- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 17, November 25 - December 2)

Welcome to Vol. 17 of Keyed In, the official Consortium Key newsletter!

Drop your stocks and grab your blocks, it’s time to breakdown another wild week for crypto!

BTC took a breather, XRP hit 7 year highs, regulators mounted up, and Pump.Fun dumped following last week’s streaming fiasco.

Lots to cover (as always) so let’s dive in!

THIS WEEK’S MENU:

📈 XRP Surges to 7 Year Highs

🌐 Justin Sun Saves WLFI

🏦 Regulations Sweeping the Nations

⛽️ Pump.Fun Profits Slashed

☕️ Fresh T/A, and more!

As my father always said: “Eat what you want, and leave the rest!”

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

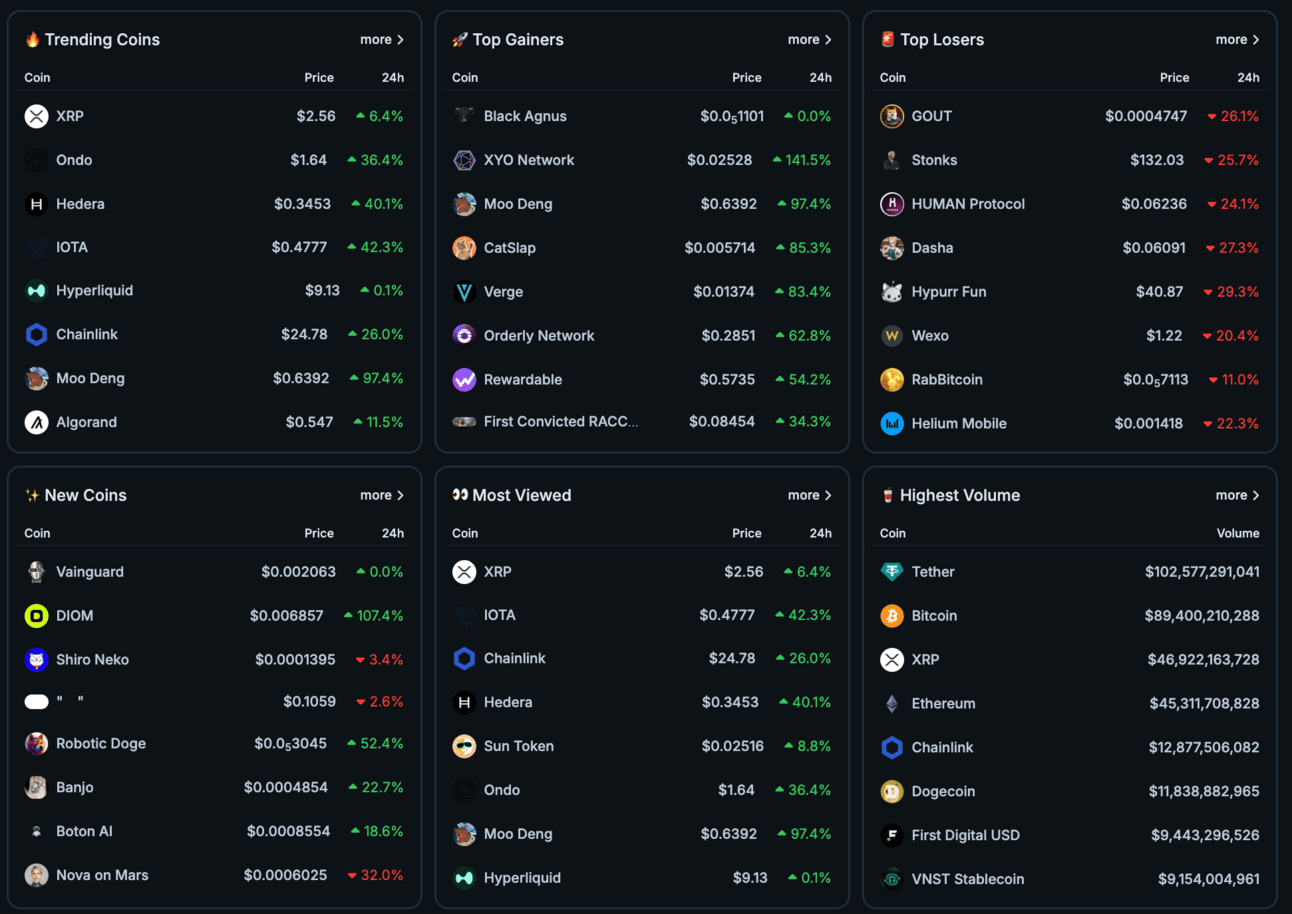

CTMC O:3.27T H:3.43T L:3.03T C:3.39T +113.33B (+3.46%) V:355.73B

CTMC kept on chugging without BTC’s help last week thanks to several major rallies in its top alts. The index continued outperforming its US equity counterparts (SPX +1.06%, NDQ +0.74%), pushing even further beyond the critical $3T level with over $2.3B in liquidations. Now resting comfortably over $3.4T, CTMC has passed its 2021 highs by more than 13%.

A flood of regulatory clarity and pro-crypto cabinet appointments remain the primary drivers of the move. CTMC began this week cresting further into price discovery, falling just short of $3.5T before rejecting yesterday afternoon. Retracement has been minimal, and the index remains up half a percent despite 4 consecutive green candles on the weekly.

TOP STORIES:

Since election day, XRP has been one of the best performers, rising 430% since November 5th.

The rally has been fueled by regulatory updates, including SEC Chair Gensler’s announced retirement and Trump’s crypto friendly cabinet appointments.

Speculation surrounding ETF approval has also boosted prices, with several asset managers including WisdomTree having filed requests for fund approval.

Outside of the US, XRP ETF products have seen $95M inflows this week—67% of yearly totals.

XRP was the third most traded digital asset Monday, surpassing BNB, SOL, TETHER, and taking its’ spot in Crypto’s coveted top 3 market caps.

TRON Founder and crypto billionaire Justin Sun announced a $30M purchase of WLFI, World Liberty’s governance token.

WLF launched in September, seeking $300 million in WLFI sales. After struggling post-launch, it slashed that goal by 90%, seeking just $30M.

The Trump family’s struggling DeFi product had previously sold just $20M worth of tokens prior to Sun’s purchase.

Sun, who just last week ate a $6.2M banana, now owns over 50% of the WLFI tokens in circulation.

According to the project’s gold paper, only after $30 million has been raised to will key participants including President-elect Donald Trump see a payday.

Thanks to Sun’s purchase, the threshold has been reached, and the LLC associated with Trump will now earn 75% of net protocol revenues including token sales.

Regulatory efforts have ramped up globally as the world begins to recognize crypto’s legitimacy as a (taxable) asset class.

As reported by Bloomberg, the U.K. Financial Conduct Authority plans to complete crypto regulations by 2026.

After banning the asset class in 2017, Morocco is looking to enact proper regulations to boost industry growth.

Brazilian Lawmakers proposed a National Bitcoin Reserve last week, hoping to allocate 5% of treasury to the purchase of BTC.

Russia finally recognized crypto as a taxable asset class, introducing a federal law that will impose taxes on digital assets within the country.

Memecoin launchpad Pump.Fun suspended their livestream feature last week following numerous reports of harmful content being broadcast—including animal cruelty, pornography, and literal shit-eating live on the platform.

From 11/18–11/24, DefiLlama data shows Pump.Fun generated $33.83M in revenue for the week, a 400% increase from the start of the month.

Pump.Fun tokens accounted for 62% of Solana’s November volume.

Following the suspension, revenue dropped considerably. The platform pulled in just $11.3M, a 66% drop from the previous week.

Digital and Analog Partner Yuriy Brisov told Cointelegraph the fiasco is “a legitimate reason for a criminal investigation and civil lawsuits.”

TradingView co-founder Mikko Ohtaama tweeted that, despite any actions taken, Pump.Fun will likely be shut down as regulators wrap their heads around what’s taken place.

“I advocate for freedom of speech, but these streams are causing practical issues where people are breaking the law in live broadcasts. This will trigger a shutdown when the mainstream media catches a wind on this. It will become an easy target for career politicians and police to go after, and further (the) ‘crypto is only for criminals’ narrative.”

LOCKING IN:

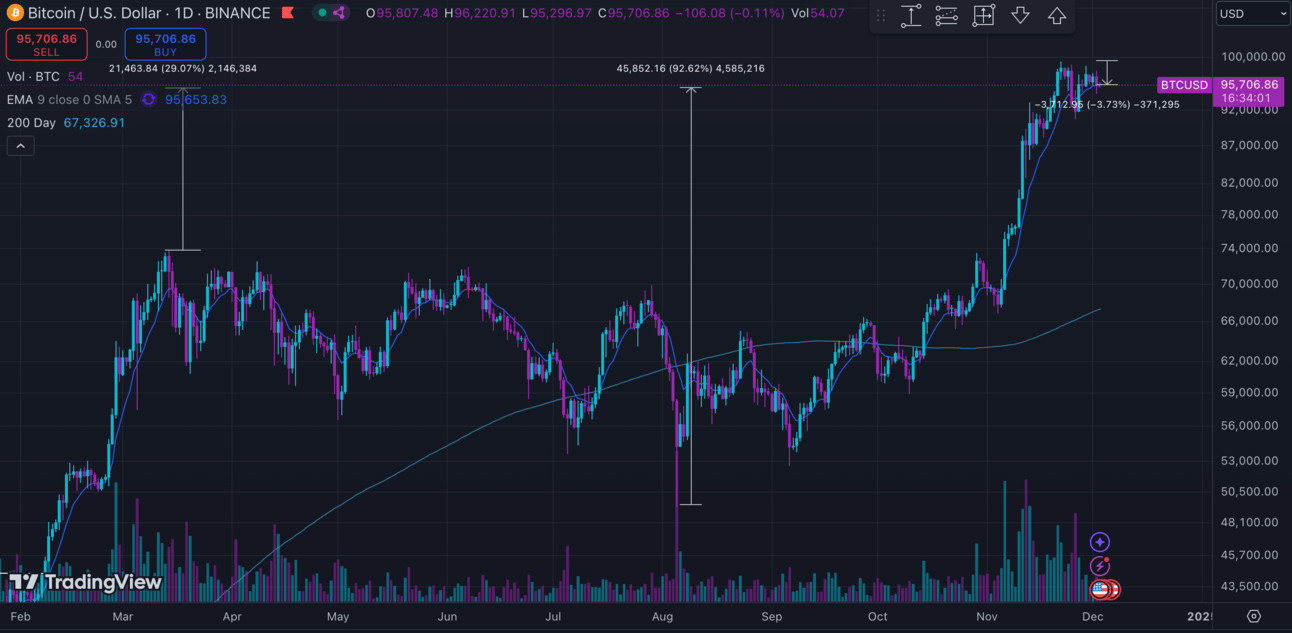

BTC/USD (BINANCE) O:97911 H:98862 L:90708 C:97026 -865.54 (-0.88%) V:2.89K

BTC finally decided to take a breather, snapping its 4 week win streak with a fractional correction. Slowing ETF inflows (+$217M) and profit taking amongst whales fueled price suppression, with capital rotating decisively into BTC’s younger siblings. Despite its struggle to maintain momentum, retracement remains minimal. BTC has since continued inching south, briefly cresting below $95K at weekly open before bouncing back just ahead of the closing bell.

Technically speaking, BTC remains up over 35% since October’s close. As mentioned in last week’s report, corrections are to be expected considering the depth of the move and the lack of resistance along the way. Corrections can happen in two ways: over price, and over time. In this case, we will continue to recommend profit taking for those who managed to catch the move, first proposed in Vol. 12 of KeyedIn. As highlighted by last week’s price action, capital rotations are to be expected here.

$100K remains decisive psychological resistance. Clear sell walls exist just below the key level, and we prefer to wait for breakout confirmation rather than penny-pinching riskier reentries. Looking south, a loss of 93K would suggest additional downside certainly worth avoiding considering the recent rally. A powerful short squeeze remains in play should we break above, though profits are likely best sidelined/rotated in the interim.

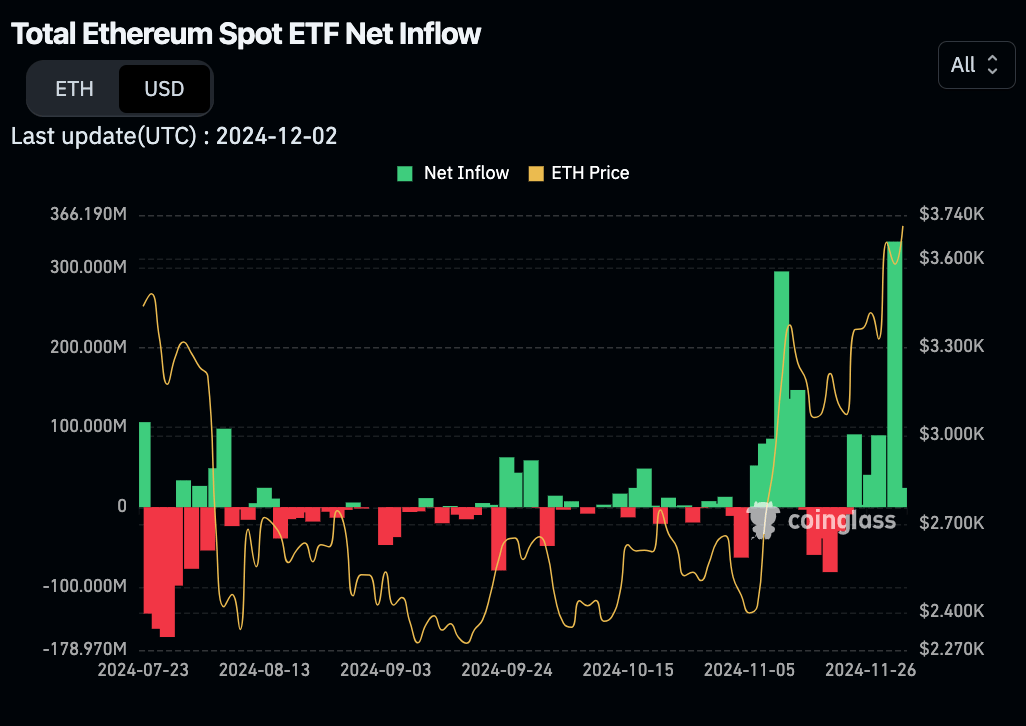

ETH/USD (BINANCE) O:3362 H:3751 L:3255 C:3710 +348.54 (+9.31%) V:392.14K

ETH displayed decisive relative strength against BTC last week, doing its’ best to catch up to big brother’s gains with the help of some healthy capital rotation. Dominance (ETH.D) saw a sizable bounce, however still unable to break above its’ downtrend amid major rallies for several high profile alts. ETFs, however, saw a record week, adding $464M in net inflows. On Friday alone, ETH ETFs amassed $339M in net inflows, marking a new daily record and ultimately surpassing BTC products for the first time since inception.

Looking at the technicals, ETH has finally gained some meaningful distance above its previous trend resistance. Last week we discussed breakout entries upon breach, a prediction that paid off almost immediately for those tuning into the report. The previous pivot high at $3950 will likely be the next big hurdle, one that could come with wide range swings to the upside should ETH successfully crest above. ETH has plenty of room to run relative to both BTC and CTMCs 2024 performance, well worth our attention as we head into the last month of this year’s trading.

In the meantime, there is certainly no shame in profit taking below $4K for those who caught the move. While ETH managed to buck BTC’s performance last week with a near double-digit rally, crypto’s flagship asset has yet to enter a meaningful correction. Should BTC finally decide to return to orbit, ETH will almost certainly suffer in the short term. NFA, DYOR, etc. Just remember missed money is always better than lost money!

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment below and don’t forget to vote in this week’s poll!

Stay tuned for next week and—in the meantime—consider yourself Keyed In!

CONSORTIUM UPDATES - NEW BOT ADDED 🤖

WEEKLY POLL:

CHART OF THE WEEK

XRP DAILY, NOTE DEPTH & WIDE RANGE VOL. IGNITION

CHEEZY CHARTS:

NOTE TOP SPOT (OTHERS) & XRP #2

NOTE RECORD HIGHS LAST FRIDAY, 1ST OUTPERFORMANCE OF BTC ETFs

CTMC (2021-2024), CURRENTLY 13% ABOVE 2021 ATHs

BTC (2021-2024)

37% ABOVE 2021 HIGHS, 38.5% ABOVE 3BP ENTRY FROM V12 KEYED IN

ETH (2021 - 2024)

27% BELOW 2021 HIGHS

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

Feel free to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community.

Plenty more to come so stay tuned! Also, don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

KEY READS

/

TOP TWEETS:

We are thrilled to invest $30 million in World Liberty Financial @worldlibertyfi as its largest investor. The U.S. is becoming the blockchain hub, and Bitcoin owes it to @realDonaldTrump! TRON is committed to making America great again and leading innovation. Let's go!

— H.E. Justin Sun 🍌 (@justinsuntron)

6:57 PM • Nov 25, 2024

Pump dot fun discovers the need of content moderation.

I am a bit intellectually happy that they allowed this in the first place, just to show the world again what kind of the place the Internet is today.

— Mikko Ohtamaa (@moo9000)

9:18 AM • Nov 25, 2024

Today was the largest ETH ETF inflow day since inception. ETH saw larger $ inflows than BTC. Single day inflow near 10 bps the entire market cap or ETH.

Don’t midcurve it, alt rotation has begun last week and wallstreet is officially joining the fun.

— Felix Hartmann (@FelixOHartmann)

5:38 AM • Nov 30, 2024

My phone when I open up my portfolio & look at the $XRP chart

— 𓂀 (@PharaohX33)

2:40 AM • Dec 2, 2024

Microsavagery

— Keyed In (@KeyedIn_)

4:34 PM • Nov 26, 2024

/