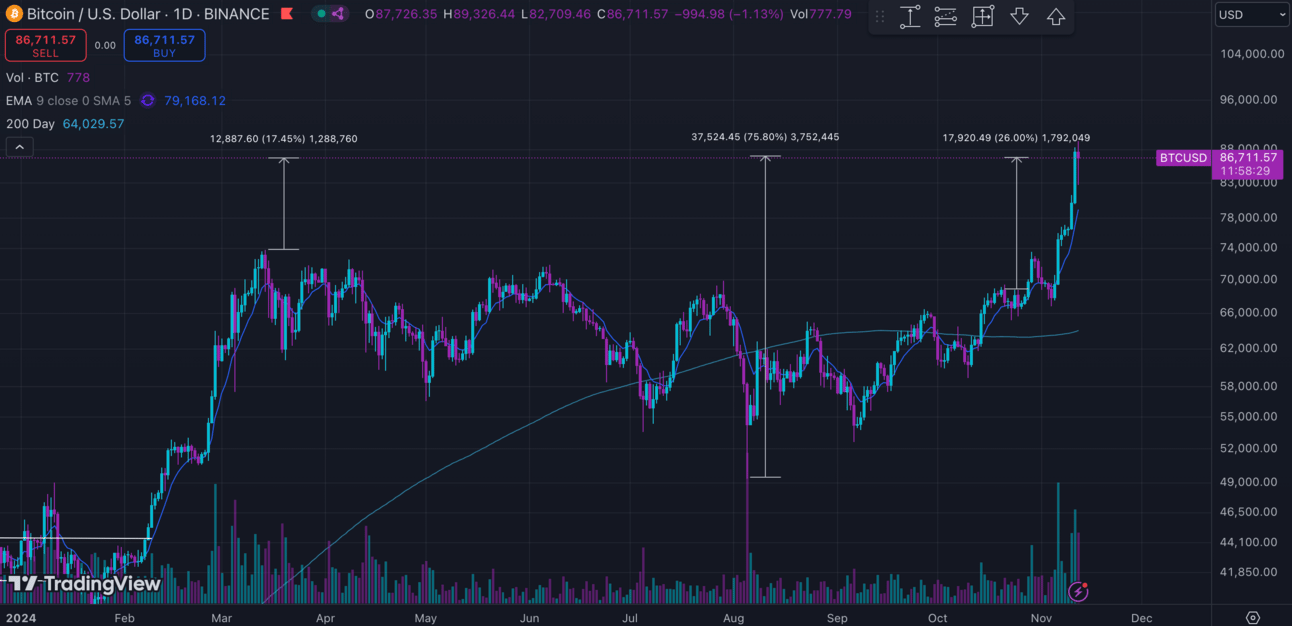

BTC/USD (BINANCE) O:68913 H:81251 L:66832 C:80152 +11243.48 (+16.32%) V:3.707K

BTC had a star-studded performance following the US elections, gaining 16% and reaching a fresh ATH of 81K by week’s end. Record ETF inflows totaling $1.3B and a historic short squeeze were the main drivers of the move, as both retail and institutional investors begin to position themselves for a meaningful policy shift in Washington. Things only continued to ramp up since this week’s open, with BTC tacking on an additional 9.6% in the Monday session, the largest single day price move for the asset since inception.

Technically speaking, our 3 bar play deep dive in Vol. 12 of Keyed In has played out fantastically. BTC has added nearly 25% since our initial breakout call, and there is certainly no shame in some profit taking here for those who were able to catch the move. Assets often need time to rest after going on such wide range moves, and missed money is ALWAYS better than lost money! That being said, BTC has made clear its desire to move higher. The market is very clearly eyeballing psychological resistance at 100K. A confident move beyond 90K could easily open the doors to test a 6 figure BTC, well worth our attention as we move beyond the 6 month mark of BTC’s halving.

ETH/USD (BINANCE) O:2457 H:3250 L:2357 C:3185 +729.22 (+29.68%) V:428.061K

ETH flipped the script last week, channeling the Undertaker and gaining nearly 30% by Sunday’s close. ETH’s ETFs finally got the memo, adding a weekly record $154M in net inflows throughout the week, eclipsed even further by a daily record $295M in yesterday’s session. After being trapped in a bearish consolidation pattern for nearly 8 months, it would certainly seem ETH is poised to take a crack at greener pastures.

Looking at the technicals, last weeks breakout call at $2750 has proven extremely well advised. As discussed, ETH needed to make up for considerable lost ground in order to provide an attractive option for capital allocation. After regaining the 200D MA and breaching the 70% RSI level for the first time since March, it would seem ETH has been taking notes. Similar to its eldest sibling, ETH may need some time to rest here, and there is no shame in some profit taking for those who caught the move. That being said, ETH has considerable ground to cover relative to its price at BTC’s 2021 peak, providing plentiful upside so long as momentum can continue.

DXY O:104.317 H:105.441 L:103.373 C:104.951 +0.634 (+0.61%)

DXY locked in a 0.64% gain last week, marking the 6th consecutive green candle on the weekly despite a clear return to risk on trading. Bets on a stronger dollar under a Trump administration have played out predictably, with DXY finally gaining some ground above its 200D MA. Technically speaking, the index remains very much trapped in its 2 year channel, with 106.2 likely acting as the nearest resistance worth our attention.

Last week’s rate cut was almost entirely priced in, and should come with no surprise to those who have kept up with our weekly reports. December’s decision is a bit murkier, with 68% of participants expecting another 25bps cut according to data from CME FedWatch. Polymarket bets have largely fallen in line, with 70% of bettors expecting the same.

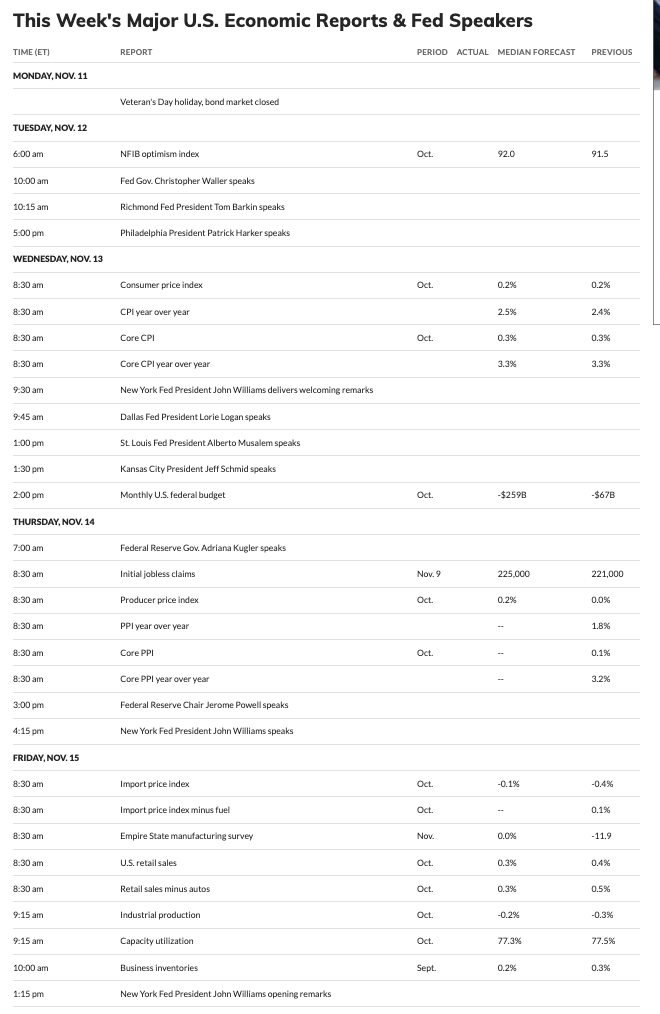

Looking ahead, we’re getting several Fed speeches this week leading into CPI Wednesday and PPI Thursday. Both readouts will be well worth our attention, likely providing the best picture regarding what to expect from the US Fed moving forward. Experts expect both figures to show declining inflation. Bank earnings will likely take center stage, with JPMorgan Chase, Wells Fargo, BlackRock, and BNY Mellon all reporting quarterly results.

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment below and don’t forget to vote in this week’s poll! Stay tuned for next week and—in the meantime—consider yourself Keyed In!

WEEKLY POLL:

CHEEZY CHARTS:

CTMC (2021-2024)

BTC (2021-2024)

ETH (2021 - 2024)

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

Feel free to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Also, don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!