- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 10, Uptober 8 - Uptober 14)

Welcome to Vol. 10 of Keyed In, the official Consortium Key newsletter!

Hotter than expected CPI and a solid DXY rebound threatened the market, but a late week rally just barely managed to even the score. Momentum has continued into this week’s trading, with engulfing rallies across markets in the Monday session including fresh ATHs for DJI and SPX. Plenty to cover (as always) but rumor has it Uptober may still be on the calendar, so let’s dive in!

TODAY’S MENU:

🥵 HOT CPI

🕵️♂️ FBI Coin (Operation Token Mirror)

💰 China *Crypto* Stimulus

🏦 Microstrategy $1T BTC Bank

☕️ Fresh T/A, and more!

P.S be sure to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:2.254T H:2.259T L:2.028T C:2.138T -116.059B (-5.15%) V:129.967B

CTMC barely managed to stay in the green last week after bottoming out Thursday following hotter than expected CPI and souring rate cut expectations. Volume descended marginally, maintaining relatively average levels and totaling $112B by weeks end. Liquidations, on the other hand, fell 30%—still managing to top $1B with the help of $200M in shorts wiped out in Sunday’s trading. ETFs saw $359M in net inflows, a whopping 99% of which came from BTC funds. The index has since seen a notable uptick, gaining nearly 5% in Monday’s trading with the help of a $200M short squeeze and bullish macro movements in both the US and China, including fresh ATHs for both DJI and SPX. Overall, CTMC looks poised to break out of its descending triangle, though it remains to be seen whether or not momentum will continue.

Beyond the technicals, CPI managed to shake markets after a lackluster 0.1% drop in YoY cost of living. Despite the correction that followed across CTMC, its worth noting that CPI remains on a six month downtrend, and that the current 2.4% is far lower than the 9.1% seen just two years prior. Headline inflation remains on a clear path to 2%. Despite having stalled, core inflation should be expected to take a bit longer to bottom out considering it took an additional 3 months for it to top out in 2022. Zooming out, it would certainly appear markets may have overreacted, evident in the rebounds and price discovery we’ve seen in the days that have followed.

In an interesting development on the legal side of things, the FBI created a fake token designed to expose market manipulation in an operation codenamed “Token Mirrors”. The (surprisingly sophisticated) sting included a website for a fake company called NexFundAI, which promised to redefine the "intersection between finance and artificial intelligence" and to "create a cryptocurrency token that not only serves as a secure store of value but also acts as a catalyst for positive change in the world of AI." The sting resulted in charges being brought upon 18 people and entities, including market makers ZM Quant, CLS Global, MyTrade, and GotBit. Over $25M was confiscated, and multiple wash trading bots were disabled. For those interested, a detailed report from the SEC can be found here.

Across the pond, a lack of clarity regarding China’s stimulus package has helped boost CTMC as capital that was expected to move into Chinese equities rotates into crypto markets. A policy update over the weekend left investors concerned about the scope and scale of the stimulus, providing minimal details for traders to latch onto. Orbit Markets co-founder Caroline Mauron summed up the movement well—stating that “Markets are probably taking a disappointing China stimulus to be positive news for bitcoin, as capital rotation from bitcoin into Chinese equities was understood to be previously weighing on crypto prices.”

Last, but certainly not least, Microstrategy revealed its endgame plans to open a BTC Bank. Finally beginning to answer the question of what MSTR planned to do with its 252K (and counting) BTC, Michael Saylor told Bernstein Analysts he was eyeing a $1T valuation as the worlds largest BTC Bank. Following Bernstein’s report, MSTR rallied 11%, blasting through resistance at $200 and rising as high as $212, a fresh ATH for the company. The prospect of a BTC bank certainly seems appealing for those versed in the asset’s fundamentals, including cypherpunk Hal Finney, who first proposed the idea in 2010. Saylor’s announcement is particularly beneficial to the market considering the trepidation surrounding the size of MSTR’s holdings, and the lack of clarity regarding its use.

"With purported promoters and self-anointed market makers teaming up to target the investing public with false promises of profits in the crypto markets, investors should be mindful that the deck may be stacked against them."

LOCKING IN:

BTC/USD (BINANCE) O:62818 H:64487 L:58927 C:62635 -177.91 (-0.28%) V:1.12K

BTC remained just barely in the red despite largely recovering from its early week losses. While price action failed to impress, ETFs saw $357M in net inflows, followed by a two month daily high of $555M in yesterday’s session. Liquidations totaled just over $300M, a near 20% drop from last week. Volume descended marginally, maintaining relatively average levels before igniting into two month highs in yesterday’s session. The ignition followed a 5% pop in Monday’s trading amid the postponement of Mt. Gox repayments, pushed back a year to October 2025. In the statement published on the exchange’s website, the trustee cited issues with creditors completing the necessary repayment procedures. The news is certainly welcome for traders, easing (or at least delaying) concerns over supply shocks related to the distributions.

Looking at the technicals, last week’s reentry calls have proven well advised. BTC seems poised to break above its descending triangle, though resistance is likely to be met around 67K. Profit taking is advised prior to testing, with the possibility of further reentry above should BTC successfully push through. Looking south, a loss of 64.5K would suggest further downside still in play, well worth avoiding considering recent volume ignitions to start of this week’s trading. Keeping a close eye out for further ignitions, along with retracement levels as we wait for the dust to ultimately settle.

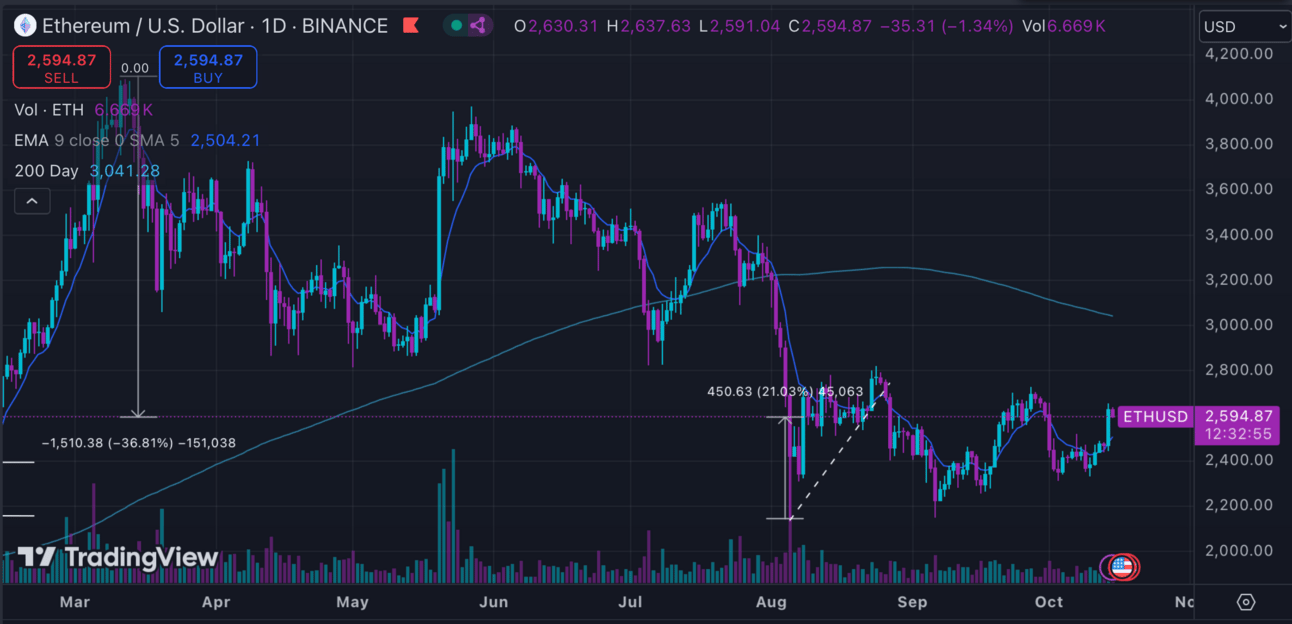

ETH/USD (BINANCE) O:2659 H:2663 L:2311 C:2440 -219.79 (-8.23%) V:143.587K

ETH enjoyed slight relative strength last week, gaining just over 1% after bottoming out just above $2300 Thursday afternoon. Liquidations totaled $305M. ETFs, however, continued failing to impress—just barely going green with a humble $2M in net inflows. Liquidations totaled just above $181M. ETH’s relative strength continued into Monday’s trading with a 6.5% gain. As far as ETH news is concerned, we remain focused on EIP-7781, a proposal meant to improve ETH’s network at the base layer and slash block times by 33%.

Technically speaking, clear resistance remains in play right around September’s highs at $2750. Profit taking is recommended below, with reentry on the table should ETH successfully breach. Missed money is ALWAYS better than lost money, and there’s no reason to penny pinch if it means risking our well earned gains. On the other side of the digital coin, a 50% retracement of Monday’s move around $2550 would imply deeper corrections still on the table, similarly worth avoiding considering the depth of the move. ETH’s volume has failed to deliver the same ignition as its older sibling, leaving the door open for further wide range swings well worth our attention considering ETH’s relative performance over the last several months.

DXY O:102.487 H:103.178 L:102.292 C:102.915 +0.428 (+0.42%)

DXY continued its reversal last week, tacking on an additional 0.4% after making a wide range 2% short squeeze move in the previous week’s trading. The index is further distancing itself from the critical 100 level, aided by geopolitical tensions and a technical breakout above 102.6, the bottom of its 2023 channel. Having begun this week with an another 0.2% gain, DXY seems poised to retest resistance at 104, and will likely remain bullish so long as 102.6 can hold.

According to data from CME FedWatch, traders anticipate an 86% chance of easing in the November meeting despite the hot CPI report. The market seems set on a 25bps cut, largely writing off the possibility of another 50bps. Polymarket (which just recently hit record volume) is currently pricing in an 86% chance of 100bps worth of cuts this year, up from just 38% at the beginning of October. Jobless claims and retail sales will be the big tickets worth our attention this week, both scheduled for Thursday. For extra clarity (and extra credit), SF Fed President Daly and Fed Governor Kugler will both be giving speeches later today worth tuning in.

WEEKLY POLL:

CHEEZY CHARTS:

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_