- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 18, December 2 - December 9)

Welcome to Vol. 18 of Keyed In, the official Consortium Key newsletter!

Drop your stocks and grab your blocks, it’s time to breakdown another wild week for crypto!

The appointment of a pro-crypto SEC chair helped BTC crack $100K, leading Russian lawmakers to propose a strategic national reserve. Talk about game theory in action! If you still need some icing for this delicious crypto cake, look no further than Metavisio, who just announced the world’s first Web3 laptop.

Lots to cover (as always) so let’s dive in!

THIS WEEK’S MENU:

🌽 BTC CRACKS $100K

🤝TRUMP NAMES PRO-CRYPTO SEC CHAIR

🏦 RUSSIA PROPOSES NATIONAL BTC RESERVE

👾 METAVISIO’S WEB3 LAPTOP

☕️ Fresh T/A served with a side of hot memes, and more!

As my father always said: “Eat what you want, and leave the rest!”

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:3.39T H:3.67T L:3.26T C:3.62T +229.19B (+6.76%) V:423.21B

CTMC hit ATHs for the third consecutive week, cresting above $3.5T with the help of BTCs historic move to $100K and several major rallies within its alts. The index continued outperforming its equity counterparts (SPX +0.96%, NDQ +3.31%), both of which also pushed deeper into price discovery off the back of Paul Atkins SEC appointment and continued bullishness regarding the upcoming administration.

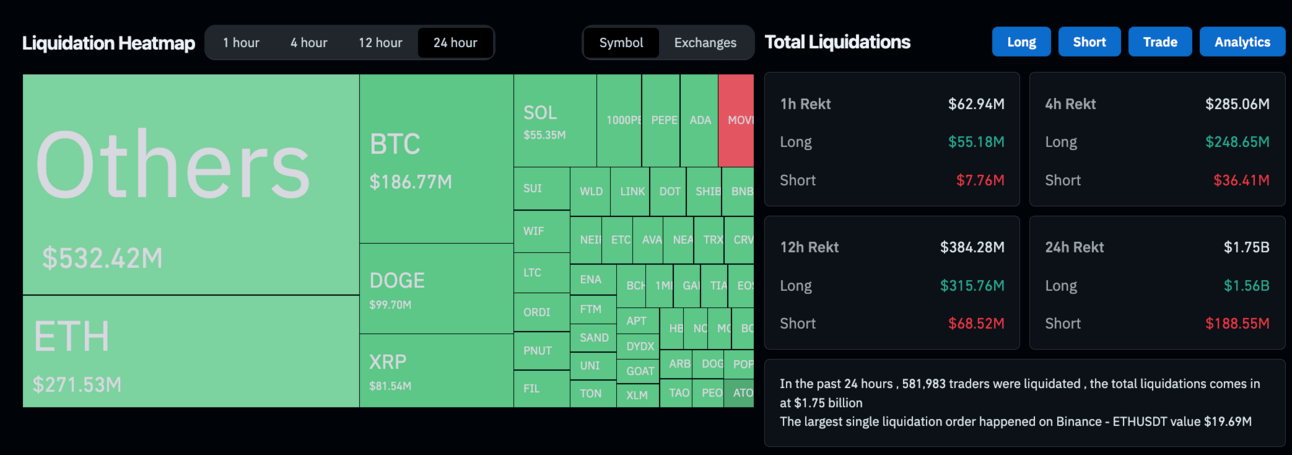

Liquidations totaled over $4B, nearly doubling last week’s already inflated numbers with the help of a head-turning $1.55B of longs wiped out on Sunday.

CTMC has since seen an engulfing correction, dropping nearly 7% since weekly open amid a market-wide retracement. Considering the 50% worth of gains seen in the past 5 weeks, it’s no surprise to see things begin to cool off as we approach the final few weeks of this year’s trading.

TOP STORIES:

Bitcoin catapulted over $100,000 for the first time on Thursday, ultimately striking rock just above $103K before entering a light retracement.

The move was largely fueled by optimism surrounding the regulatory stance of the incoming administration, including the appointment of pro-crypto SEC Chair Paul Atkins.

Along with his pledge to transform the US into the “crypto capital of the planet” and create a US Bitcoin reserve, Trump’s administration is expected to reduce regulatory scrutiny, opening the door for sidelined institutional players.

Trading volume has seen a notable increase across exchanges, with both retail and institutional investors hoping to capitalize on the historic run

Related stocks such as BTC miners also saw sharp gains, with the rally further solidifying BTC’s status as a leading tool for financial innovation and a hedge against economic uncertainties.

Donald Trump tapped pro-crypto former SEC commissioner Paul Atkins to replace Gary Gensler as the new SEC chair, fueling BTC’s historic rally to 100K.

Atkins is known for favoring innovation over heavy-handed enforcement. His leadership could mean fewer crackdowns and more clarity for crypto companies—a welcome change after Gensler’s strict policies.

Industry experts praised the move, with executives from Bitwise, Ripple, and Coinbase voicing their support for Atkins to lead the agency after Gensler’s departure.

While some fear Atkins might be too lenient, many believe he could strike the right balance between fostering growth and protecting consumers.

Trump’s team is also looking at expanding the CFTC’s role in crypto oversight, signaling a broader policy revamp well worth our attention moving forward.

“My take is that Paul Atkins might become the greatest SEC chair in US history,”

Russian lawmakers proposed creating a Bitcoin reserve to shield Russia from geopolitical and economic challenges, particularly those stemming from Western sanctions.

The reserve could enhance financial stability, allowing Russia to bypass traditional banking systems and facilitate cross-border transactions in a more decentralized manner.

Russia’s crypto pivot is part of its broader strategy to de-dollarize its economy and build financial independence. This includes exploring cryptocurrency for international trade and mining legalization.

Some officials view Bitcoin as a strategic asset that could strengthen Russia’s position in the global economy, though concerns remain about volatility and regulatory hurdles.

The move aligns with Russia’s broader efforts to integrate cryptocurrency into its economic policies, including ongoing discussions about mining and blockchain development.

European computer company Metavisio has announced plans to release the world's first Web3 laptop, scheduled to drop in 2025.

Featuring a built-in cold storage wallet and blockchain-friendly functionalities, the laptop is designed to seamlessly integrate blockchain and decentralized features into hardware.

The laptop focuses on enhanced security and user control, storing private keys offline and significantly reducing the risks of being hacked.

With native support for decentralized apps (dApps), it promises to make blockchain-based services easily accessible, allowing users to interact directly with Web3 applications.

Priced competitively to attract a broader audience, the laptop is expected to range between $523-$2100.

The announcement follows the reveal of the Seeker, Solana’s successor to the sold-out Saga smartphone, also scheduled for release in 2025.

LOCKING IN:

BTC/USD (BINANCE) O:97020 H:103629 L:92285 C:101043 +4017.49 (+4.14%) V:3.39K

BTC had a date with destiny last week, and things certainly seemed to have went well. After making a historic breach of the $100K level for the first time in trading history, BTC continued edging higher, striking rock just above $103,600 and entering a notably light retracement. ETF’s inflows remained positive throughout the week, totaling $2.8M as institutional investors continue piling into the asset in anticipation of regulatory clarity. Despite successfully closing above $100K, BTC has since seen its’ own engulfing correction on the weekly, returning decisively below the key level to start this week’s trading.

Technically speaking, BTC remains up over 40% since October’s close. We continue to anticipate some form of correction considering the depth of the move. The asset remains up over 36% move since our initial 3BP call in Vol. 12 of Keyed In, leaving considerable wiggle room for those who were able to catch the move. Many traders remain unfazed by the price jump, including Michael Saylor, who just announced another $2.1B purchase at an average price of $98,783 per BTC.

Interestingly, ETF flows remained in the green despite the near 4% correction in yesterday’s session. This suggests clear institutional interest remaining despite anticipated pullbacks. $100K will continue to serve as psychological resistance, though a fresh breach of the key level would certainly open the door for further gains. That being said, BTC’s run is arguably overextended here, and consolidation is likely in the interim. Looking further south, a loss of 93K remains suggestive of additional downside in play likely worth avoiding considering the depth of the move.

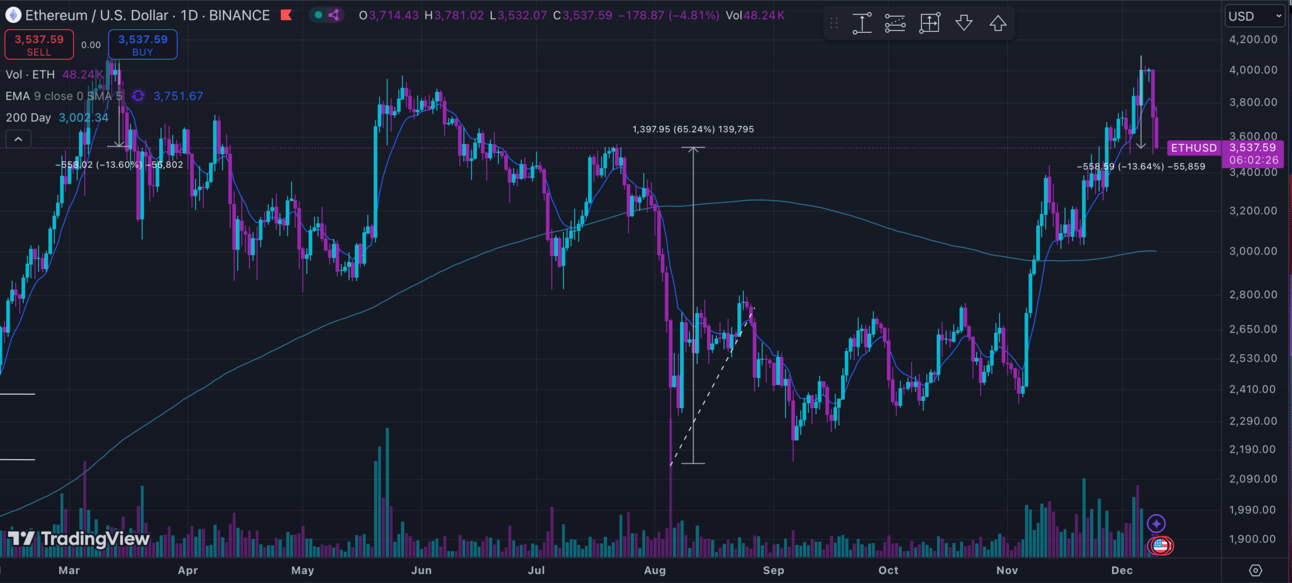

ETH/USD (BINANCE) O:3710 H:4093 L:3503 C:4007 +296.73 (+8.00%) V:475.17K

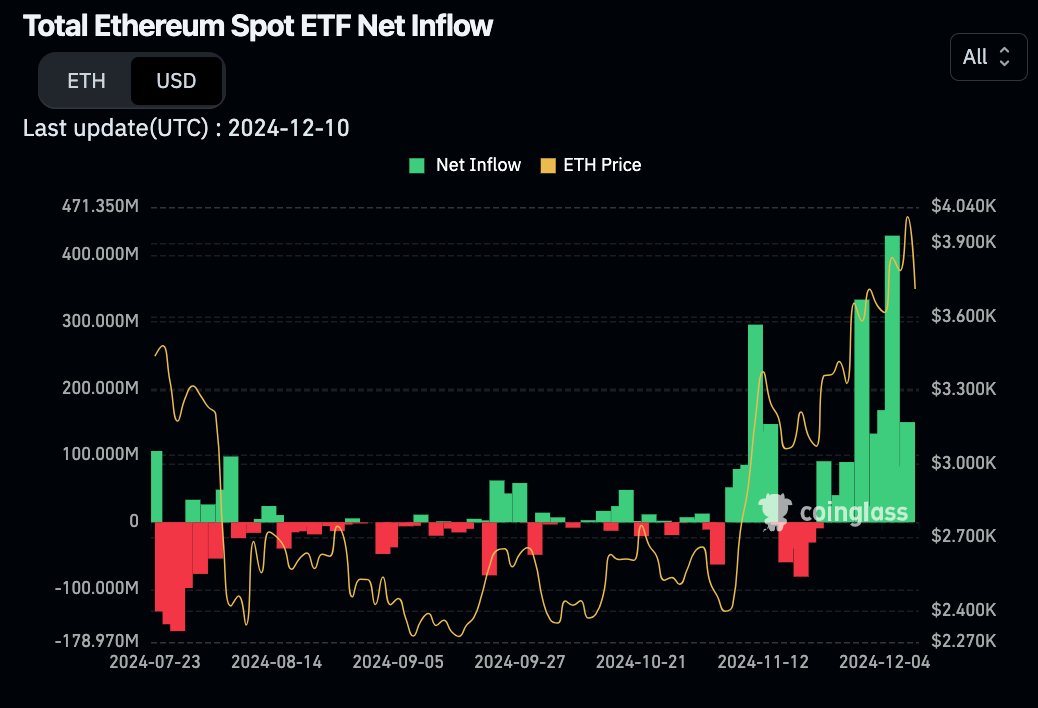

ETH continued showing clear relative strength against BTC last week, cresting above $4K and reaching its highest levels since December 2021. Dominance (ETH.D) kept climbing, still trapped in its’ downtrend amid continued rallies for several high profile alts, including a 13% jump for XRP. ETFs saw another record week, adding $834M in net inflows. On Thursday alone, ETH ETFs amassed $428M in net inflows, marking a new daily record and the 10th consecutive day of positive flows into the funds. ETH has since suffered an engulfing correction on the weekly, dropping double digits since Monday’s open.

Looking at the technicals, ETH has returned to retest its previous trend resist, a move that should provide some helpful insight depending on how things shake out. Engulfing corrections to start the week certainly don’t bode well. That being said, some form of retracement here is arguably necessary to maintain health considering the depth of ETH’s recent run. Last week we called for profit taking below $4K, a move that paid off well considering the 10% correction seen since falling back below the key level.

While ETH still has plenty of room to run relative to BTC at 2021 highs, a market wide correction could easily result in relative weakness. ETH loves to play the role of BTC’s dramatic younger sibling. Full retracement’s on the weekly suggest deeper corrections in play, well worth avoiding considering heightened volatility. Reversals are available for higher risk traders here, though tighter stops and earlier targets will remain recommend in the interim.

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment below and don’t forget to vote in this week’s poll!

Stay tuned for next week and—in the meantime—consider yourself Keyed In!

WEEKLY POLL:

CHART OF THE WEEK

BTC Top Catalysts 2018-2024

CHEEZY CHARTS:

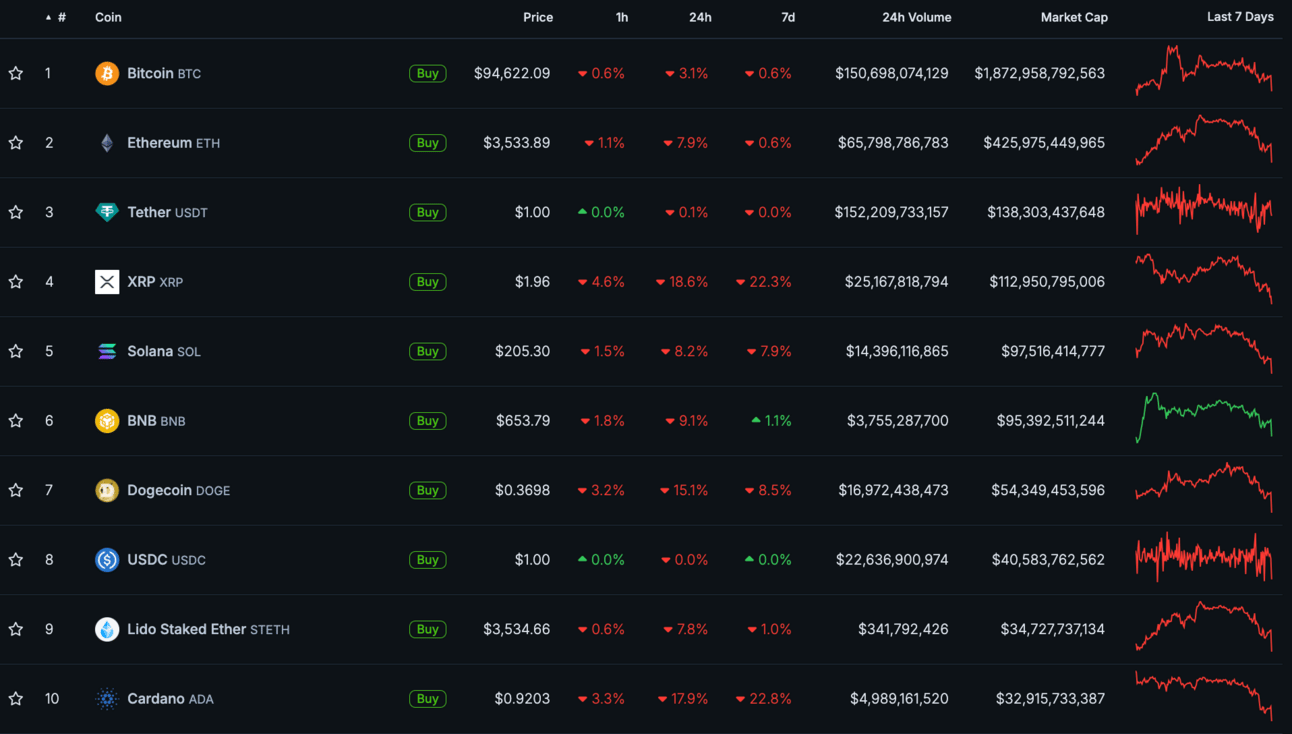

7D TOP GAINERS/LOSERS (TOP 1000 COINS)

COINGECKO 24H HIGHLIGHTS

NOTE TOP SPOT (OTHERS) & ETH #2

NOTE EXTREMELY WIDE RANGE CANDLE ON PULLBACK

NOTE FRESH RECORD HIGHS & CONTINUED NET INFLOWS DESPITE CORRECTION

CTMC (2021-2024)

BTC (2021-2024)

ETH (2021 - 2024)

CPI/PPI THIS WEEK, SHOULD PROVIDE MUCH NEEDED CLARITY FOR FED DIRECTION

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

Feel free to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community.

Plenty more to come so stay tuned! Also, don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

KEY READS

TOP TWEETS:

#Bitcoin has hit six digits, passing $100K for the first time! A historic win for the crypto community.

— Binance (@binance)

2:37 AM • Dec 5, 2024

Agreed - Paul Akins is an excellent choice for the new SEC chair!

— Brian Armstrong (@brian_armstrong)

12:02 AM • Dec 5, 2024

MicroStrategy has acquired 21,550 BTC for ~$2.1 billion at ~$98,783 per #bitcoin and has achieved BTC Yield of 43.2% QTD and 68.7% YTD. As of 12/8/2024, we hodl 423,650 $BTC acquired for ~$25.6 billion at ~$60,324 per bitcoin. $MSTR

— Michael Saylor⚡️ (@saylor)

1:04 PM • Dec 9, 2024

This is the greatest crypto meme you will see all week

— LilMoonLambo (@LilMoonLambo)

1:03 PM • Dec 5, 2024

Every Bitcoin Holder right now 🥂🎉

— ₿itcoin Meme Hub 🔞 (@BitcoinMemeHub)

5:53 AM • Dec 5, 2024