- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 19, December 9 - December 16)

Welcome to Vol. 19 of Keyed In, the official Consortium Key newsletter!

Drop your stocks and grab your blocks, it’s time to breakdown another wild week for crypto!

AI projects stay making headlines, MSTR stays apeing BTC, FTX stays 🦆ing people over, and token unlocks stay driving prices down.

Lots to cover (as always) so let’s dive in!

THIS WEEK’S MENU:

🤖 Ai16z Partners with Stanford Labs

🏦 MSTR Apes Ahead of NDQ Listing

💰 FTX Announces Distributions

🔓 Degens Guide to Token Unlocks

☕️ Fresh T/A served with a side of hot memes, and more!

As my father always said: “Eat what you want, and leave the rest!”

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:3.62T H:3.64T L:3.22T C:3.62T -1.44B (-0.04%) V:348.33B

CTMC struggled to maintain momentum last week, snapping a 5 week win streak with an initially engulfing correction at weekly open. The index ultimately finished marginally in the red, bouncing off support above $3.2T with the help of a +3% move from BTC. CTMC showed a mixed performance against its equity counterparts (SPX -0.64%, NDQ +0.73%) with all three showing fractional change as they continue hovering right around ATHs.

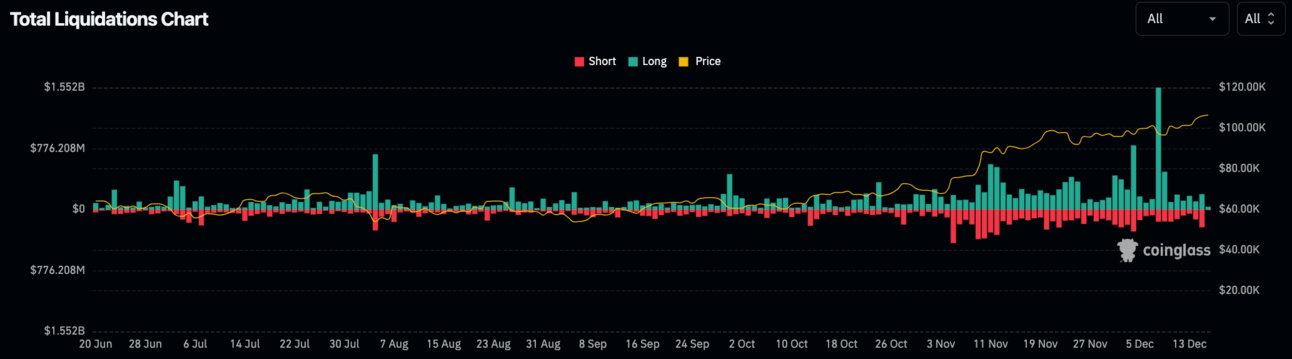

Liquidations totaled $2.25B, nearly slashing the previous week’s numbers in half and highlighting volatility declines throughout the market.

CTMC has since flipped back into the green. The index has gained nearly 1% off the back of a market-wide rally to start this week’s trading, including fresh ATHs for BTC and a $4K return for ETH. Considering the depth of last week’s washout and the rebound that followed, CTMC is showing clear signs of strength as we head into the final two weeks of 2024 trading.

TOP STORIES:

Eliza Labs, creators of the ai16z AI platform, has partnered with Stanford’s Future of Digital Currency Initiative (FDCI) to explore AI and blockchain innovation.

The ai16z platform integrates AI agents with blockchain applications and memecoins, attracting significant attention with over 1,400 GitHub forks.

Stanford’s FDCI, led by professors David Mazières and Dan Boneh, focuses on advancing research in digital currencies and decentralized systems.

Eliza Labs contributed a grant of over $250,000 to support FDCI’s research on trust mechanisms, governance, and AI agent coordination.

The partnership aims to improve blockchain computational power and explore AI-driven applications in digital financial systems.

Eliza Labs’ founder, Shaw, emphasized the collaboration’s potential to push the boundaries of AI and blockchain technologies.

MicroStrategy aped another 15,350 BTC for $1.5B, at an average price of $100,386 per BTC—its 6th consecutive weekly purchase announced just ahead of its upcoming NASDAQ listing

The purchase increases the company's total holdings to 439K BTC, averaging $61,725 per BTC

Amid plan to become the “World’s first BTC bank”, MSTR now hodls over 2.1% of BTC’s total supply

MicroStrategy's market capitalization has surged to nearly $100B from just $1.1B in 2020, reflecting the company's substantial Bitcoin investments.

The company's stock has experienced a 490% YTD increase, pushing it into the coveted ranks of the NDQ-100 Index, which tracks the performance of the 100 largest non-financial companies on the Nasdaq stock exchange.

FTX has announced plans to begin distributing funds to creditors starting in January 2025, following its bankruptcy proceedings.

The court-approved plan is set to take effect 1/3/25, with initial distributions expected within 60 days after

Creditors expect to receive 119% of portfolio value in-kind at the time of filing, a significant haircut considering the price difference in tokens from 2022

Kraken and BitGo have been selected as distribution partners to facilitate the repayment process in supported jurisdictions.

The first phase of distributions will prioritize creditors in the "convenience classes," typically those with smaller claims. Schedules for other claim types will be announced in the coming months.

Despite initial concerns, distributions have so far failed to suppress prices, highlighted by the lack of correction throughout Mt. Gox’s recent payment processing

FTX's CEO, John J. Ray III, described the upcoming distributions as a significant milestone in the company's efforts to recover and return funds to its customers.

A recent report by Keystone provided critical insights into the impact of token unlocks on crypto markets (Below is a quick TL:DR, though the full report can be found here.)

Over $600 million worth of tokens are unlocked weekly, introducing significant liquidity into the market.

Approximately 90% of these unlocks lead to price declines, regardless of the unlock's size, type, or recipient.

Price impacts often commence up to 30 days before the unlock event, suggesting that market participants may be preemptively adjusting their positions.

Larger unlocks can cause price drops up to 2.4x greater than smaller ones, accompanied by increased volatility.

To mitigate future risks associated with token unlocks, consider exiting positions 30 days before an unlock and re-entering 14 days after, most aligning with observed market patterns.

Impact by Recipient Type:

Team Unlocks: Associated with the most significant price declines, averaging around 25%, possibly due to immediate sell-offs by team members.

Investor Unlocks: Tend to have a more controlled impact on prices, indicating that investors may employ strategies to mitigate market disruption.

Ecosystem Development Unlocks: Some of these unlocks have a positive effect on token prices, with an average increase of 1.18%, likely due to their role in fostering ecosystem growth.

Here’s a list we threw together of next week’s token unlocks, with heavy hitters including Cardano (ADA), Arbitrum (ARB), and ApeCoin (APE). NFA as always, DYOR 😉.

Play to your strengths and don’t try to catch every runner…it’s fine to miss, just catch a few that make you bags and just chill.

LOCKING IN:

BTC/USD (BINANCE) O:101033 H:104841 L:94185 C:104182 +3138.81 (+3.11%) V:2.66K

BTC continues to show decisive strength here, building up support above $100K after confidently reclaiming the key level following last week’s correction. ETF inflows continue propping up prices, totaling over $2.1B throughout the week. To underscore continued interest, BTC ETFs have seen 13 consecutive sessions of net inflows, remaining in the green throughout December’s trading.

BTC has since entered price discovery for the third week in a row, topping out just below $107,500 Monday afternoon.

Looking at the technicals, BTC remains in a clear position of strength, both relative to the broader market and to CTMC’s basket. Outside of the fractional correction to close out November, BTC has enjoyed nearly 7 weeks of positive price action. The asset has gained over 55% since our 3BP entry in Vol. 12 of Keyed In, and we will continue to recommend some degree of profit taking for those who have caught a sizable portion of the move. Capital rotation is worth considering here, with opportunities for significant gains throughout the market.

Corrections remain anticipated at some point, though a hold above $105K would suggest further upside in play well worth our attention. Looking south, a loss of $103,600 would begin to raise concerns, though BTC has already given itself considerable wiggle room to start this week’s trading.

ETH/USD (BINANCE) O:4009 H:4009 L:3521 C:3956 -51.01 (-1.27%) V:287.04K

Despite last week’s decline, ETH still continues to show strength here. After opening last Monday with an engulfing correction on the weekly, ETH managed to retrace nearly 90% of the move, successfully retesting previous trend resist. ETFs continue to prop up prices, adding $852M in net inflows and tacking another 5 sessions onto what is now a 17 day win streak for the funds. ETH has since engulfed the remainder of last week’s correction, briefly cresting above $4100 before retreating slightly into Monday’s close. At the time of writing, ETH rests just above the critical $4K level.

While the asset has left much to be desired in 2024, the depth of last week’s bottoming wick suggests clear buyer interest remaining below $4K. ETH remains decisively above its previous downtrend, with plenty of room to run relative to its eldest siblings gains over the last several months. BTC now sits over 50% above its 2021 highs. With the help of some dubious mathematics (shouts to Benjamin Cohen), we can determine that an equal sized gain for ETH would put the price right around $7400. Obviously plenty of factors aren’t taken into account here, including continued declines in dominance (ETH.D) and the rise of several high profile ALTs like SOL and XRP.

Overall, ETH has successfully made a textbook retest of previous trend resist, providing some helpful insight regarding what to expect moving forward. Last week’s reversal calls proved very well advised, and there’s plenty of room to keep running here should CTMC continue trending higher. ETH seems poised to make some wide range moves to the upside, though it will likely be at the will of its eldest sibling for the foreseeable future.

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment below and don’t forget to vote in this week’s poll!

Stay tuned for next week and—in the meantime—consider yourself Keyed In!

WEEKLY POLL:

CHART OF THE WEEK

ALT TMC, NOTE FRESH HIGHS JUST BREACHED

CHEEZY CHARTS:

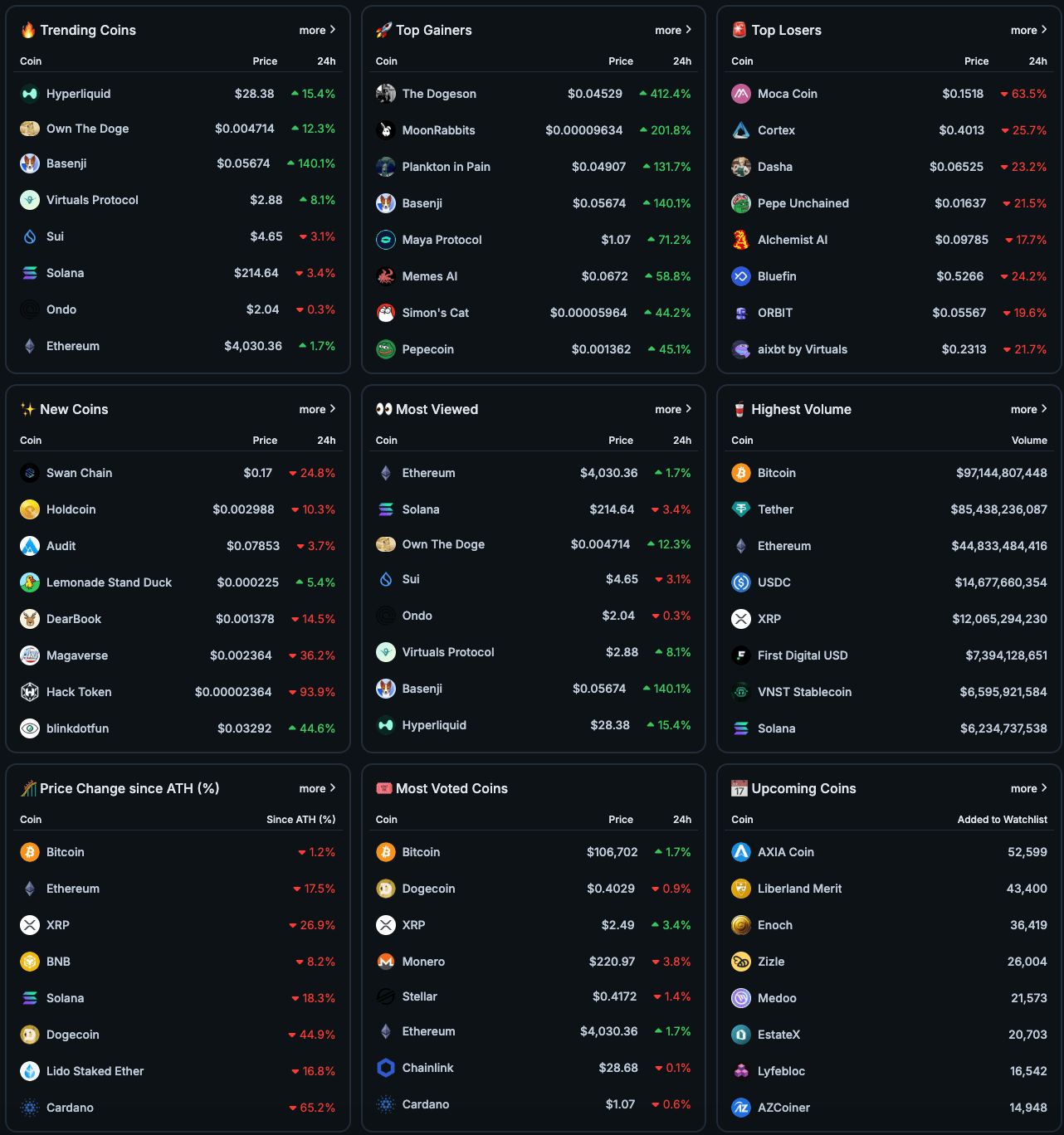

7D TOP GAINERS/LOSERS (TOP 1000 COINS)

COINGECKO 24H HIGHLIGHTS

NOTE: ETH & BTC RETURN TO TOP SPOTS

NOTE: 13 DAY WIN STREAK

NOTE: 17 DAY WIN STREAK (NET INFLOWS DESPITE PRICE CORRECTION)

CTMC (2021-2024)

BTC (2021-2024)

ETH (2021 - 2024)

PCE THIS WEEK, SHOULD PROVIDE MORE CLARITY FOR FED DIRECTION

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

Feel free to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community.

Plenty more to come so stay tuned! Also, don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

KEY READS

TOP TWEETS & HOT MEMES:

MicroStrategy has acquired 15,350 BTC for ~$1.5 billion at ~$100,386 per #bitcoin and has achieved BTC Yield of 46.4% QTD and 72.4% YTD. As of 12/15/2024, we hodl 439,000 $BTC acquired for ~$27.1 billion at ~$61,725 per bitcoin. $MSTR

— Michael Saylor⚡️ (@saylor)

1:03 PM • Dec 16, 2024

Is SaylorTracker.com missing a green dot?

— Michael Saylor⚡️ (@saylor)

12:50 PM • Dec 15, 2024

The FTX Debtors today announced that the effective date for its Plan of Reorganization has been set for January 3, 2025, which is also the initial distribution record date for holders of allowed claims in the Plan’s Convenience Classes. Read more here:

— FTX (@FTX_Official)

5:42 PM • Dec 16, 2024

So you want to make AI agents?

Check out AI Agent Dev School.

We start from scratch, assuming no coding experience, and we go into everything you need to know to be an agent dev.

Start here. Start now. Work hard. You can have everything you dream of.

— Shaw 🌙 */acc (@shawmakesmagic)

6:45 AM • Dec 9, 2024

Episode 25: Griffain | NFT's | Bear to Bull | Special Guest: @TheBoggartt

open.spotify.com/episode/1WhRZZ…

— Trench Talk (@TrenchTalkShow)

5:33 PM • Dec 15, 2024

Bitcoin this month

— naiive (@naiivememe)

9:39 AM • Dec 16, 2024

when u have spreadsheets about btc eth sol over their lifetime & ur drunk roommate outperforms u in 5 days with fartcoin

— sartoshi (@sartoshi_rip)

12:34 AM • Dec 16, 2024

/