- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 6, September 2 - September 10)

Welcome to Vol. 6 of Keyed In, the official Consortium Key newsletter! Clear corrections last week across the risk curve with solid reversals since Monday’s open. Traveling ATM so apologies for the late update but don’t worry—we will soon return to our regularly scheduled programming! Plenty to cover with a couple extra days tacked on so lets dive in!

TODAY’S MENU:

🚗 Heavy ETF Outflows

🧱 ATHs for ETH Network activity

🧨 Major upticks in exchange deposits

🧵 Comments from TG Founder Pavel Durov

☕️ A side of hot T/A

Be sure to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or anything else you’d like us to dive into!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:1.968T H:2.054T L:1.814T C:1.904T -64.611B (-3.28%) V:114.468B

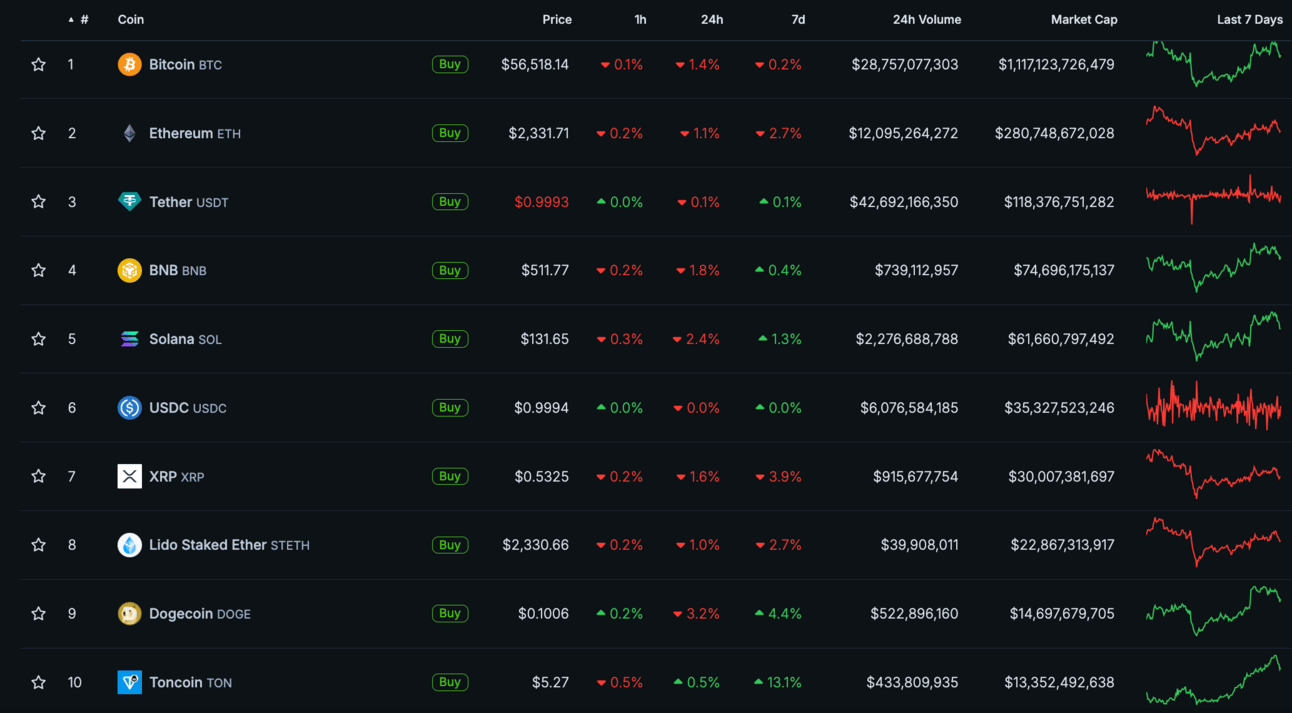

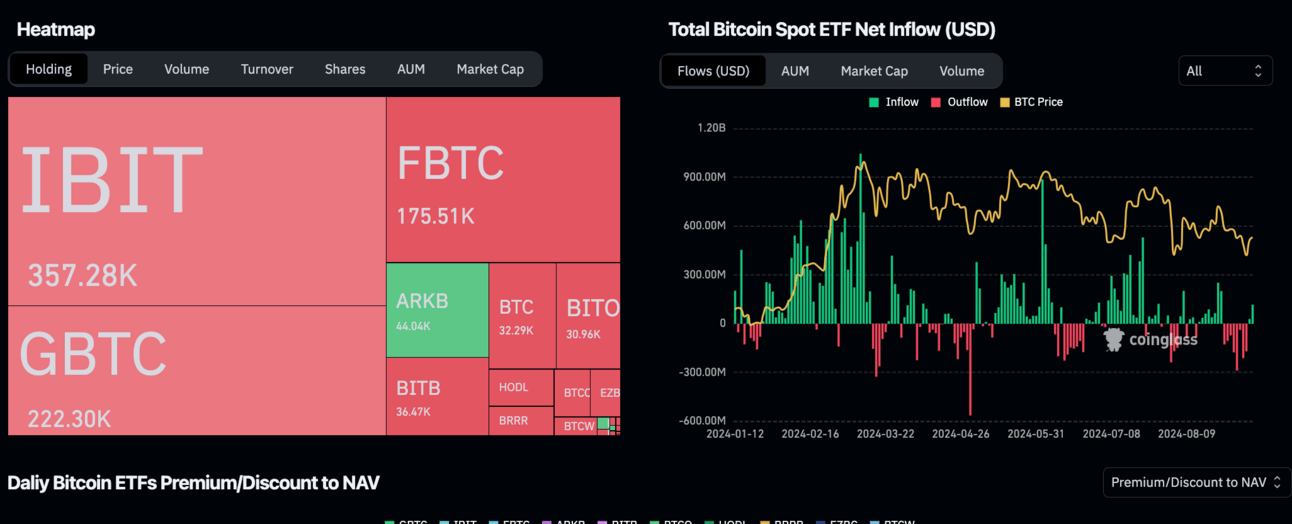

CTMC continued to struggle last week. Risk-off trading fueled by seasonal slumps, notably weak jobs data, and uncertainty surrounding US rate cuts led to another critical rejection just above the key $2T level. The index largely fell in line with its’ US equity counterparts (DJI -2.93%, SPX -4.85%, NDQ -5.89%) all of which saw corrections relative to position on the risk curve. Volume snapped a 4 week down streak, ascending marginally with the help of busy weekend trading. ETFs got slammed, totaling just under $800M in net outflows between BTC and ETH. Despite recent troubles, we’ve since seen solid reversals to start the week, including a fully engulfing candle for BTC and significant retracement for ETH ahead of next week’s rate announcement. While we haven’t quite worked our way out of the woods, things certainly have begun to show some promise after two weeks of corrections across the board.

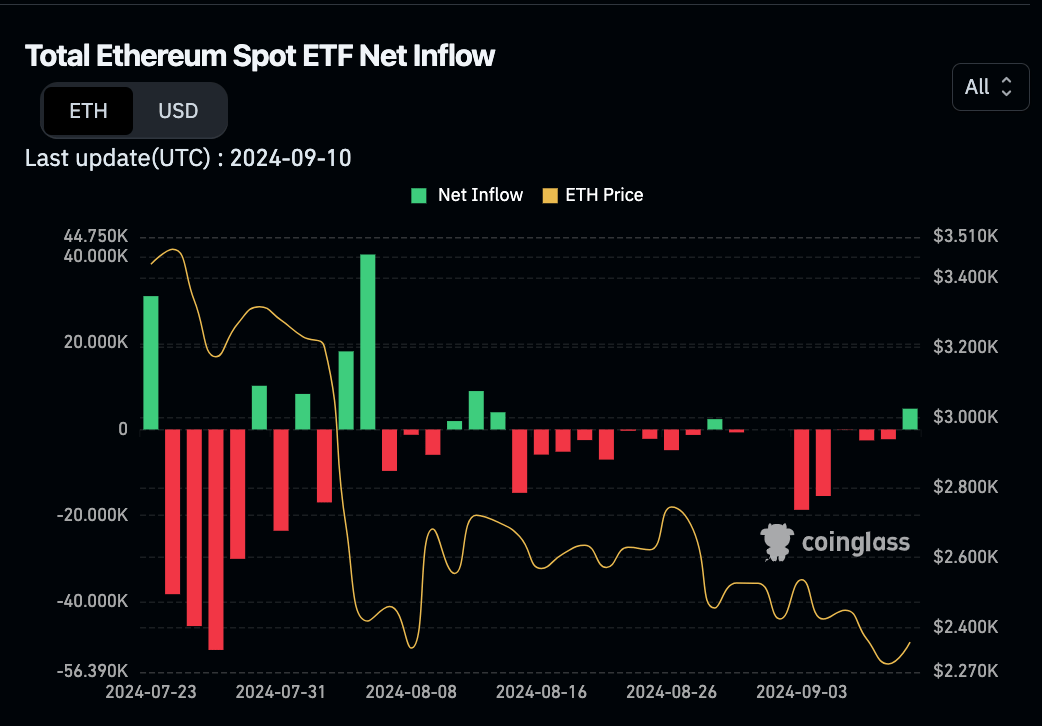

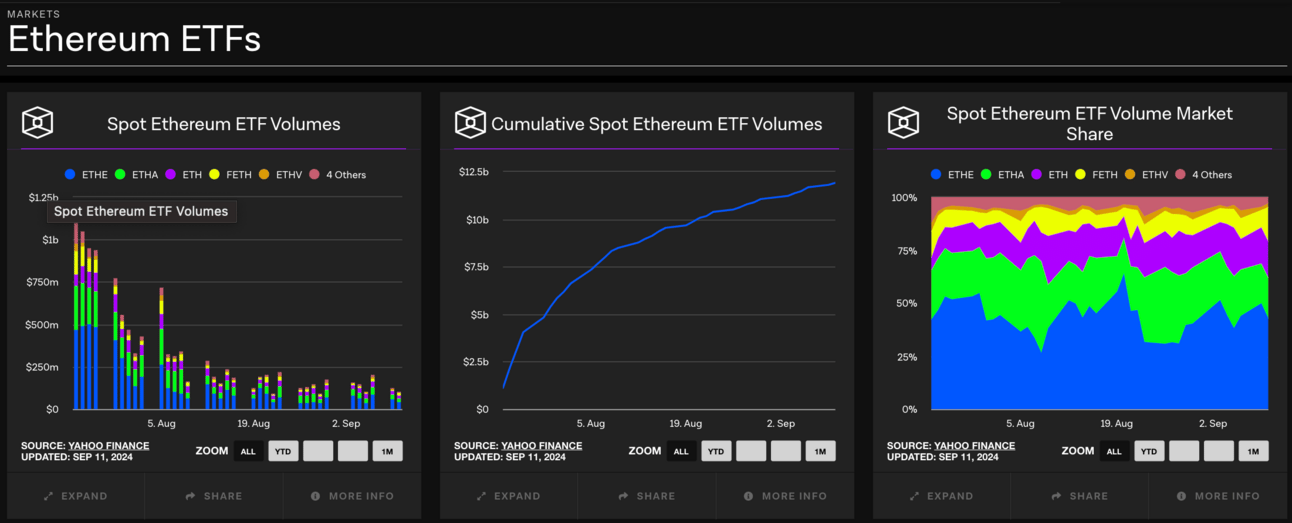

ETFs had a particularly rough week, recording the second highest week of outflows for crypto related products in 2024. BTC funds saw over $700M in net outflows, bringing the recent losing streak into its 8th consecutive session. ETH funds managed to slow the recent bleeding, however still recording nearly $100M in net outflows by week’s end. On top of having largely failed to attract the volume initially expected post approval, ETH ETFs have posted net outflows for the past 4 weeks. Underlining recent struggles, VanEck announced Friday it will be closing its ETH futures ETF (EFUT), citing issues with performance, liquidity, and overall investor interest.

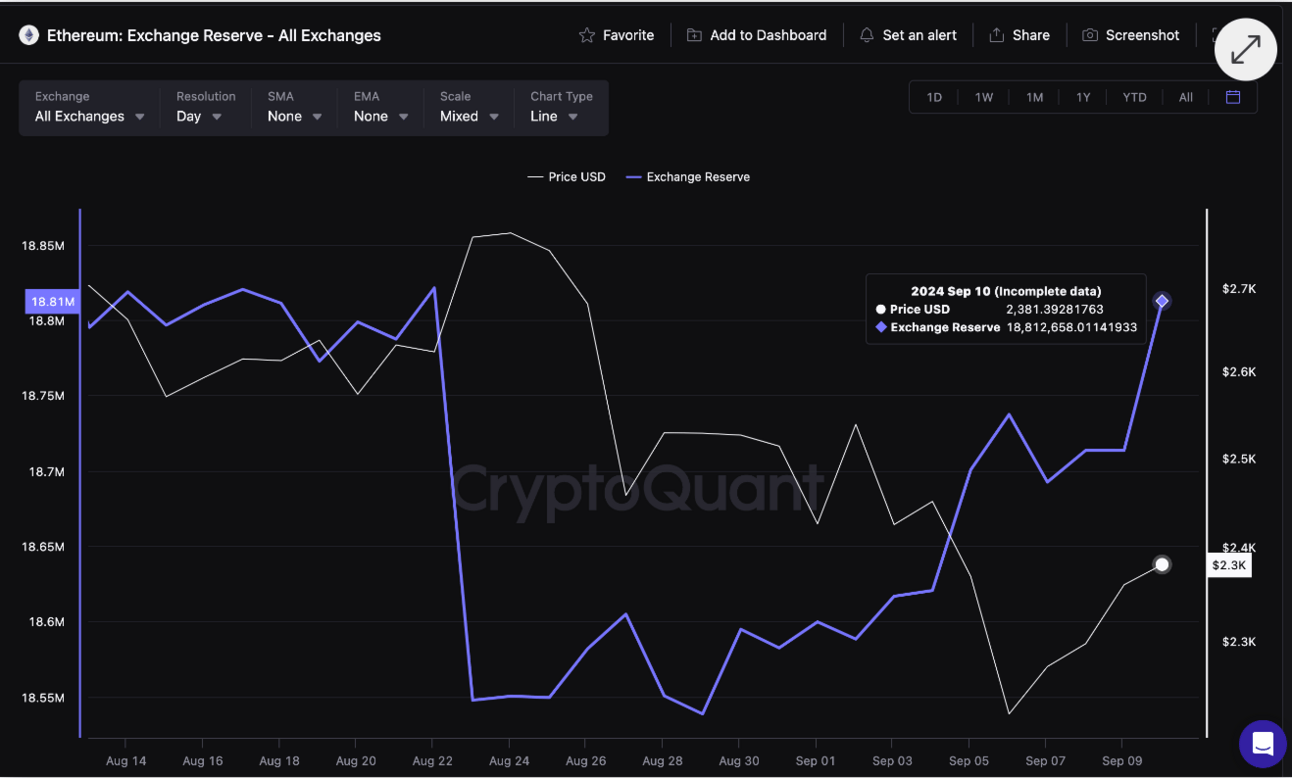

ETH made up for plenty of lost ground in the last few days, gaining double digits and emerging as one of the top 10s best performers since Monday’s open. Network activity hit ATHs amid a 90% drop in fees YTD. That being said, concerns remain regarding the recent uptick of funds sent to exchanges, with deposits totaling over $600M in the last 20 days alone. Similar deposit events have historically preceded profit taking, well worth our attention after such a strong reversal following 2 weeks of correction.

Telegram founder Pavel Durov finally released a statement on X regarding his recent arrest, revealing cooperation with French authorities including a hotline set up to help with ongoing terrorist threats. The company will be taking a more proactive approach in moderating the platform, highlighted by the removal of exemptions for mod requests in private chats according to changes in Telegram’s FAQs. In the last three weeks, TG’s native token TONCOIN has shed nearly 30% of market value. Durov remains out of custody on a $5.5M bail.

Telegram’s abrupt increase in user count to 950M caused growing pains that made it easier for criminals to abuse our platform. That’s why I made it my personal goal to ensure we significantly improve things in this regard. We’ve already started that process internally, and I will share more details on our progress with you very soon.

LOCKING IN:

BTC/USD (BINANCE) O:57356 H:59844 L:52622 C:54981 -241879 (-4.21%) V:1.447K

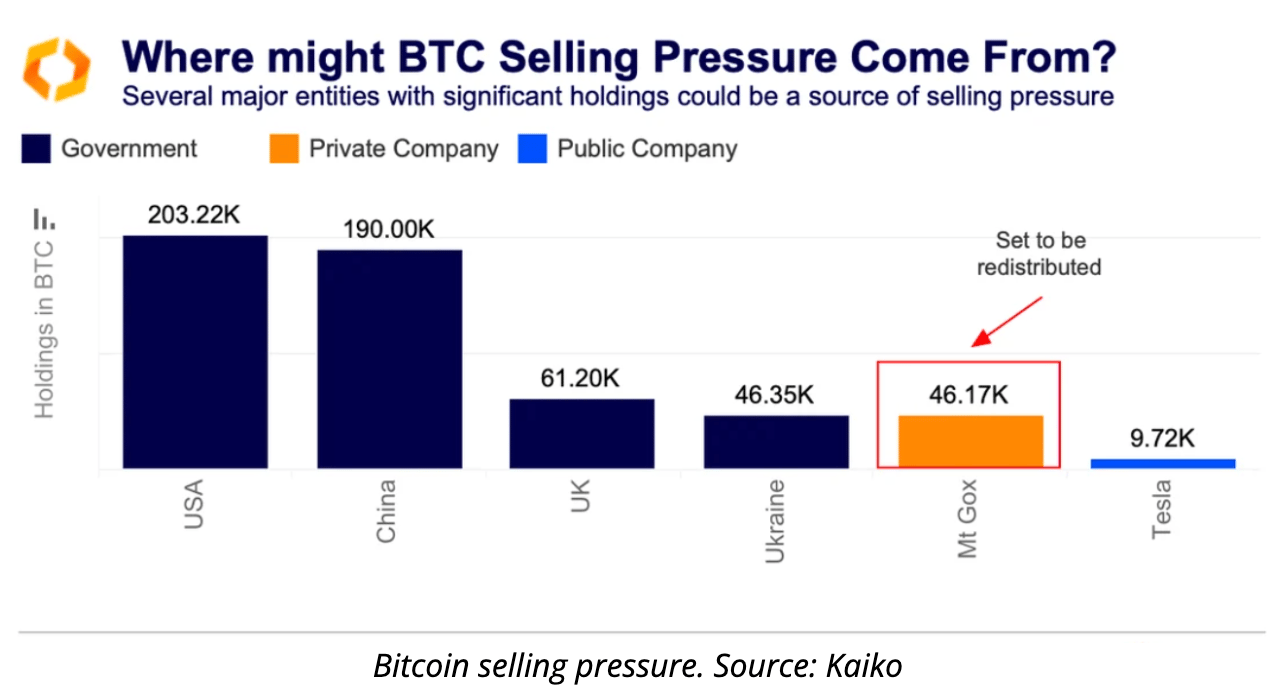

BTC continued its correction last week with the help of mounting ETF outflows and a broad market correction. Liquidations saw a sizable uptick, totaling just over $350M. ETFs were red throughout the week. Net outflows totaled over $700M, 40% of which came from Tuesday’s trading in the worst performing ETF session since early May. Volume ascended marginally, and BTC.D shed less than a percent—still consolidating well above the 55% level. Mt. Gox creditor concerns continue to linger after the exchange sent a test transaction from a wallet holding over $2B in BTC, an event that usually precedes sizable distributions. Despite concerns, Mt. Gox creditors have largely held on to the BTC received so far, though much of it has yet to be returned.

Previous profit taking calls remain well advised. That being said, BTC managed to engulf the entirety of last week’s losses since Monday’s trading. While this slightly opens the door for higher confidence reversals, 58K remains formidable resistance. With markets still in recovery, tighter stops and earlier targets remain advised for those unwilling to wait until resistance breaks. Despite last week’s breakdown, BTC has made a sharp return into its previous descending triangle. Looking south, a loss of $56,500 remains suggestive of additional downside likely worth avoiding should we fall confidently below.

ETH/USD (BINANCE) O:2428 H:2564 L:2151 C:2298 -130.53 (-5.37%) V:171.64K

ETH continued grappling with light relative weakness against BTC and CTMC, though the dramatic younger sibling seems to be doing its best to flip the script since Monday’s open. ETFs did little to alleviate the pressure, posting net outflows for 15/16 of the last sessions with nearly $100M shed last week alone. Notably, ETH activity managed to hit fresh ATHs amid a 99% reduction in fees, touching some of the lowest levels since inception. While the extra activity certainly reads bullish, concerns remain regarding inflationary pressures as burned tokens struggle to keep up with freshly minted supply. Exchange deposits remain concerning, with some degree of profit taking to be expected approaching resistance considering ETH’s early week success.

Technically speaking, we remain in profit protection—advice which allowed us to avoid over 15% of losses since Vol. 4 of Keyed In. ETH’s dominance largely remains in freefall, dropping decisively below 15% and touching the lowest levels seen since June 2022. Looking at the weekly, ETH.D has printed red candles in the last 9 of 11 weeks of trading. A loss of lower trend support from February has certainly elevated concerns. Continued price action below $2400 remains suggestive of potential corrections still on the table. That being said, a reclamation of the level and a confident move above $2440 could certainly open the door for higher confidence reversals. Tighter stops and earlier targets will remain similarly recommended as we continue to build confirmations.

DXY O:101.733 H:101.917 L:100.583 C:101.188 -0.544 (-0.53%)

DXY saw a near engulfing reversals last week off the back of a notably weak US jobs report, raising recession fears and marking the worst August report since 2017. The labor department has missed the mark significantly, overestimating labor market growth by 818,000 from March 2023 to March 2024 according last weeks report. Rate cut expectations remain just short of 100% for next week’s meeting, the size of which will likely determine what to expect from the Fed moving forward.

Technically speaking, DXY certainly seems to have avoided a deeper correction, still holding tightly above trend support just above the 101 level. Continued support above this level could open the door for further gains, putting additional pressure on risk assets despite the upcoming cuts. The frequency of rate cuts also remains up for debate, though it would seem the market is slowly beginning to price in the potential of significant easing just around the corner. Wednesday’s CPI and Thursday’s PPI reports will likely provide us with some much needed clarity.

WEEKLY POLL:

CHEEZY CHARTS:

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

KEY READS

I'm still trying to understand what happened in France. But we hear the concerns. I made it my personal goal to prevent abusers of Telegram's platform from interfering with the future of our 950+ million users.

My full post below.

— Pavel Durov (@durov)

10:48 PM • Sep 5, 2024