- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 12, Uptober 21 - Uptober 28)

Welcome to Vol. 12 of Keyed In, the official Consortium Key newsletter!

Last Tuesday we forecasted light corrections on the horizon based on the depth of our recent move and the streak of fresh highs in US indices. Our predictions were on the money, and we saw dips across the market heading into this weeks open. SPX snapped a 6 week win streak, and CTMC saw a 3% haircut. SOL and GOLD—however—clearly didn’t get the memo, leading to decisive outperformances and another week of fresh ATHs for the latter.

Engulfing rallies to start this week’s trading with wide range breakouts and clear restructuring of previous consolidations. Waves are certainly starting to kick up, so let’s dive in while the waters nice!

TODAY’S MENU:

☀️ SOL Survivor—Memecoins buck the market

⛓ Kraken DeFi—No chain, No gain

🏦 Stripe’s Billion Dollar Stablecoin Bet

☕️ Fresh T/A

📊 BTC 3 Bar Play Breakdown, and more!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:2.334T H:2.355T L:2.17T C:2.263T -70.706B (-3.03%) V:141.198B

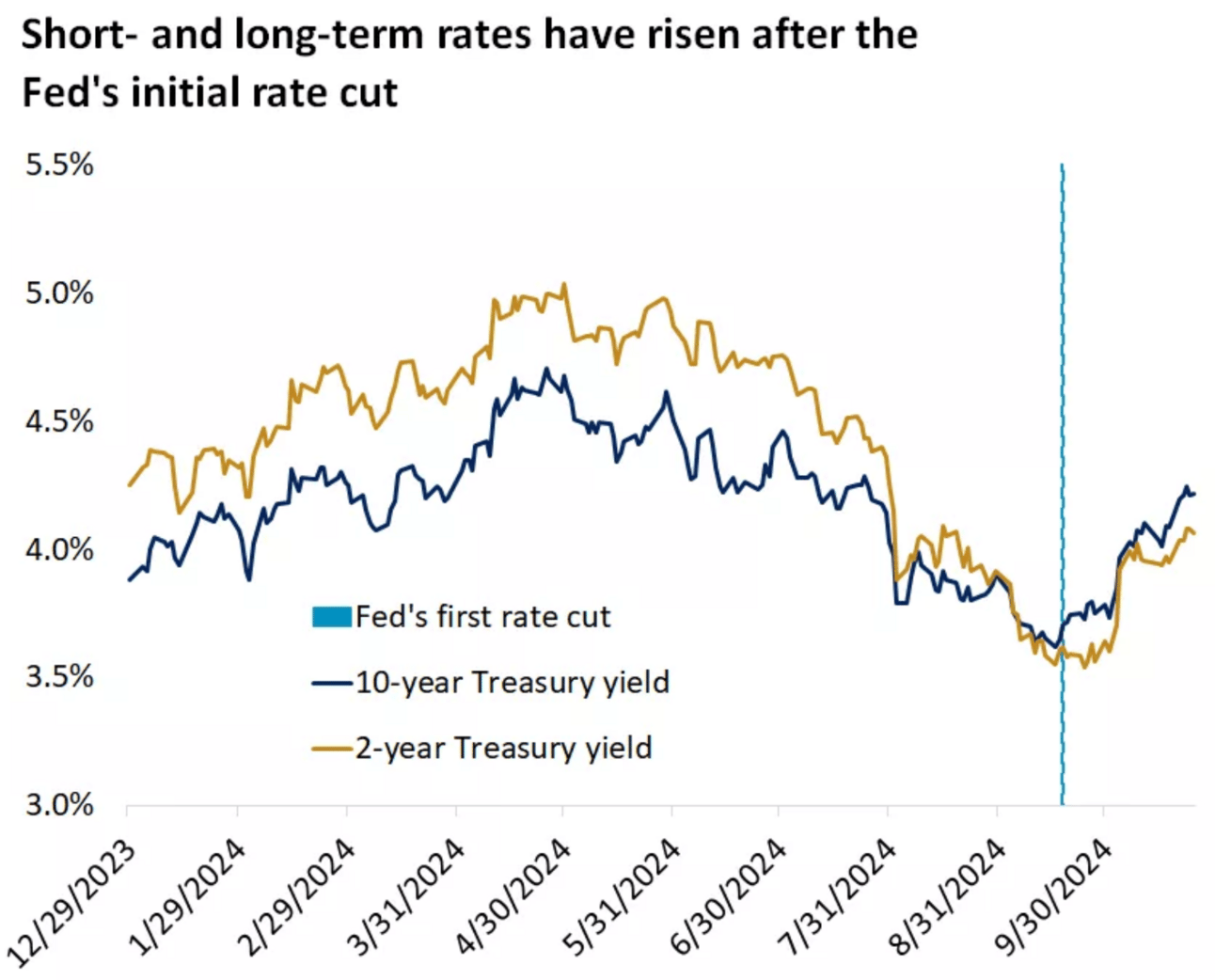

CTMC was unable to avoid last week’s dip, shaking a modest 3% with the help of rising treasury yields and overextended rallies in US equities. Assets often need time to rest after going on such heavy sprints, and corrections of this size were to be expected. Retracement is the key factor here, and CTMC remained well above the 50% level—leaving plenty of room to continue the run post-consolidation. Naturally, just as we began to put together this week’s report, CTMC proved exactly that.

After fully engulfing the entirety of last week’s losses since Monday’s open, CTMC seems poised to show strength as we head into the final days of Uptober trading.

☀️ SOL Survivor

SOL weathered the storm last week, rallying in the midst of a market correction with the help of some serious memecoin trading. The move came with some pretty impressive metrics, including ATHs for SOL/ETH and record daily/active addresses. Network income hit fresh highs for four consecutive days, ultimately flipping ETHs daily fees. Notably, 77% of SOL’s DEX trading volume is memecoin related, with over 40K tokens created Thursday alone.

The network has gained nearly 20% this month, continuing to outperform both BTC and ETH since Monday’s open.

⛓ Kraken DeFi—No Chain No Gain

In the spirit of healthy competition, Kraken announced the upcoming launch of its own blockchain, called Ink, in early 2025. The platform aims to facilitate decentralized applications (dApps), enabling users to trade, borrow, and lend tokens without intermediaries. The announcement follows a growing list of top exchanges that have found considerable success launching their own chains, including both Coinbase and Binance. Inks’ founder, Andrew Koller, stated that a testnet will be introduced later this year.

Devs will be able to experiment with applications prior to the opening of the chain to retail and institutional users in the first quarter of 2025.

🤝 Stripe for the Taking—$1.1B Stablecoin Acquisition

Less than 2 weeks after integrating payments via USDC, Stripe announced the $1.1B acquisition of Bridge—a stablecoin payment network founded in 2022 to compete with the SWIFT banking system. The purchase of the network marks the largest acquisition in crypto history. For context, Stripe surpassed $1T in payment volume in 2023. The total output of businesses using the processor amounts to 1% of global GDP.

SWIFT is known for its predatory fee structures, and the deal is sure to shake things up considering the sheer volume that SWIFT oversees globally. To put things further into perspective, SWIFT handles about $5T a day, averaging out to a staggering $1.25 QUADRILLION a year. Should Stripe’s stablecoin network manage to successfully capture a fraction of SWIFT’s business, the volume and fees saved globally would be tremendous. The move also goes a long way in legitimizing stablecoins, which are arguably the most common use case for blockchains and the cheapest method of making cross-border payments.

The Stripe / Bridge acquisition is the canary in the gold mine. There are many more Bridges, growing just as fast, bringing stables to the masses.

LOCKING IN:

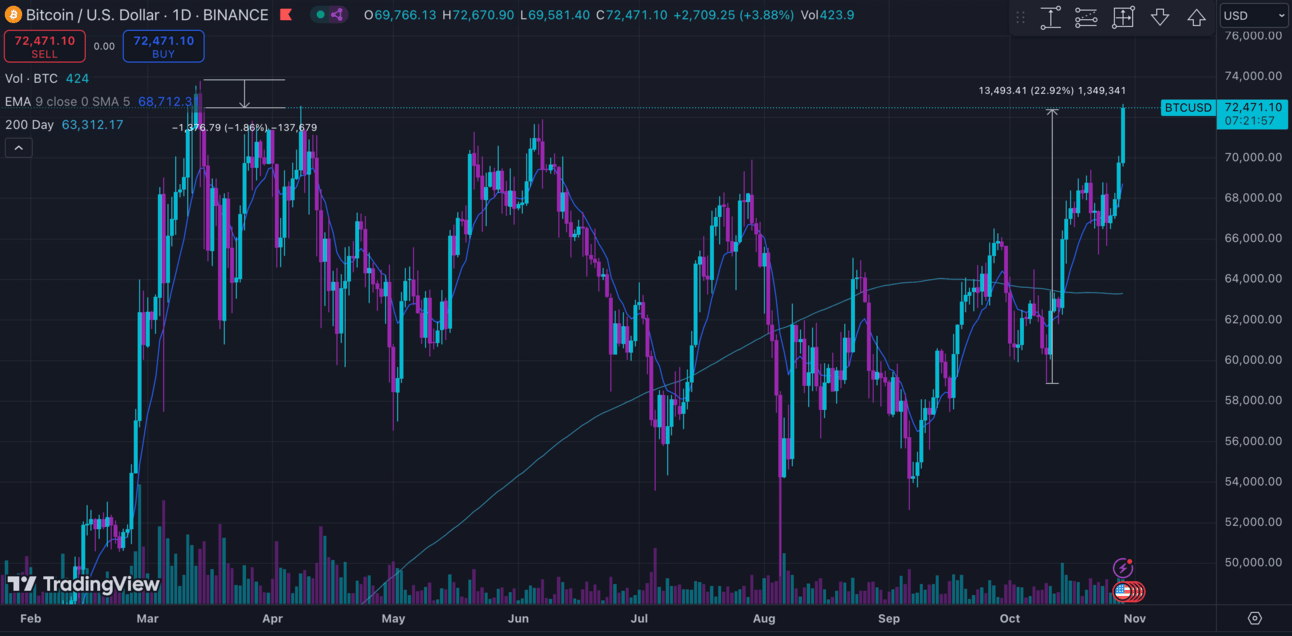

BTC/USD (BINANCE) O:68774 H:69397 L:65234 C:67972 -801.74 (-1.17%) V:1.363K

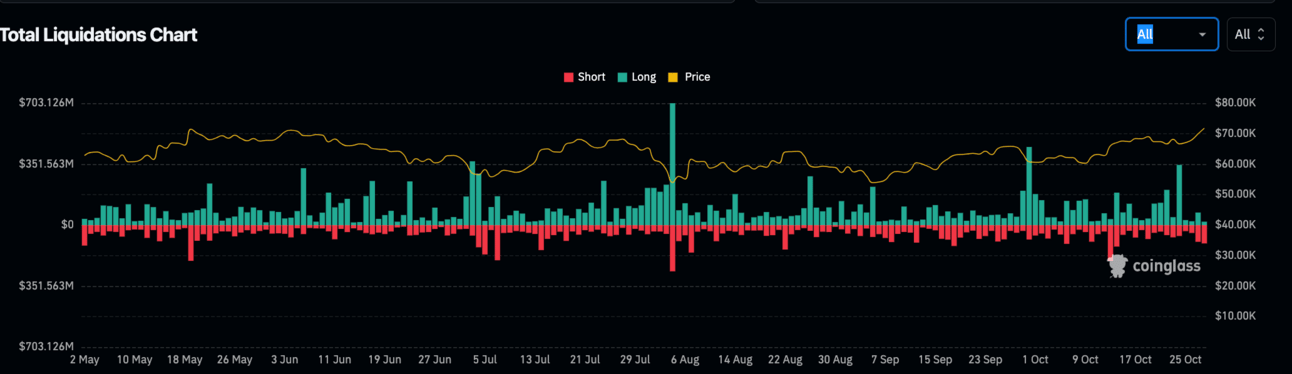

BTC saw marginal losses last week, ultimately shedding just over 1% after bouncing off support at $65,200 Wednesday afternoon. Despite the price pause, ETFs continued climbing, adding just over $1B by weekly close. Liquidations totaled $250M with an additional $85M over the last 24 hours. Since this week’s open, BTC has enjoyed a potent rally, breaching $71K for the first time since early June. Binance whale activity, significant ETF inflows, and bullish bets on the US election regardless of the winner have all contributed to the rally, which has led to $143M in liquidated shorts across CTMC.

Looking at the technicals, BTC seems determined to make a decisive break out of the consolidation pattern that began in March. Last week we called for additional upside in the event of a clean move above 70K. BTC has provided a wide range engulfing candle, suggesting plenty of room to run. Multiple confirmations are key, and the move also coincides with a solid 3 bar play on the weekly. This pattern that has a very strong potential for significant gains—especially considering the amount of time spent in consolidation. The short squeeze has been real, and while there’s certainly no shame in taking some profits for those who caught the move, there’s a strong possibility here for further upside IMO. I’ll link a longer video here from Live Traders for those interested in learning more about the pattern (as it’s one of my favorite to trade) but the basics are as follows:

✅ Bar 1: Wide range igniting bar taking out multiple pivots (volume ignition preferred)

✅ Bar 2: Narrow range resting bar (>50% retracement, relatively equal high as bar 1)

✅ Bar 3: Entry bar—breaks the high of bars 1 & 2

Heres a look at BTC on the weekly, along with a textbook example for comparison:

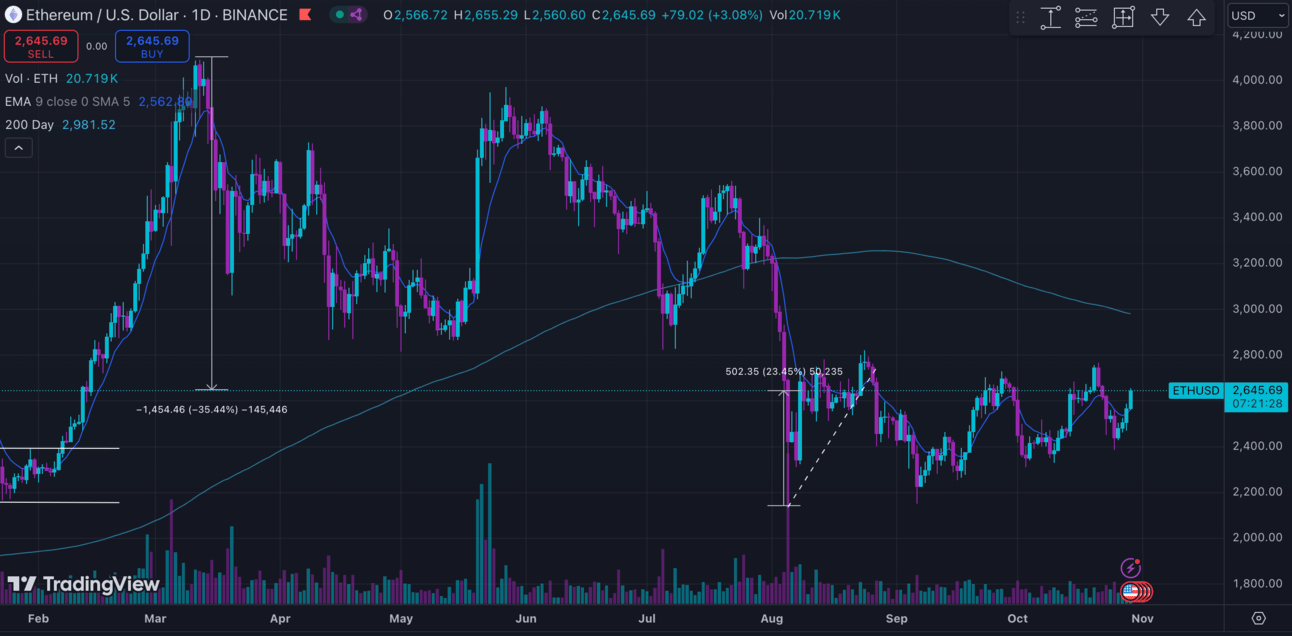

ETH/USD (BINANCE) O:2746 H:2768 L:2381 C:2505 -240.58 (-8.76%) V:154.562K

ETH continued to struggle last week, showing decisive relative weakness with a near 9% correction amid a record outperformance from SOL. Liquidations were largely unchanged—totaling $239M by week’s end. ETH’s ETFs returned to the negative with $25M in net outflows amid record performances from BTC’s. Overall, ETH continues leaving much to be desired. Continued underperformance and inability to retrace last week’s losses despite a market wide rally to start this week’s trading are certainly worth noting.

Moving to the technicals, we continue to cite clear resistance for ETH right around September’s highs at $2750. So long as ETH remains below this level, it will be difficult to justify long positions relative to similar sized entries in its’ counterparts. Looking south, we will continue to monitor the $2550 level for any signs of further downside in play. a move below the $2550 level would suggest much further downside in play, though the move is increasingly unlikely so long as CTMC continues its uptrend.

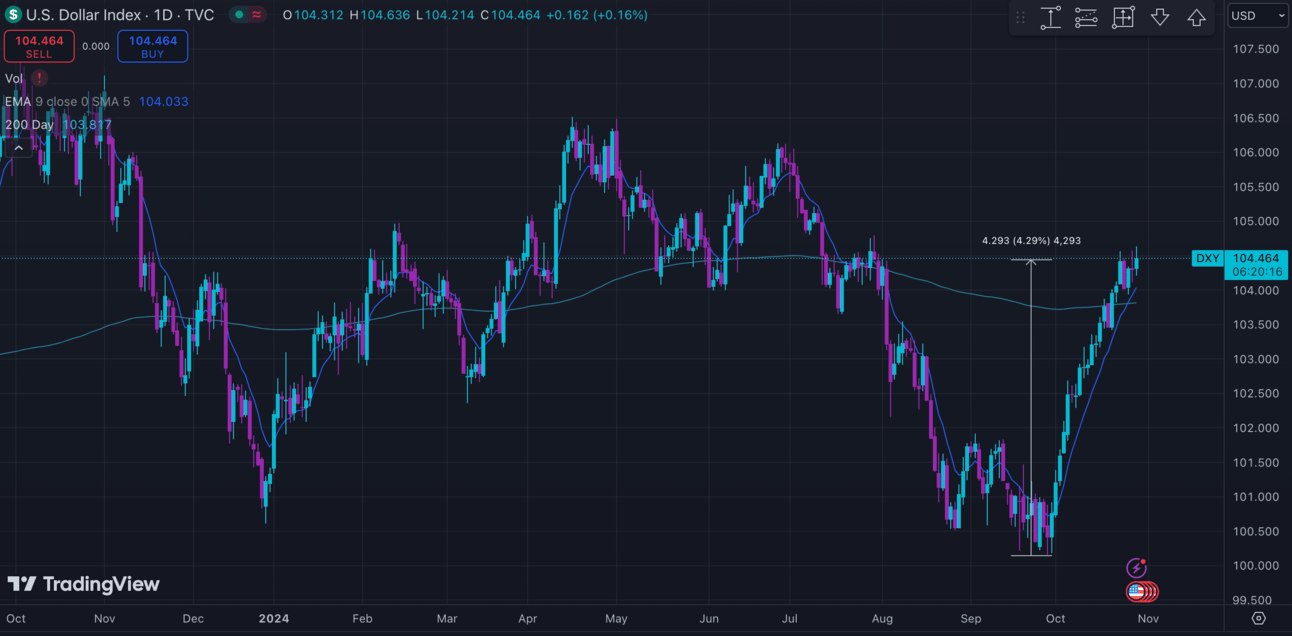

DXY O:103.464 H:104.570 L:103.421 C:104.317 +0.854 (+0.83%)

DXY extended its reversal into the 5th consecutive week, gaining nearly a full percent off the back of rising treasury yields and a shallow correction for risk assets. The break above the 104 level certainly opens the door for further upside, though trend resistance remains notably intact. DXY’s run is arguably overextended, and the lack of movement at this week’s open suggests indecision. Treasury yields still have room to run here post rate cuts, now sitting at 4.3%. As mentioned in last week’s recap, equities can begin to look less attractive to investors as opposed to safe gains via government bonds as yields continue to rise. This trend will absolutely remain well worth our attention as we head into the FOMC and the first few week’s of November’s trading.

According to data from CME FedWatch, traders anticipate an 98% chance of easing in the November meeting, up 10% from this time last week. 50bps bets remain largely nonexistent. In clear contrast to last week, Polymarket bets on the cut remain largely unchanged. The prediction market is currently showing a 60% chance of 100bps worth of cuts this year, up from just 38% at the beginning of October just 1% from last week’s report. PCE data Thursday and employment data Friday should give us a better picture of what to expect moving forward, though most signs point to a 25bps cut to be announced on the 9th of next month.

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment below and don’t forget to vote in this week’s poll! Stay tuned for next week and—in the meantime—consider yourself Keyed In!

WEEKLY POLL:

CHEEZY CHARTS:

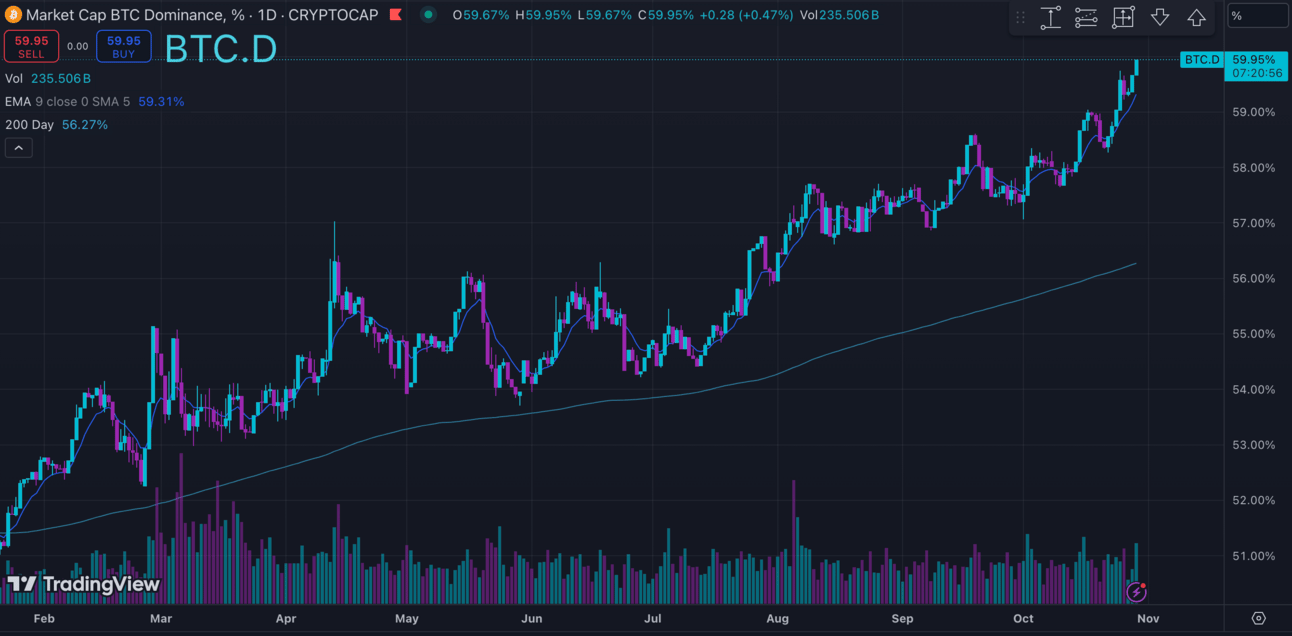

BTC.D

ETH.D

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

Feel free to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Also, don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

KEY READS

Bitcoin's rally continues, led by Binance exchange

“The current #Bitcoin price is being driven by Binance whales, with sustained inflows of U.S. capital.” – By @mignoletkr

Read more 👇

cryptoquant.com/insights/quick…— CryptoQuant.com (@cryptoquant_com)

11:08 PM • Oct 28, 2024