- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 15, November 11 - November 18)

Welcome to Vol. 15 of Keyed In, the official Consortium Key newsletter!

Markets pulled back last week after post election rallies, but it would seem crypto didn’t get the memo. CTMC broke the fabled $3T mark, shorts got obliterated, BTC hit fresh ATHs, and net ETF inflows hit a record $3.3B. FTX sued Binance, 18 states sued the SEC, and we got a heap of news regarding a crypto-friendly wave headed straight for Washington.

Lots to cover this week, so let’s dive in! 🤙

THIS WEEK’S MENU:

🐸 Memecoin Mania and the D.O.G.E

🤝 Trump’s Private Coinbase Meeting

🥊 FTX v Binance

👋 GGs Gary Gensler

☕️ Fresh T/A, and more!

As my father always said: “Eat what you want, and leave the rest!”

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:2.696T H:3.046T L:2.669T C:2.956T +260.941B (+9.68%) V:435.186B

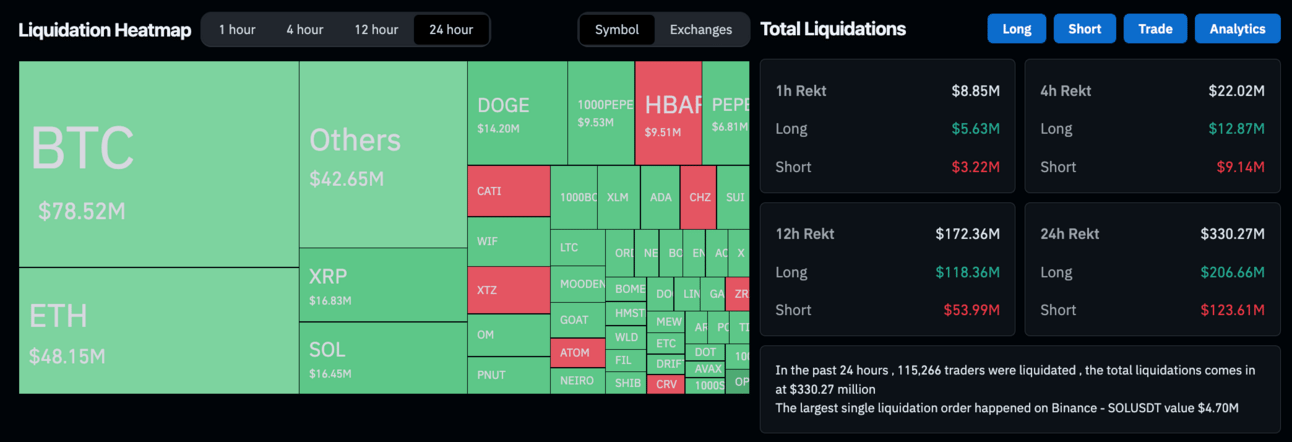

CTMC extended its breakout last week, showing clear relative strength amid a 50% retracement of post election rallies amongst its equity counterparts (SPX -2%, NDQ -3.4%). Liquidations continued ramping, totaling a staggering $3.3B—a 130% increase from just two weeks ago. ETFs put up over $1.6B, marking record inflows for the second consecutive week.

Economic easing and a clean sweep in the elections remain the primary drivers of the move, allowing CTMC to cross the fated $3T mark for the first time ever. The index continues to edge higher since this week’s open, doing its’ best to form a base of support at $3T as the broader market begins to regain last week’s losses.

TOP STORIES:

🐸 MEMECOIN MANIA and the D.O.G.E

While the rest of the market began to cool off following last week’s pump, rotations into memecoins fueled notable rallies throughout the sector. DOGE passed $60B, PNUT cracked the top 100, and WIF spiked 37% following its fresh listing on Coinbase.

Adding fuel to the fire, President-elect Donald Trump released a statement announcing Elon Musk’s upcoming leadership of the Department of Government Efficiency (D.O.G.E). Along with Vivek Ramaswamy, the department aims to identify inefficiencies across federal agencies, reduce redundant functions, and propose cuts to programs that don’t deliver clear value.

Musk hopes to “reduce the annual budget by at least $2T”, along with reducing the number of federal bureaucrats by 75%. Despite a lack of formal connection outside of the department’s name, DOGE hit 3 year highs above $0.43 within hours of the announcement. The OG memecoin has pumped nearly 150% since US election night, marking a 320% move in 2024.

🤝 TRUMP’S PRIVATE COINBASE MEETING

According to the Wall Street Journal, Donald Trump will be meeting privately with Coinbase CEO Brian Armstrong to discuss staffing decisions for critical positions. Having already tapped crypto enthusiasts including RFK Jr, Elon Musk, Vivek Ramaswamy, and Charles Hoskinson, it seems like the pro-crypto campaign message may truly be more than basic election pandering.

The meeting is expected to address political appointments for roles related to both crypto and financial regulation. Brian Armstrong has long supported reforms in Washington, speaking with lawmakers on several occasions over the last few years. It’s unclear whether Armstrong or a Coinbase employee could potentially have a role in the next US president’s administration, though it would certainly seem the administration is positioning itself for a friendlier regulatory environment in Washington.

🥊 FTX v BINANCE

If last week’s Jake Paul Mike Tyson fight taught us anything, it’s that some rivalries are better left alone. That lesson was clearly missed by FTX’s lawyers, who took legal action against Binance last week regarding the alleged fraudulent repurchase of shares by FTX former CEO Sam Bankman-Fried. The repurchase was funded by Alameda research (SBF’s trading firm) using native tokens FTT and BNB.

According to filings, Alameda was insolvent at the time of purchase, with Caroline Ellison having warned that they “don’t really have the money for this” and that they’ll “have to borrow from FTX to do it.” Since FTX was already insolvent and FTT tokens were worthless at the time of the transaction, the transfer should be classed as fraudulent—the document alleges.

I’m certainly no legal scholar, but if I were to buy a product from a store using a bad check, it would seem a bit unreasonable to turn around and sue the store for allowing me to make the purchase, right?

Binance seems to think so, having responded by saying “The claims are meritless, and we will vigorously defend ourselves," in an emailed statement shared with CoinDesk. While a victory would certainly bode well for creditors, a loss would amount to little more than another bag of money being paid to FTX lawyers instead of the people ultimately defrauded by the defunct exchange.

👋 GG’s GARY GENSLER

Everyone hates getting fired, and world-renowned hater/SEC Chair Gary Gensler is certainly no exception. Following Donald Trump’s promises to remove him from office upon his return to the White House, it would seem Gensler has read the writing on the wall. The chairman, who has face years of criticism for the crypto industry, announced on Thursday that he was “proud to serve” the SEC, strongly hinting at an upcoming resignation.

Gensler and the SEC were sued on Thursday by 18 states for alleged unconstitutional overreach in their regulation of the digital asset industry. The lawsuit asks a federal judge to block the SEC from bringing enforcement actions, arguing "the SEC's crypto policy is unlawful executive action" and that it violated the Administrative Procedures Act.

Several crypto-friendly current and former SEC commissioners have been floated as potential replacements, including Robinhood’s current CLO Dan Gallagher.

“I think we finally have a chance to get some regulatory [clarity] in the U.S. about some of these big open issues that frankly, under Gary Gensler, we just haven't gotten any clarity for a long time,”

LOCKING IN:

BTC/USD (BINANCE) O:80147 H:93163 L:79974 C:89464 +9312.79 (+11.62%) V:5.163K

BTC continued breaking necks with another double-digit gain last week, pushing further into price discovery, flirting with 60% dominance, and cementing a solid base of support well above $80K. Record net ETF inflows totaling $1.6B remain at the forefront of the move, with an notable rotation from Gold counterparts as traders reposition in anticipation of friendlier policy in Washington. BTC continues inching higher since this week’s open, taking advantage of a market wide rebound despite having decisively ignored last week’s correction.

Looking at the technicals, BTC has made a 33% jump since our 3 bar play deep dive in Vol. 12 of Keyed In. As mentioned, there is certainly no shame in some profit taking for those who were able to catch the move. BTC is now within striking distance of the fabled $100K level, likely to provide short term psychological resistance despite the lack of noise on the charts. Worth noting, BTC has yet to return to its pre-election price since inception. Wiggle room remains in play to the upside, especially should broader markets continue to move higher.

ETH/USD (BINANCE) O:3183 H:3443 L:3013 C:3075 -110.46 (-3.47%) V:439.578K

ETH fell victim to its’ own recent success along with the market’s correction last week, showing slight relative weakness against its crypto counterparts. Despite the cooldown, ETH’s ETFs added a record $514M in net inflows, eclipsing the previous record—set just last week at $154M. Despite the fresh institutional attention, ETH still has its younger siblings to contend with. Nansen data reports SOL having overtaken ETH as the most used chain according to the latest data.

Technically speaking, weakness here only tells a part of ETH’s story considering the 29% rally from the previous weekly candle. Assets often need time to rest after going on significant sprints, and a 30% move on the weekly would certainly qualify. That being said, ETH has considerable ground to cover relative to BTC’s recent price discovery. This allows for worthy wiggle room for the asset, which remains on the precipice of breaking 9 month trend resistance. A move beyond trend could easily open the door for additional wide range moves, well worth the attention of those eyeballing potential reentries.

DXY O:104.951 H:107.064 L:104.934 C:106.673 +1.722 (+1.64%)

DXY’s inverse correlation to risk assets has begun to decouple, and its’ no surprise to see the index rallying as traders continue betting on a stronger USD following Trump’s reelection. For this reason, technical analysis here will take the backseat. I’d prefer to focus this section on monetary policy and market calendars for the time being, and will likely update headers, images, etc. moving forward to reflect the change.

For any (disappointed) forex traders reading this, feel free to reach out and I’d be happy to give you my thoughts 😉

With that out of the way, let’s get into it!

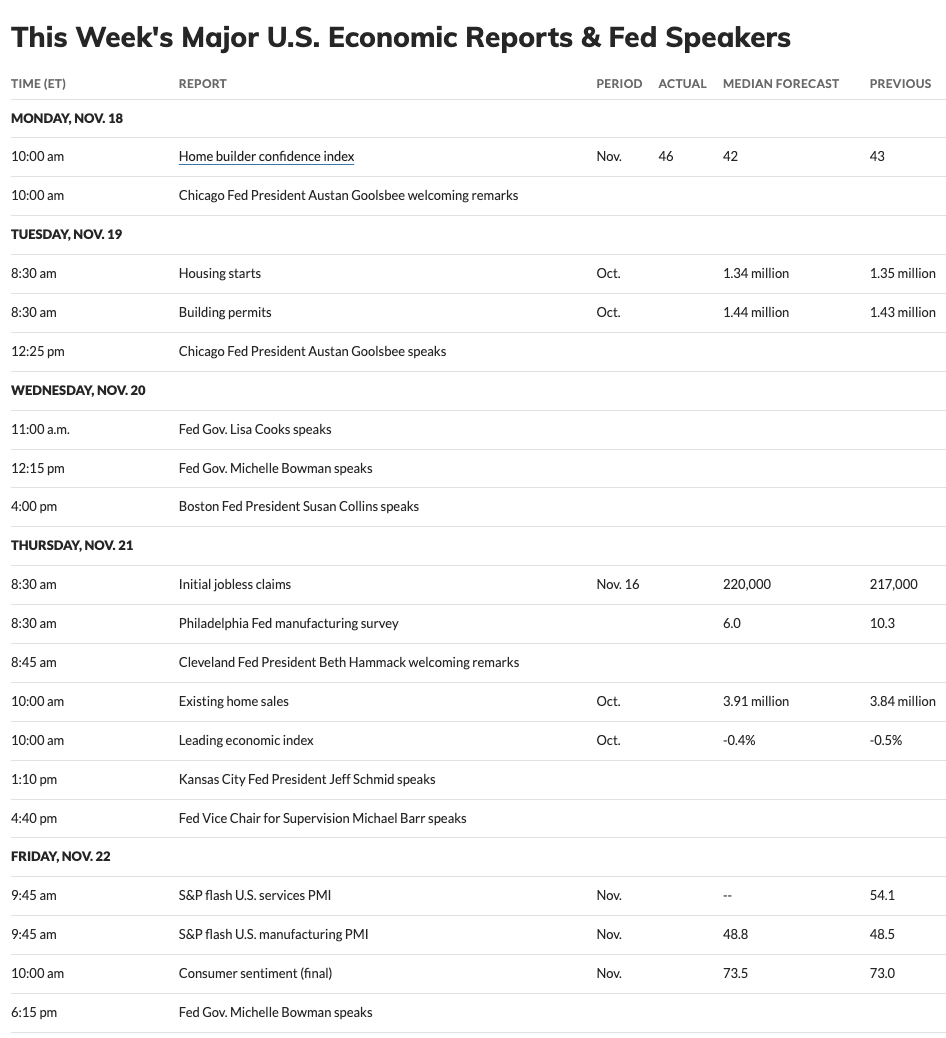

Last week’s CPI and PPI fell largely in line with expectations, temporarily boosting bets on rate cuts despite core inflation still resting above 3%. The boost ended up being short-lived, however, with strong inflation data suggesting the Fed may slow its roll come December’s meeting. According to data from CME FedWatch, only 58% of traders expect another cut next month, down from 68% last week. Polymarket bets are slightly more favorable, with 62% of traders betting on a cut.

Looking ahead, this week’s market calendar is fairly light, with a few Fed speeches leading into jobless and home data on Thursday. Earnings this week will be worth noting, with Walmart, Target, and Nvidia all reporting. Perhaps most importantly, we will likely be finding out who the next US Treasury Secretary will be, giving some worthy insights regarding what to expect post Janet Yellen. (I’ll miss the memes most of all)

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment below and don’t forget to vote in this week’s poll!

Stay tuned for next week and—in the meantime—consider yourself Keyed In!

WEEKLY POLL:

CHEEZY CHARTS:

CTMC (2021-2024)

BTC (2021-2024)

ETH (2021 - 2024)

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

Feel free to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Also, don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

KEY READS

TOP TWEETS:

. @DOGE is a once in a lifetime opportunity to increase economic freedom in the U.S. and cut the size of government back to health.

The founding fathers were geniuses but (with humility) may have missed the adverse incentives which grow the size of democratic government over… x.com/i/web/status/1…

— Brian Armstrong (@brian_armstrong)

5:46 AM • Nov 17, 2024

📈 Digital asset inflows reached US$2.2bn last week, bringing year-to-date inflows to a record US$33.5bn. #Bitcoin and #Ethereum saw inflows of US$1.48bn and US$646m respectively. Short bitcoin investment products saw inflows of US$49m.

Full report: coinshares.com/se-en/resource…

— CoinShares (@CoinSharesCo)

10:19 AM • Nov 18, 2024

Solana is now the #1 most used chain on @nansen_ai.

First time in 4+ years it's not Ethereum.

— Alex Svanevik 🐧 (@ASvanevik)

9:46 AM • Nov 18, 2024

* Bitcoin hits the new all time high *

meanwhile eth :

— naiive (@naiivememe)

1:21 PM • Nov 18, 2024

When #XRP hits $0.80 but you remember you bought at $1

— 💫ROB ART🚀CRYPTO COINS CREW (@SirRobArtII1)

8:51 AM • Nov 15, 2024

Crypto Guys researching memecoins before all in their life saving

— naiive (@naiivememe)

11:29 AM • Nov 16, 2024