- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 3, August 12 - August 19)

Welcome to Keyed In, the official Consortium Key newsletter! Feel free to share this with your fellow degens, looking forward to building it out along with our team and the rest of the CK community. Plenty more to come so be sure to stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or anything else you’d like to see us dive into. NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

Click the link below to subscribe!

https://consortiumkey.beehiiv.com/subscribe

ZOOMING OUT:

CTMC O:2.014T H:2.131T L:1.958T C:2.027T +12.816B (+0.64%) V:129.232B

CTMC was largely unchanged last week, moving just over half a percent amid 2024’s strongest global equity rally. 5 year lows in network fees were seen for ETH, resulting in 16,000 coins added to supply. Crypto exchange BitGo confirmed the upcoming final distribution of BTC from Mt. Gox. US Democrats continue pushing for a more crypto-friendly perception, participating in a “Crypto4Harris” virtual townhall alongside Mark Cuban, Anthony Scaramucci and Congressman Adam Schiff.

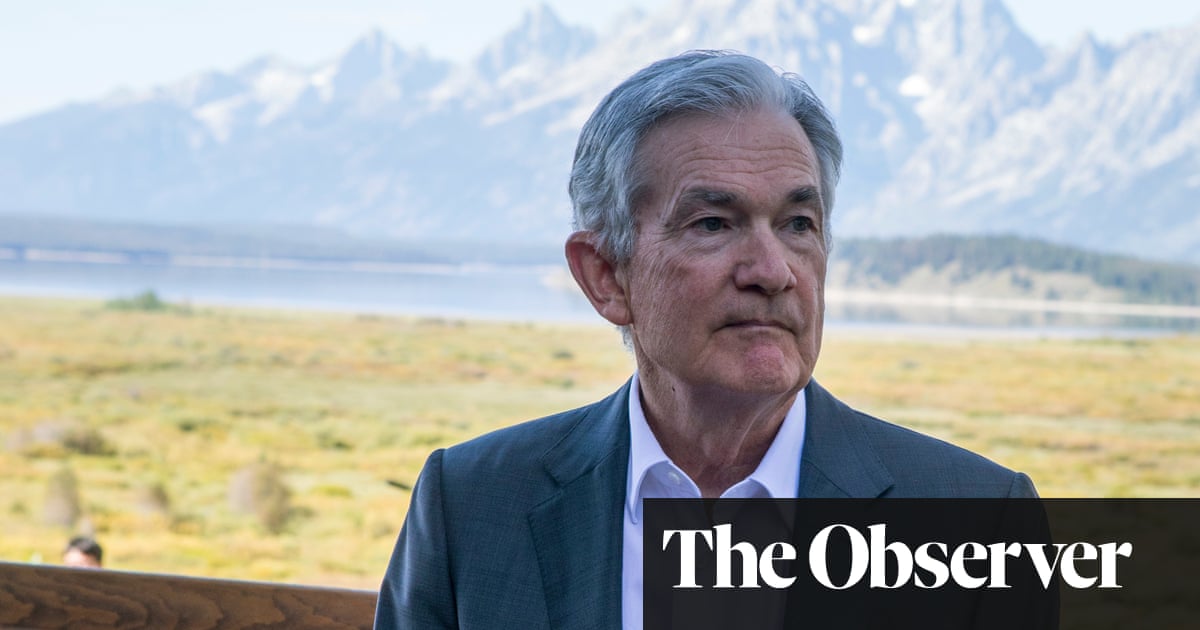

US CPI came in largely in line with expectations, showing a slowing of annual inflation to 2.9%—the lowest levels seen in over 3 years. Paired with strong US retail sales data and Jobless numbers, we saw a significant uptick in rate cut expectations and fresh ATHs for Gold. Across the pond, both New Zealand and the Philippines announced their first rate cuts in over 4 years. With the recent market chaos now firmly in the rear view mirror, all eyes have turned to the upcoming annual US Fed meeting in Jackson Hole, where Chairman J Powell is expected to set the stage for the first US rate cut since March 2020.

“The Fed will probably react to the gathering clouds by easing monetary policy by more and faster than we had expected.”

LOCKING IN:

BTC/USD (BINANCE) O:58784 H:61857 L:56170 C:58491 -284.63 (-0.48%) V:1.672K

BTC saw marginal relative weakness against both US equities and CMTC, ultimately shedding half a percent by weekly close and falling decisively short of reclaiming critical psychological support at 60K. Despite its struggles and in clear contrast to recent weeks, BTC ETFs saw $32M in net inflows, printing green candles in 4 of 5 sessions. This contrast is particularly interesting with Morgan Stanley having recently green-lit over 15,000 financial advisors to begin recommending the ETFs to clients.

Meanwhile, the US Government recently transferred $600M in BTC to CoinBase, though it is more likely related to a custody agreement than a desire to sell, despite initial concerns. Other notable coin movements include a $2B BTC transfer from BitGo, one of the five exchanges tasked with the redistribution of BTC creditor repayments from Mt. Gox.

Looking at the technicals, $61,800 remains the nearest resistance worth our attention. Any confident, sustained moves above the level remains suggestive of additional upside in play. Conversely, trend support remains firmly intact, though we will continue to expect deeper corrections in play should we fall meaningfully below. Trading is a game of contingency!

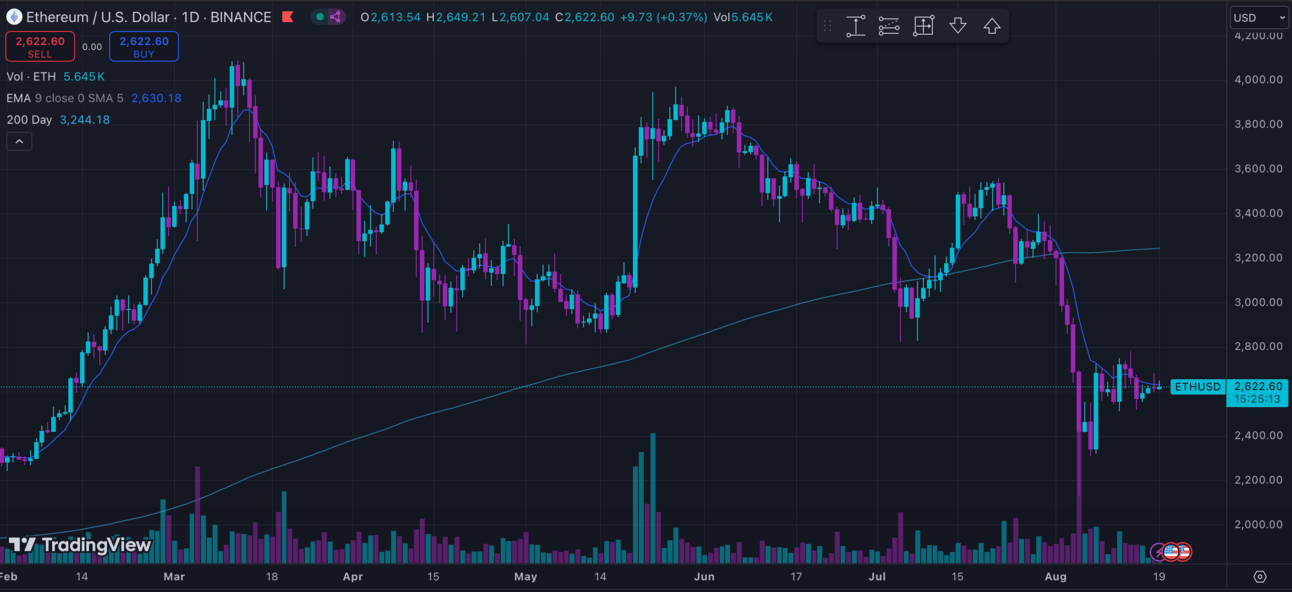

ETH/USD (BINANCE) O:2556 H:2780 L:2509 C:2612 +56.29 (+2.20%) V:206.394K

ETH managed to flip last week’s script, gaining 2.2% off the back of a clear return to risk-on trading and 5 year lows in network fees. ETFs saw $14.4M in net outflows amid a continued bleeding out from Greyscale’s funds. With higher fees, trading premiums, and $2.3B in outflows in ETHE alone, Greyscale has officially conceded its first place position to Blackrock—who now holds the most AUM for Crypto listed products. ETH continues making waves in mainstream finance, including a recent financial disclosure from Republican Nominee Donald Trump detailing ETH holdings estimated at $3.6M, according to Arkham intelligence.

Network fees—now as low as 0.6 gwei for low-priority transactions—highlight a decreased demand for ETH block space. Traders (including many in our own CK community) continue migrating towards faster, cheaper blockchains like Solana and Layer 2 solutions. Combined with the Dencun upgrade improving network efficiency, this reduction in fees has led to a notable increase in ETH’s supply. Underscoring this, nearly 16,000 ETH has been added over the past week, a metric we expect to significantly impact ETH’s price dynamics moving forward.

Moving onto the technicals, relative strength is certainly worth noting. ETH seems poised to make significant gains should markets continue trending in a risk-on direction amid global rate cut announcements. ETH.D has shown signs of a potential local bottom, allowing the asset to make up for critical lost ground with a successful reversal. A confident move above resistance at $2700 would certainly open the door for further upside. Conversely, a loss of key support at $2500 remains suggestive of additional downside in play, likely not worth the trouble should markets concede recent gains.

DXY O:103.154 H:103.310 L:102.270 C:102.402 -0.752 (-0.73%)

DXY struggled last week amid clear risk on trading, including solid continuation rallies for both SPX (+3.93%) NDQ (+5.38%). Notably, both indexes now sit less than 7% below respective ATHs. With a light week ahead in terms of economic data, near term downside for DXY would seem minimal despite clear weakness leading into Monday’s open. Technicals are primed to retake the driver’s seat, though an overly dovish tone in Jackson Hole could easily stir things up. EUR and JPY strength will be worth our attention this week, along with political instability in the US as VP Kamala Harris edges ahead in the polls leading up to the 2024 DNC.

Rate cut expectations remain just short of 100% for the September meeting according to data from CME FedWatch. We can expect the stage to be set during the Fed Symposium in Jackson Hole, well worth our attention as US markets continue to grapple with multi-decade highs in borrowing costs. While an expected rate cut won’t change the price of eggs or create job openings overnight, it will certainly signal a new phase of the monetary cycle with major consequences for both markets and consumers globally.

WEEKLY POLL

CHEEZY CHARTS

LINKS

KEY READS

Institutional BTC adoption is about to go parabolic! Wonder how? 🏛️

#KeyedIn, our very own newsletter is here to break it down--completely free!

Keep reading for a full summary of last weeks key rumblings & subscribe to the free newsletter for more! 👇

1/ x.com/i/web/status/1…

— Keyed In (@KeyedIn_)

9:08 PM • Aug 13, 2024