- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 20, December 16 - December 23)

Welcome to Vol. 20 of Keyed In, the official Consortium Key newsletter!

Drop your stocks and grab your blocks, it’s time to breakdown another wild week for crypto!

Markets pump.fun and markets dump.run. Tether joined the AI bandwagon, the IRS doubled down on staking taxes, and industry experts weighed in on Trump’s potential day 1 policy changes.

Lots to cover (as always) so let’s dive in!

THIS WEEK’S MENU:

📈 BTC & The Global Money Supply

🤖 Tether’s AI Ambitions

💰 IRS Taxes Staking

🇺🇸 Trump’s Day 1 Crypto Policies

☕️ Fresh T/A served with a side of hot memes, and more!

As my father always said: “Eat what you want, and leave the rest!”

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:3.62T H:3.73T L:3.05T C:3.2T -416.71B (-11.53%) V:313.02B

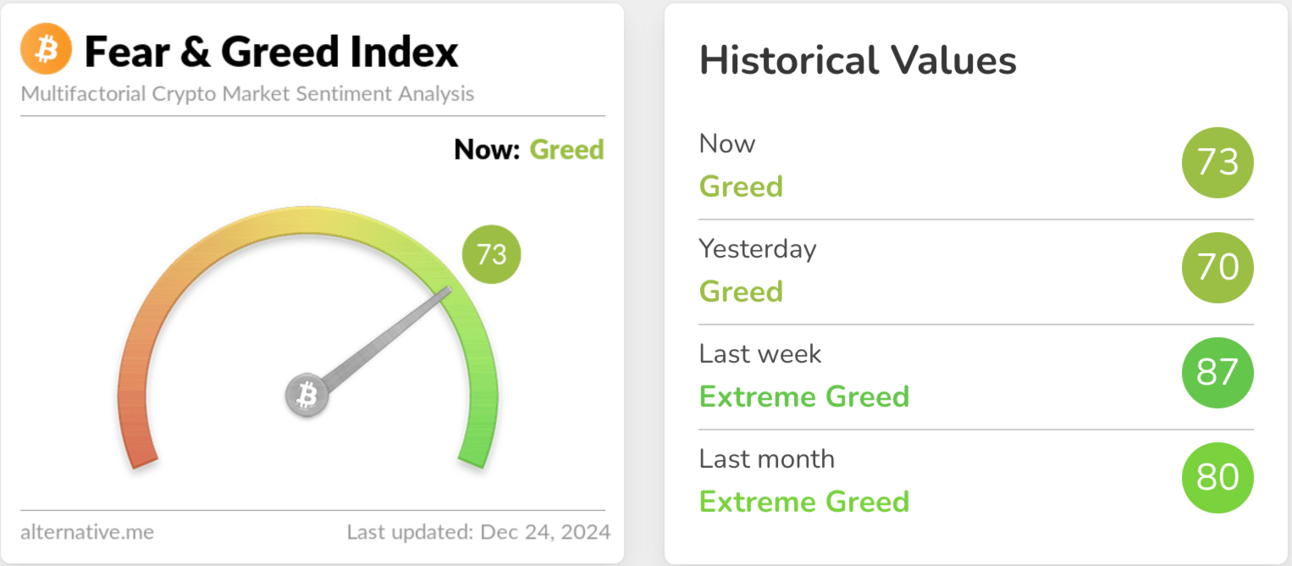

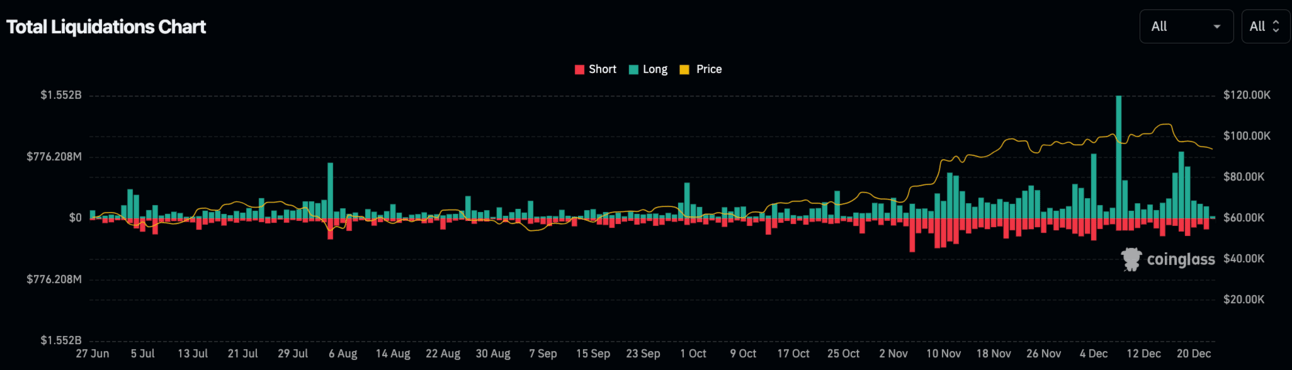

CTMC snapped a 6 week win streak with a double-digit correction, dropping over 11% off the back of hawkish fed policy regarding future rate cuts and tightening global liquidity. The index ultimately struck rock just above key support at $3T on Friday, rebounding into the green just prior to session close. ETF inflows held on by a thread, and liquidations ballooned to over $3.7B. CTMC underperformed its equity counterparts (SPX -1.99%, NDQ -2.25%) which both saw corrections relative to position on the risk curve.

CTMC has since done its’ best to maintain its footing, clawing back half a percent of last week’s losses since Monday’s open. The move has been largely in-line with the broader market, with all 3 primary US indices experiencing fractional gains to start the week. Still resting above $3.2T, CTMC is doing its best to continue projecting strength despite the recent selloff. So long as CTMC can continue building up support above the key $3T level, we can avoid getting overly concerned with market health.

TOP STORIES:

In the past, BTC prices have followed changes in global money supply (M2) with a ~10 week delay

In October, M2 hit a new record of $108.5T, leading to BTC’s ATH at $108K

Since then, M2 has dropped over $4.1T to $104.4T, the lowest since August.

If correlation holds true, Kobeissi analysts believe BTC could fall as much as $20,000 over the next few weeks.

Macro pressures, including tighter global liquidity and hawkish Fed policies, continue driving downward momentum.

BTC performance often signals the rest of CTMC, providing key insights regarding what to expect from the rest of the market moving forward.

Despite the bearishness, its worth noting BTC has yet to return to its pre-election price since inception.

Paolo Ardoino, the CEO of Tether, announced plans for an AI platform targeting an early 2025 debut.

Best known for USDT, the company recently made significant efforts under Ardoino's leadership to expand its business beyond stablecoin issuance.

Tether’s recent pivot includes a reorganization of its corporate structure to reflect its broadening focus, and investments in tech innovators such as Blackrock Neurotech & Northern Data Group.

The platform will likely integrate with Tether's existing financial infrastructure, potentially creating new opportunities for blockchain and AI synergy.

Details are scarce, but development is underway, with further details anticipated as we get closer to the launch date.

"Our upcoming AI platform is just the beginning of a long journey that will see very important investments by Tether in this sector…Tether's focus as always, will remain, building technology solutions that focus on freedom, independence and resilience.”

The IRS has reaffirmed that staking rewards are taxable as income when received, not when sold or exchanged.

This stance was challenged in a lawsuit filed by Josh and Jessica Jarrett, who argued that staking rewards, like a farmer’s crop, should not be taxed until sold.

After rejecting a settlement, the court dismissed their lawsuit, upholding the IRS's position.

The IRS maintains that staking rewards must be reported as income at their fair market value in the year they are received, in line with its broader digital asset taxation guidelines.

The ruling emphasizes that crypto participants are responsible for reporting their staking rewards on their tax returns, even if they have not yet sold the rewards.

This case sets a precedent for how the IRS will treat staking rewards in the future, signaling continued scrutiny of crypto tax practices.

The US crypto industry is pushing for Trump to issue executive orders on his first day in office, calling for clear policies to boost adoption and innovation.

One of the primary proposals is the establishment of a national BTC reserve, aimed at securing Bitcoin's position in the financial system.

The industry also seeks banking access for crypto firms, allowing them to operate more freely in the traditional financial system without fear of restrictions or shutdowns.

A proposed crypto advisory council would help guide future regulations and serve as a bridge between crypto and government entities, ensuring that emerging technologies are properly regulated without stifling innovation.

Trump's team is reportedly planning a reorganization of agencies overseeing crypto, with pro-crypto officials like Paul Atkins, a former SEC commissioner, being appointed to key positions.

Although nothing is set in stone, focusing on these policy changes could lead to a more favorable environment for crypto businesses in the U.S., pushing to make the country a global hub for blockchain technology.

LOCKING IN:

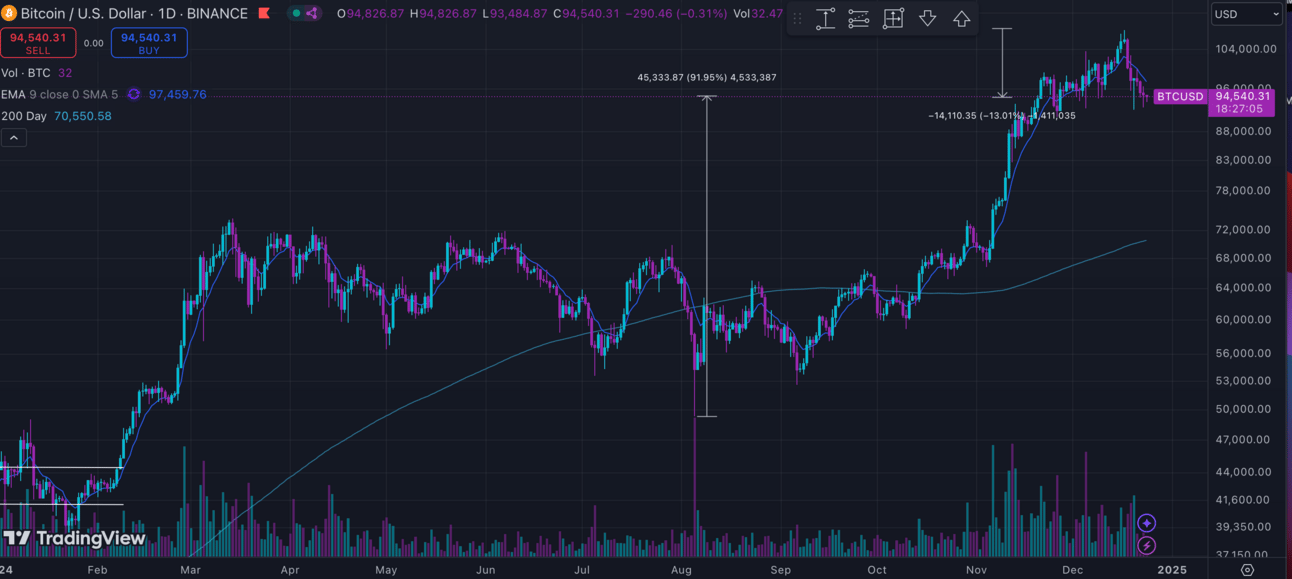

BTC/USD (BINANCE) O:104197 H:108230 L:92072 C:95303 -8878.03 (-8.52%) V:3.29K

BTC notched fresh ATHs last week, cresting above $108K before falling into an engulfing correction in line with the broader market. Slight relative strength was shown against CTMC, resulting in a near 3% gain for BTC.D, topping out just below 60% Friday afternoon. ETF inflows managed to stay positive, adding $447M despite record daily outflows totaling $672M in the Thursday session. Thanks to rising institutional interest, BTC ETFs have now seen 14 consecutive weeks of positive price action. BTC has since continued correcting, shedding an additional 1.5% since weekly open and dropping once again below 93K.

Looking at the technicals, last week’s profit taking recommendations have proven well advised. Despite missing out on BTC’s early week gains, we managed to protect capital throughout the correction that followed. We try our best not to penny-pinch our entries and exits, and corrections are to be expected considering the depth of BTC’s recent run. Looking south, a move below $92K (narrowly avoided twice since December’s open) would suggest further downside still in play likely worth avoiding. On the other hand, a return above $98K would open the door for another triple digit push, though tight stops and earlier targets will remain recommended in the interim.

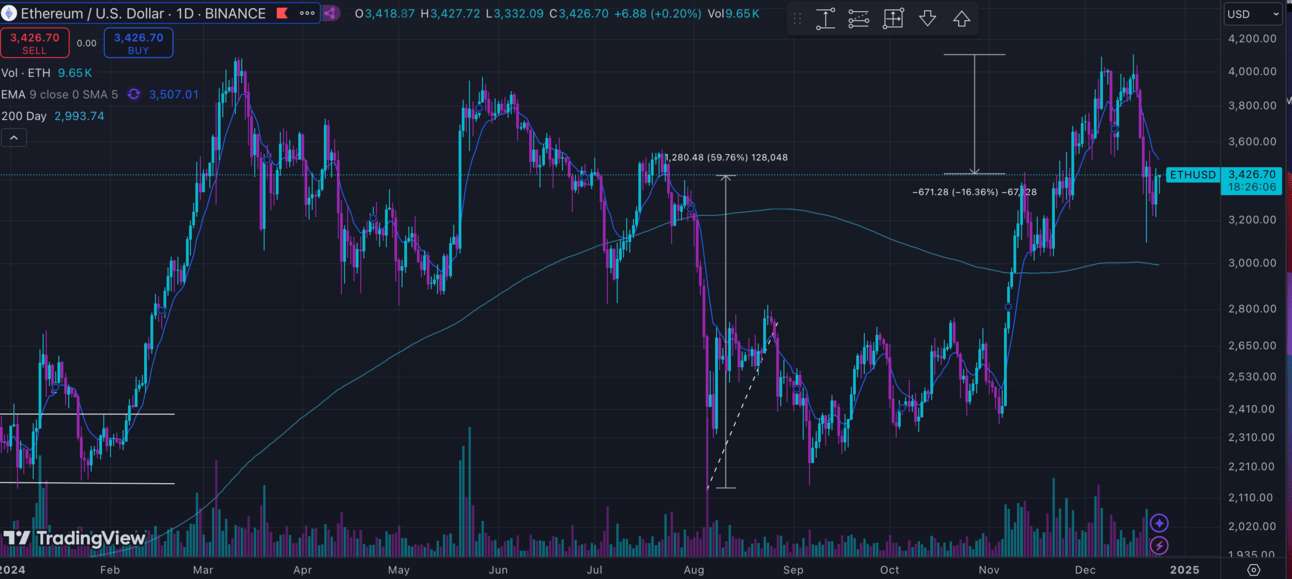

ETH/USD (BINANCE) O:3960 H:4106 L:3096 C:3279 -676.65 (-17.10%) V:324.54K

Despite briefly topping out above $4100 for the first time since December 2021, ETH fell victim to the broader market correction. The asset ultimately printed its own engulfing candle on the weekly, striking rock just below $3100 before rebounding into Sunday’s close. ETFs held on by a thread with $62M in net inflows, a 90% drop from the previous week. ETH has since done its bet to mitigate the damage, gaining 4% since Monday’s open off the back of a shallow, market wide reversal.

Technically speaking, ETH has begun to show some signs of concern here, having made a clear return into its previous channel. As discussed in last week’s report, ETH will likely remain at the will of its eldest sibling for the time being. Despite price disparities relative to previous cycle peaks, ETH will likely struggle to gain momentum so long as BTC continues its correction. A return above $3500 would coincide with a 50% retracement and a breach of early December lows, opening the door for reversals so long as momentum can continue throughout the market. ETH still has plenty of room to run here, though historic data suggests that the majority of its gains can be expected in Q1 of 2025. Following both prior US elections, ETH was largely dormant—experiencing its most notable price surges in first quarter of the following year.

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment, vote on our polls, and check out all the bonus content down below for extra credit!

Stay tuned for next week and—in the meantime—consider yourself Keyed In!

WEEKLY POLL:

CHART OF THE WEEK

BTC v M2 (Global Money Supply

NOTE: Strong correlation ~10 week lag

CHEEZY CHARTS:

7D TOP GAINERS/LOSERS (TOP 1000 COINS)

COINGECKO 24H HIGHLIGHTS

NOTE: ETH & BTC REMAIN @ TOP SPOTS

NOTE: RECORD OUTFLOWS LAST FRIDAY

NOTE: 17 DAY WIN STREAK (NET INFLOWS DESPITE PRICE CORRECTION)

CTMC (2021-2024)

BTC (2021-2024)

ETH (2021 - 2024)

LIGHT WEEK w/ HOLIDAYS, HOPE EVERYONE ENJOYS

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

Feel free to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community.

Plenty more to come so stay tuned! Also, don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

KEY READS

TOP TWEETS & HOT MEMES:

Is Bitcoin overdue for a correction?

In the past, #Bitcoin prices have followed global money supply with ~10 week lag.

As global money supply hit a new record of $108.5 trillion in October, Bitcoin prices reached an all-time high of $108,000.

Over the last 2 months, however,… x.com/i/web/status/1…

— The Kobeissi Letter (@KobeissiLetter)

6:45 PM • Dec 21, 2024

Just got the draft of the site for Tether's AI platform.

Coming soon, targeting end Q1 2025.🪿🤜🤛 (goosebumps)

— Paolo Ardoino 🤖🍐 (@paoloardoino)

4:49 PM • Dec 20, 2024

ever wish there was a tool to let you sell 100+ tokens in literally one click?

i built @PocketChange_gg w/ a few friends to solve that

no more manually scraping wallets, missing balances, clicking hundreds of times

literally a lifesaver tool - go collect ur change on sol & eth

— The Boggartt (@TheBoggartt)

4:08 PM • Dec 23, 2024

🚨 Token unlocks: market killer or misunderstood opportunity?

Keyrock studied 16,000 token unlocks and found that 90% led to price declines. But there’s more to the story. 👇

1/

— Keyed In (@KeyedIn_)

7:02 PM • Dec 17, 2024

crypto market this week

— naiive (@naiivememe)

5:44 AM • Dec 23, 2024

When you recommended a coin to your crypto bro, and it immediately pumping

— naiive (@naiivememe)

6:18 AM • Dec 17, 2024

@cryptoaussie When the market dumps 📉📉🤭 #crypto #cryptocurrency #cryptok #fyp #invest #investing #bitcoin #crash #finance #cryptoinvesting #stocks #funny #meme