- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 13, Uptober 28 - November 4)

Welcome to Vol. 13 of Keyed In, the official Consortium Key newsletter!

Whipsaw trading last week ended mostly in the red despite early week rallies. Volatility upticks and engulfing rallies from the market as we inch closer to US election results, an event that has historically proven bullish for CTMC. That being said, indecision remains very much in the driver’s seat for the time being. With the results just around the corner, I thought we could take some time this week to see what that (likely) means for our bags!

Plenty to cover (as always), so let’s dive in!

TODAY’S MENU:

🥊 POTUS V BTC

💸 USDG - The New Kid on the Block

💰 Microstrategy’s Macro Strategy

☕️ Fresh T/A, and more!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:2.263T H:2.423T L:2.204T C:2.248T -14.525B (-0.64%) V:110.136B

CTMC was unable to stay in the green despite the early week rally. While the index managed to outperform its equity counterparts (SPX -1.37%, NDQ -1.57%), CTMC ultimately lost half a percent amid a continued market wide correction. Liquidations totaled over $1.5B across the index. Assets often need time to rest after going on such heavy sprints, and corrections remain largely to be expected. Continuing our recent focus on retracement levels, CTMC managed to hold successfully above the 50% level.

This week’s open began with additional pressure, leaving CTMC with minimal wiggle room in both retracement and retention of support. Engulfing rallies have been seen in the Tuesday session, setting the stage for some big moves so long as momentum can continue.

🥊 POTUS V BTC

BTC has been around since 2009. With its’ 4th US presidential election just around the corner, it seemed appropriate to look at past data to see what we can likely expect once the dust has ultimately settled. Looking at the logarithmic chart below, we can see that each election has resulted in a considerable rally for the asset. Averaging about a year from voting until cycle peak, BTC has yet to return below its price pre-election price in the 15 years since inception.

Obviously, percentage based returns have diminished each cycle. Looking at the data, we can see a 70% decrease in returns from 2016 to 2020, followed by an 87% decrease in returns from 2020 to 2024. If this trend continues, a 90% decrease in returns would put the peak cycle price of BTC just above 100K in November 2025—a 48% increase from today’s price. Volatility upticks have been seen in the weeks leading up to each election, but overall, it would seem the market is largely agnostic to which party wins.

Clarity is the name of the game here. While many people around the world care greatly about which party wins the US presidency, history would suggest BTC does not.

💸 USDG - New Kid on the Block

Tether and Circle might soon have to deal with the new kid on the block, a regulation/yield focused stablecoin announced Monday called USDG. Backed by industry titans including Robinhood, Kraken, and Galaxy Digital, USDG will be issued out of Singapore by Paxos in full compliance with the Monetary Authority. Framed as a “community token”, participants in the network will be able to accrue rewards for activity. Unlike its competitors, USDG will be distributing “something like 97%” of its economics, according to Paxos CEO Charles Cascarilla.

The prospect of a stablecoin that rewards its users as opposed to keeping revenue in house certainly seems appealing, though it would seem like a steep uphill battle considering the market share of its competitors. For reference, Tether controls about 75% of the stablecoin market—up from 55% just two years ago. For more info about USDG, feel free to check out the Global Dollar website here.

💰 Microstrategy’s Macro Strategy

About 3 weeks after announcing their plans to become the worlds’ first Bitcoin bank, Microstrategy (MSTR) rolled out a $42 billion fundraising plan with the explicit purpose of—you guessed it—buying more BTC. The company aims to raise $21 billion in equity and $21 billion in fixed income securities over the next three years, according to CEO Phong Le. To put things into perspective, Microstrategy’s total market cap is just $49.54 billion, meaning the funds raised would account for 85% of the company’s current market value.

Microstrategy currently holds over 250K BTC, about 1.2% of total supply. At a price of $70K BTC, the raise would add another 700K BTC to MSTR’s reserve—putting the total percentage of BTC owned by the company around 4%. While this certainly raises concerns regarding decentralization, the market continues to respond positively to MSTR’s gameplan. Since announcing their plans to become a BTC bank, the company has enjoyed a significant rally—up nearly 50% at last week’s peak.

We do think that, whoever wins on Tuesday, crypto markets will be looking at a more favorable regulatory environment in a new administration in the new year

LOCKING IN:

BTC/USD (BINANCE) O:67981 H:73512 L:67562 C:68901 +935.41 (+1.36%) V:2.123K

BTC started last week’s trading with a wide range ignition, peaking just above 73K for the first time since March. Despite coming within striking distance of fresh ATHs, BTC was unable to maintain its momentum amid a broader market downturn. The asset still managed to outperform—showing clear relative strength to close out Uptober trading. ETF inflows continued snowballing, adding over $2.1B in net inflows—a 100% increase from last week.

BTC dropped 1.5% to open this week’s trading amid reports of a $2.2B BTC transfer from Mt. Gox—renewing fears regarding supply shocks from upcoming repayments. Despite the rough start, BTC has since engulfed the entirety of its early week losses.

Looking at the technicals, BTC remains primed to make a decisive break out of the consolidation pattern that began in March. Last week’s ignition proved unsustainable amid the market correction, though a successful retest here could easily open the door for another shot at ATHs. Despite our optimism, a failure to maintain support at 68K would suggest additional downside still in play and likely worth avoiding. If history is any clue—however—we can expect big things for Ol’ Bitty just around the corner.

ETH/USD (BINANCE) O:2507 H:2722 L:2410 C:2456 -49.22 (-1.96%) V:186.184K

ETH continued struggling last week, putting in a lower high just above $2700 before entering a 5 day correction. ETFs were able to go green for the first time in weeks, recording a humble $14M in net inflows by Friday’s close. Continued dominance pressure from SOL trading and a powerful DOGE rally further underline ETH’s struggles, leaving much to be desired throughout the latter half of this year’s trading.

Technically speaking, resistance at September’s highs around $2750 remains fully in play. A break above this level could open the door for potential plays here. That being said, it feels like more exciting trades exist in ETH’s younger siblings, and more confident trades exist in BTC. Continued price action below the $2550 level also remains suggestive of further downside potentially in play. Frankly, ETH will likely need to make up for considerable lost ground to redirect market attention at this point in the cycle.

DXY O:104.317 H:104.636 L:103.679 C:104.317 +0.000 (+0.00%)

DXY was entirely unchanged at last week’s close despite considerable swings throughout the week. The index slipped half a percent in Monday’s trading, falling below key support at 104 amid repositioning of “Trump trades” approaching the election. Technically speaking, DXY now rests near perfectly at the 200D MA, with any meaningful moves south suggesting further correction in play. While risk markets will likely react positively regardless of outcome, a Harris victory could lead to short term dollar weakness, with many traders having priced in a stronger USD with a Trump reelection.

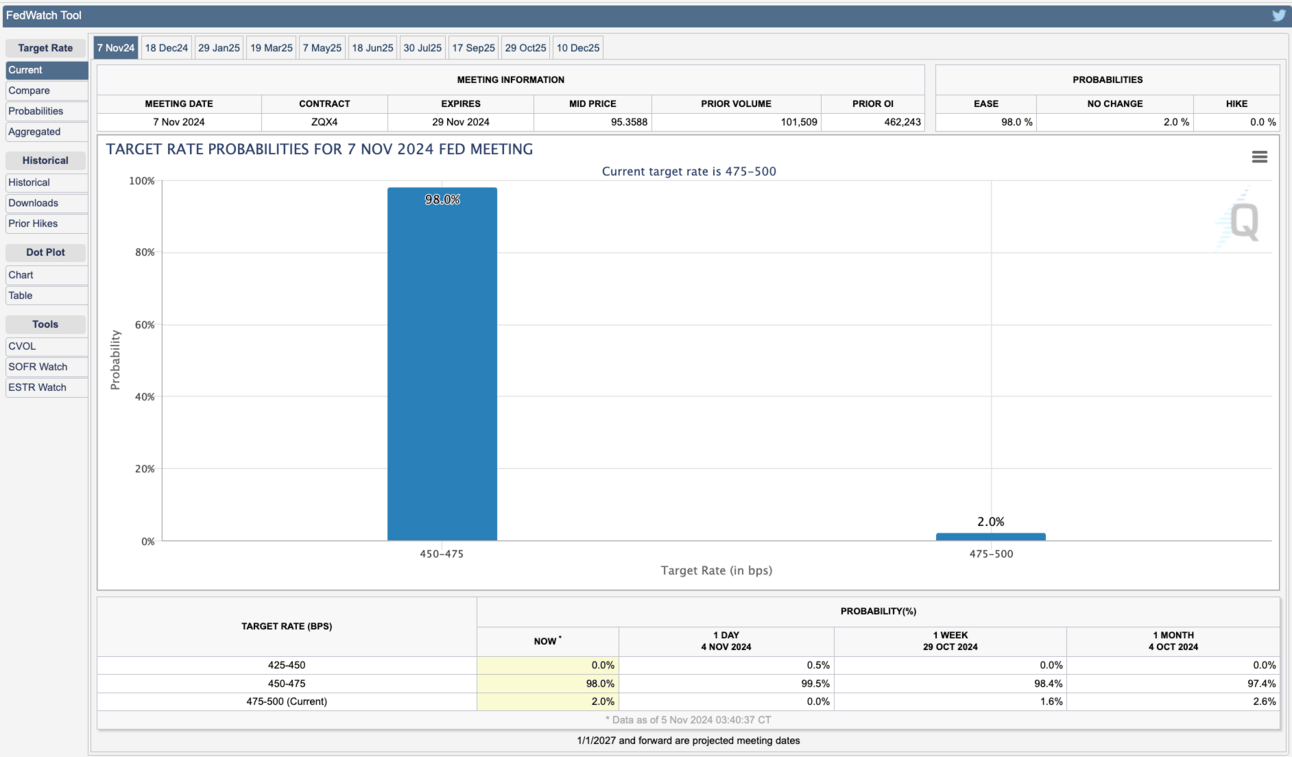

Traders continue to anticipate a 98% chance of further easing in the November meeting according to data from CME FedWatch. Polymarket bets on the cut saw a 10% jump to the upside. The prediction market is currently showing a 70% chance of 100bps worth of cuts this year, up from just 38% at the beginning of October.

Obviously, the big ticket on this week’s calendar is tomorrow’s election, arguably the biggest risk event of the year. Looking beyond election day, Thursday should provide a bit of extra clarity with jobless data and J Powell’s FOMC speech. A 25bps cut is just about guaranteed, though language used regarding future cuts will play a major role in what we can expect from the US Fed moving forward.

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment below and don’t forget to vote in this week’s poll! Stay tuned for next week and—in the meantime—consider yourself Keyed In!

WEEKLY POLL:

CHEEZY CHARTS:

BTC.D

ETH.D

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

Feel free to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Also, don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!