- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 8, September 24 - September 30)

Welcome to Vol. 8 of Keyed In, the official Consortium Key newsletter!

This week’s theme is LAW & ORDER(S) ⚖️

Limit orders in the court! All rise, up only. The honorable judge CHEEZKING is here to preside over the order book. Pursuing light sentences, not looking to give anyone a hard time. Hope you degenerates enjoy. You may be seated.

TODAY’S DOCKET:

✂️ Controversial FTX compensations

🚓 Caroline Ellison Sentencing

😎 Free CZ + Whats next

🪙 SEC V. TrustToken

☕️ (T/A will be served while court is in recess)

P.S be sure to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or sidebars with the judge!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:2.166T H:2.291T L:2.134T C:2.254T +87.834B (+4.06%) V:131.562B

CTMC continued bucking September trends last week, tacking another 4% onto its monthly gains and reaching the highest levels seen since late July. Volume continued climbing in tandem, falling just short of breaching relative highs with the help of a solid uptick in Friday’s trading. ETFs saw notable success, with both BTC and ETH related funds posting positive net inflows off the back of market wide risk-on trading. Liquidations totaled $899M, nearly a quarter of which came from longs wiped out on Sunday—just barely ahead of weekly close. Technically speaking, CTMC remains clearly locked into its descending triangle, though higher highs are certainly worth noting despite trend resistance remaining largely intact. The index has since conceded the lion’s share of last week’s trading amid hawkish fed speak and mounting concerns regarding monetary easing.

Beyond the technicals, legal troubles have begun to brew again across the crypto space. Most notably, FTX creditors are poised to take a significant haircut after the announcement of the recent compensation plan. While the company expects to “fully pay” 98% of customers affected, the value of payments will be tied to asset prices at the time of bankruptcy in November 2022. To add a bit of perspective, BTC was sitting just above $16,000 at the time, equating to a near 75% loss for creditors, who have long been promised near full compensation. Despite the troubles, FTX’s native token (FTT) spiked 70% following reports of the distribution, some of which falsely stated creditors would soon be receiving funds.

In other FTX related news, Former CEO Caroline Ellison received a 2 year sentence on Tuesday in addition to the forfeiture of $11B. Despite her extensive cooperation with prosecutors, Judge Lewis Kaplan said “the FTX case is probably the greatest financial fraud perpetrated in the history of the U.S., and because of that, a literal get-out-of-jail-free card I can’t agree to.” For any of us who were involved in this space at the time of FTX’s collapse, the sentence certainly fells well deserved considering the destruction that followed such a flagrant mismanagement and misappropriation of funds.

Former Binance CEO Changpeng Zhao dropped a “GM” on twitter following his release from prison on Friday. While his plea deal prevents him from operating or managing Binance, CZ hinted at his potential next steps, including continued work on Giggle Academy, a nonprofit online basic education platform. He also plans to finish his book, which will likely be a worthwhile read for crypto entrepreneurs. The former CEO expressed an interest in investing in decentralization along with AI, also noting that “Binance seems to be doing well without me back-seat-driving, which is excellent.”

Lastly, the SEC finally settled with TrueCoin and TrustToken over fraud accusations in stablecoin investing. Following TUSD’s depegging from $1 earlier this year, investors were unable to redeem tokens for supposed dollar value. The company was forced to pay and return over $500,000 (assuming the settlement is approved by the federal court). In his statement, Jorge G. Tenreiro, acting chief of the SEC’s Crypto Assets & Cyber Unit said “TrueCoin and TrustToken sought profits for themselves by exposing investors to substantial, undisclosed risks through misrepresentations about the safety of the investment.” Interestingly, TUSD still has a market cap over $500M, now in the hands of offshore firm Techteryx.

Risks are two sided, decisions will be made meeting by meeting…the Fed is not in a hurry to cut rates quickly…will be guided by data.

LOCKING IN:

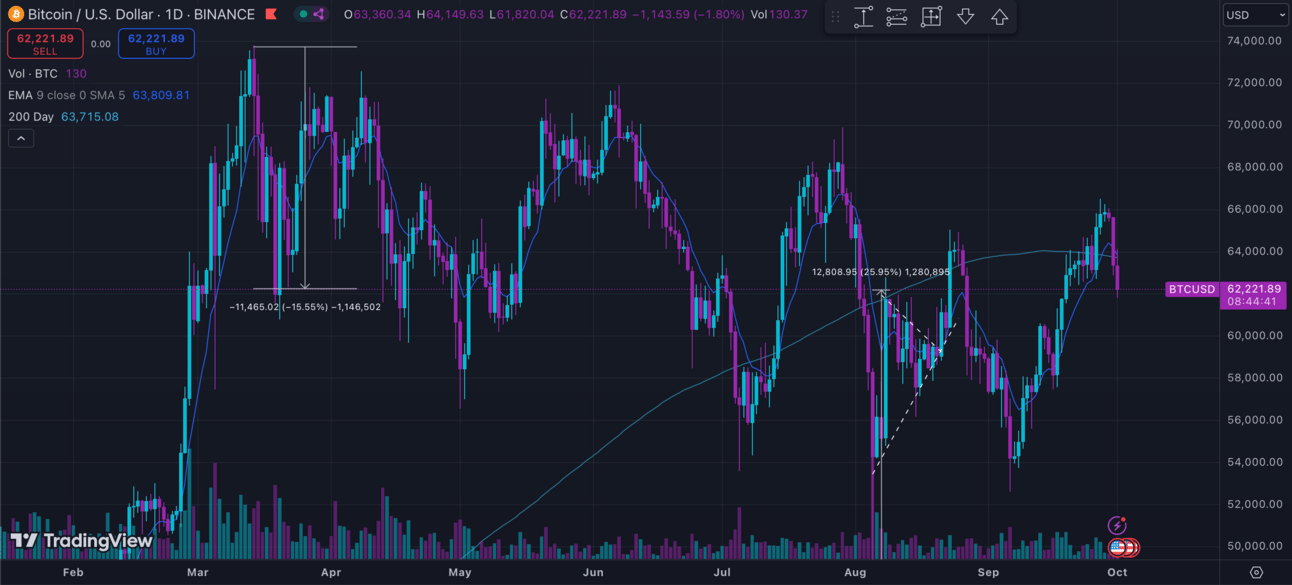

BTC/USD (BINANCE) O:63601 H:66519 L:62596 C:65634 +2047.67 (+3.22%) V:1.022K

BTC tacked on a third week of gains, capping off its September streak with a 3.2% move to the upside before rejecting just above resistance at $66,500. Rate cut honeymooning was the main driver of the move, leading risk-on trading throughout the broader market following last week’s announcement. Liquidations totaled just over $181M. ETFs saw a wildly successful week, topping $1.1B in net inflows—3X last week’s returns with the help of almost $500M added in the Friday session. BTC has since engulfed a large portion of last weeks gains, though the asset has officially locked in its’ best September performance since 2013 despite the early week decline.

Looking at the technicals, we will likely continue to recommend profit taking for those who were able to catch our reversal calls in Vol. 5. Missed money is always better than lost money, and we can always reenter with higher confidence above resistance while avoiding unnecessary corrections in the interim. BTC remains locked in its descending triangle, though any decisive moves above would suggest further gains on the horizon well worth our attention. That being said, chop remains likely here, especially as markets begin to come to terms with higher for longer rates after the hawkish fed speak we’ve seen to start the week.

ETH/USD (BINANCE) O:2581 H:2730 L:2542 C:2659 +75.98 (+2.94%) V:137.02K

ETH failed to keep its recent relative strength intact, moving in tandem with its bellwether throughout the week and ultimately rejecting just below resistance at the 200D MA ($2770). Liquidations were almost entirely unchanged, totaling just above $140M by Sunday’s close. On the other hand, ETFs snapped a lifelong losing streak, showing positive net inflows totaling a humble $84M for the first time since inception. Gas fees saw a near 500% increase from September’s average amid increased network activity and an uptick in leverage highlighted by increased USDC deposits in lending protocols.

Looking at the technicals, we will continue to recommend profit taking off our V5 reversals for those who have yet to shave positions. ETH has yet to breach its 200D MA at $2770, though a confident move above would certainly suggest further upside potential well worth potential reentry. Notably, ETH has begun this week’s trading in a position of clear relative strength, further confirming a potential local bottom for ETH.D a we continue to chop around 14%. Tighter stops and earlier targets will also remain recommended so long as ETH remain below its previous channel.

DXY O:100.738 H:101.229 L:100.157 C:100.417 -0.321 (-0.32%)

DXY spent the week chopping out around yearly lows. Rate cut fever and risk rallies continued to suppress the index, which touched its lowest point of 2024 on Friday. The critical 100 level we’ve been watching nearly got tested, though DXY was able to bounce back since the start of this week’s trading. US equities had a tremendous week with fresh ATHs for DJI, SPX, and NDQ. Gold saw price discovery as well, touching $2685/OZ for the first time in its trading history. Most indices have since retreated after a rough start to this week’ trading. Gold, however, has made a stark reversal in early Tuesday trading, hovering once again just below ATH off the back of heightened geopolitical tensions and anticipated dollar weakness.

Hawkish language from Fed officials early in the week has made a palpable difference in post cut sentiments. On Monday, Fed Chair Jerome Powell participated in a moderated discussion in Nashville, dampening future rate cut prospects while speaking about the state of the US economy. Powell stated that “the Fed is not in a hurry to cut rates quickly” and that “risks are two sided, decision will be made meeting by meeting.” Following his comments, market strength and expectations have begun to shift noticeably. According to data from CME FedWatch, 60% of market participants expect a 25bps cut, with the remaining 40% still hanging onto hopes of another 50bps. Polymarket users still largely anticipate 100-125bps worth of cuts in 2024. Looking at our economic calendar, jobs data Thursday/Friday will be most worth our attention considering the Feds data driven approach.

WEEKLY POLL:

CHEEZY CHARTS:

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

KEY READS

gm, the food taste so good... And what a luxury to be able to have more than one piece of fruit per day!

I know some of you may have a lot of questions. I won't have all the answers.

Let me chill for a bit. Then figure out the next steps. There are always more opportunities in… x.com/i/web/status/1…

— CZ 🔶 BNB (@cz_binance)

5:40 AM • Sep 29, 2024

FTX is transferring 18% of DOJ forfeiture funds up to $230m to FTX equity holders (Plan supplement)

FTX crypto holders are getting 10% to 25% of their crypto back x.com/i/web/status/1…

— Sunil (FTX Creditor Champion) (@sunil_trades)

9:36 AM • Sep 28, 2024