- Consortium Key

- Posts

- CONSORTIUM KEY - KEYED IN

CONSORTIUM KEY - KEYED IN

(Vol. 11, Uptober 15 - Uptober 21)

Welcome to Vol. 11 of Keyed In, the official Consortium Key newsletter!

Market wide rallies last week off the back of blowout earnings—including record highs for SPX, DJI, Gold, and Silver. SPX managed to bring its win streak into the 6th consecutive week, marking its longest run in 2024. CTMC capitalized on the move, gaining 8% with the help of a near double digit move from BTC. Light cooling off to begin this week, but some degree of correction is to be expected considering the depth of the move. Lots to cover as always, so let’s dive in!

TODAY’S MENU:

🤑 Record ETF inflows

🙉 Apechain Launch

👨⚖️ XRP SEC appeal

☕️ Fresh T/A, and more!

P.S be sure to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:2.145T H:2.345T L:2.128T C:2.334T +188.901B (+8.81%) V:131.374B

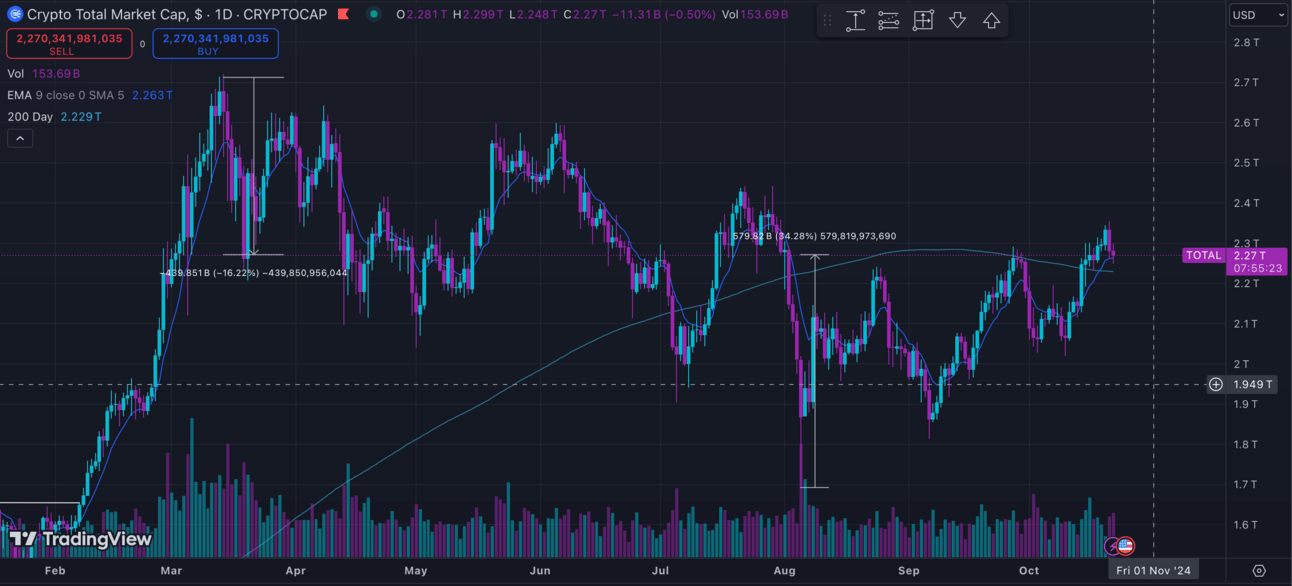

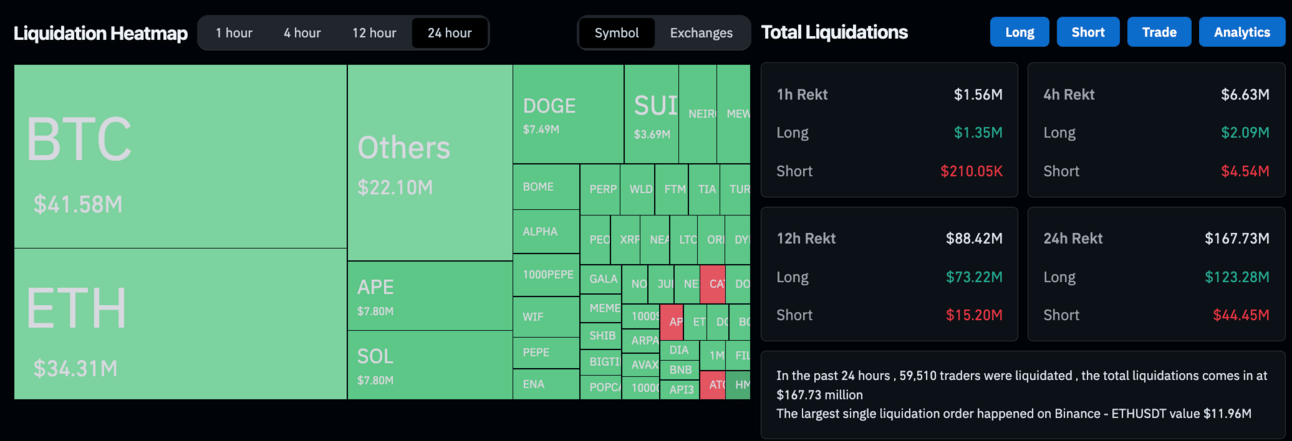

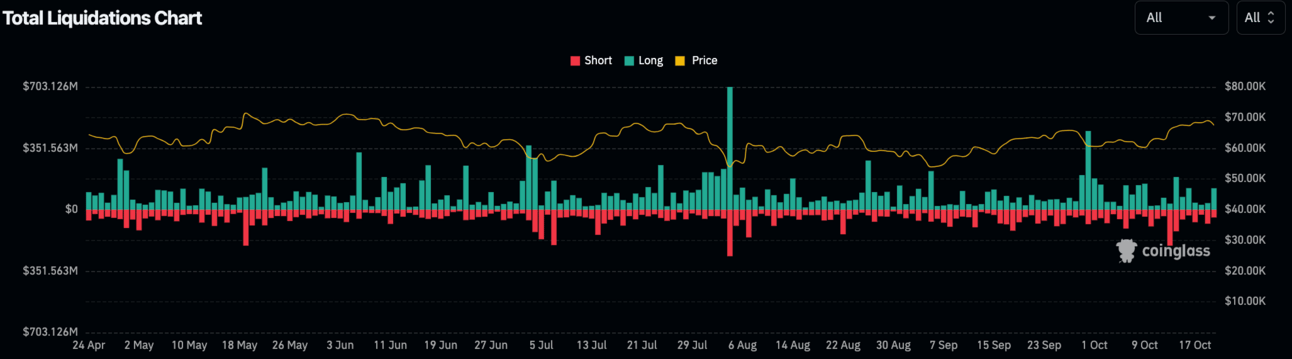

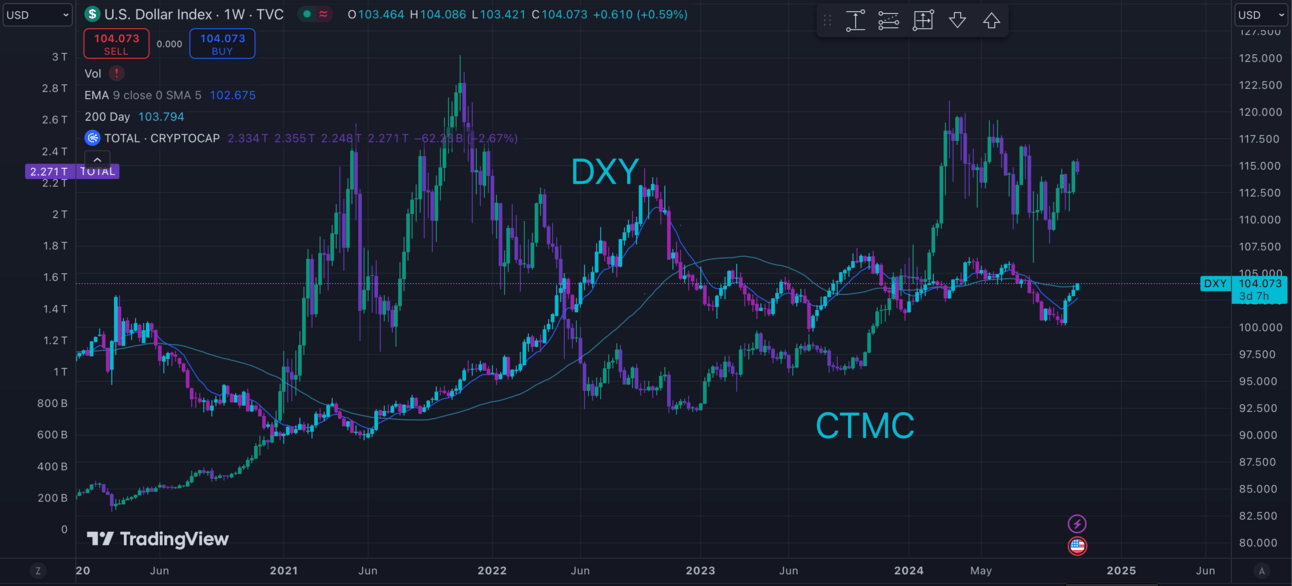

CTMC saw its strongest weekly move in two months, gaining over 9% and outpacing its equity counterparts by nearly 10X. Strong ETF inflows, a near double digit BTC move and solid memecoin performance all served to prop up the index, which briefly crested above its months-long descending channel in weekend trading. Liquidations topped $1B for the third consecutive week, and ETFs saw over $2.2B in net inflows—6X last week’s strong performance. CTMC has since returned to retest the top of its previous channel, hovering just above the key level as we prepare the remainder of our report.

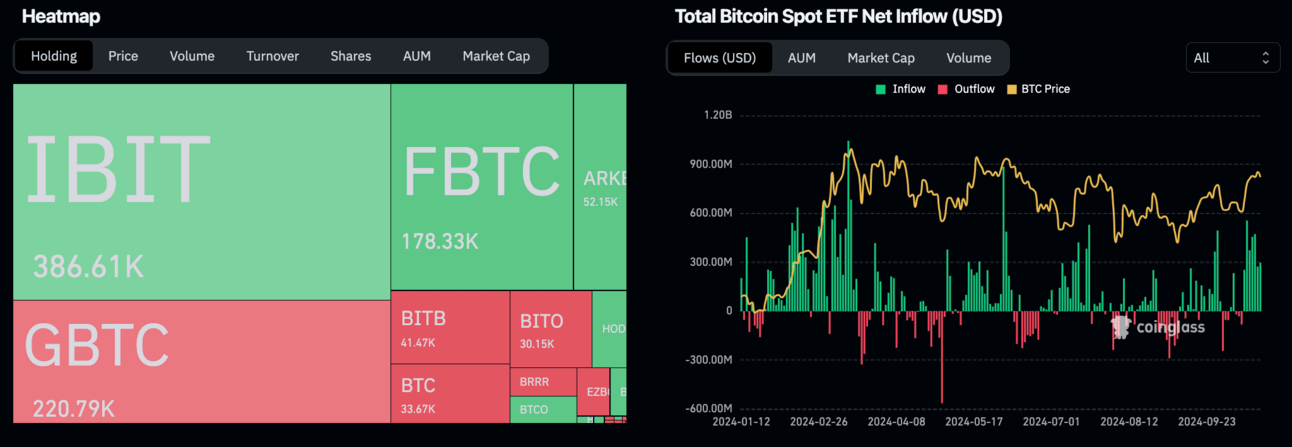

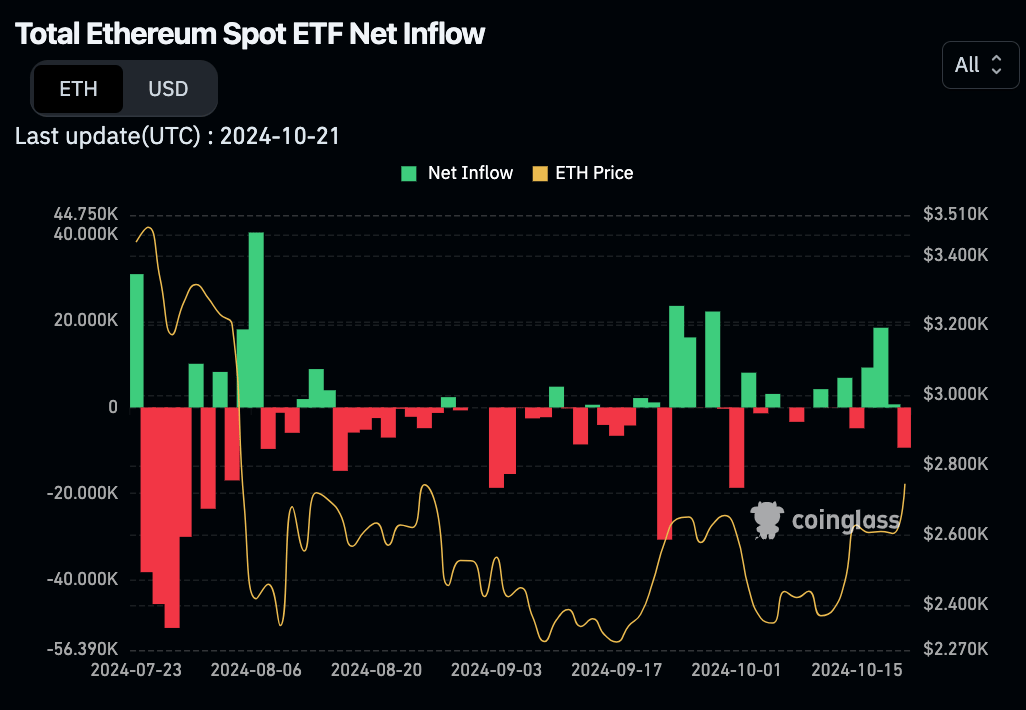

ETF’s managed to steal the spotlight last week, largely due to a $2.1B move to the upside from BTC funds—the largest weekly gain since March. After 6 consecutive days of net inflows, BTC funds were finally able to surpass the $20B mark—a milestone that took Gold ETFs over 5 years to achieve. Notably, weekly inflows amounted to 36,500 BTC, over 80X the amount of coins mined in a day. Institutional interest is seen as the primary driver behind the move—a lack of which remains reflected in ETH ETF’s struggles, still over $480M in net outflows since inception.

Well timed with the return to risk-on trading, Yuga Labs (the company behind BAYC) launched ApeChain, the highly anticipated blockchain network on Sunday. Following the launch, ApeCoin (APE) saw a near 100% uptick, topping $1.5 for the first time since April. Complete with its own bridges, automatic yields, and games, the ETH L2 aims to facilitate NFT minting, coin launches, and trading while enhancing user experience. ApeExpress, a clone of Solana’s Pump.Fun, allows users to launch tokens with zero technical knowledge. The protocol has already seen multiple tokens reach $2M+ market caps including CURTIS at $12.1 million, BORED at $12 million, and Crypto Is Fun (CIF) at $1.7 million. For our KeyedIn degens, Top Trader allows users to compete trading fake coins with 1000x leverage in the hopes of winning crypto prizes for top spots on the leaderboard.

Ripple remains in the hot seat this week after the SEC filed a last minute appeal in the drawn out legal investigation against XRP. The appeal notably does not challenge XRP’s nonsecurity status, instead focusing on sales on exchanges and sales from Ripple’s executives. Despite this, the appeal was followed by major coin movements from XRP whales—including a $10M transfer to Kraken and a $15M transfer to Bitso. The price of XRP has since continued to decline, with whales accounting for nearly 50M in dumped tokens. Ripple is set to file its own Form-C this week, and the legal process is expected to take about 90 days. Ripple’s legal team remains confident as the case progresses, highlighted by the post from their CLO on twitter.

“Institutionalisation is the short-term catalyst that gets us above (BTC) all-time highs ― combined with easing monetary policy into 2025 for follow-through”

LOCKING IN:

BTC/USD (BINANCE) O:62621 H:69117 L:62270 C:68773 +6137.88 (+9.8%) V:1.72K

BTC fell just short of a double digit gain last week, climbing 9.8% and nearly retesting 2021 highs just above 69K for the first time since July. ETF’s added a staggering $2.1B, crossing the $20B milestone with the help of 6 consecutive sessions with net inflows. Liquidations totaled $220M, and volume saw its first notable jump on the weekly in nearly 3 months. BTC has since rejected just above $69,400 before dropping 2% in the Monday session following a shallow, market wide correction.

Looking at the technicals, previously mentioned resistance above 67K remains clearly in play, despite BTC’s brief trip above the key level. BTC remains on track to claim support above its descending triangle. While last week’s breakout calls provided a window for solid profit, heavy technical/psychological resistance remains just below 70K. A confident break above this level would suggest additional upside in play. That being said, further corrections across the markets could dampen prospects. BTC has maintained an 80%+ 40D correlation with SPX, and BTC/Gold correlation breached 80% earlier this month. Both Gold and SPX have seen historic runs with significant price discovery over the past several weeks. We can expect healthy corrections for both on the horizon, though BTC will likely remain in a position of strength so long as $64,500 can hold throughout this week’s trading.

ETH/USD (BINANCE) O:2469 H:2756 L:2444 C:2746 +277.69 (+11.25%) V:167.585K

ETH enjoyed a second week of slight relative strength, moving double digits amid a clear extension of risk-on trading. Despite the move, liquidations fell notably—totaling just $223M by week’s end. ETFs managed to tack on $79M in net inflows, perhaps finally beginning to put a dent in the negative performance still inception—with overall outflows still totaling over $480M. Volume ascended marginally, especially considering the depth of the move. Despite its recent strength, ETH continues to fall short of expectations relative to its eldest sibling. BTC’s market cap now rests over $1T above ETH—the largest spread between the two since inception.

Last week we cited clear resistance for ETH “right around September’s highs at $2750.” This level remains decisively in play, highlighted by the rejection seen Sunday at $2756, and Monday at $2768. Profit taking remains recommended below this level for those who haven’t already, with reentry very much still on the table should ETH confidently breach. Looking south, we can continue to monitor the $2550 level for any signs of further downside in play. Plenty of upside remains relative to BTC, though we will recommend an extra cautious approach in the event of a market wide dip, which remains to be expected after such a long run and often affects ETH much more than its’ bellwether.

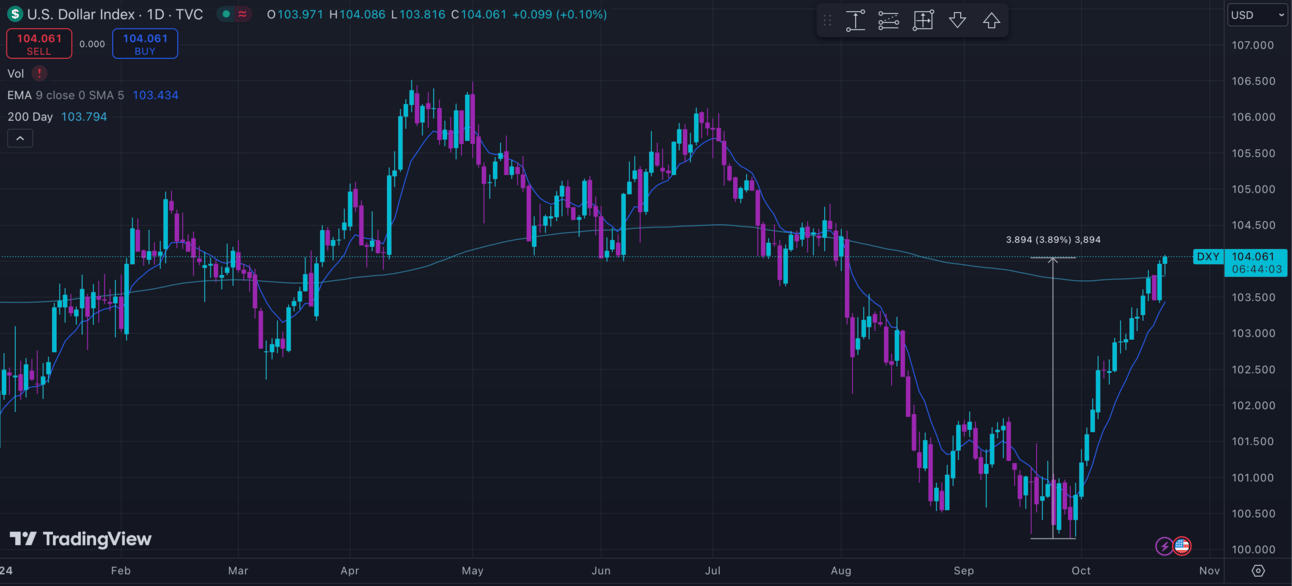

DXY O:102.915 H:103.874 L:102.915 C:103.463 +0.548 (+0.53%)

DXY continued its reversal into the 4th consecutive week, gaining another half percent off the back of rising treasury yields and ongoing geopolitical tensions in the Middle East. As predicted in last week’s report, we’ve now retested resistance at the 104 level. DXY remains just above, opening the door for further gains—though some degree of correction is to be expected considering the depth of the run. Treasury yields have seen a critical rise over the last several weeks, with US benchmark 10yrs now sitting at 4.2%. As the cost of capital increases, equities can begin to look less attractive to investors as opposed to safe gains via government bonds. This trend will continue to be well worth our attention considering the recent run of all 3 major US indices.

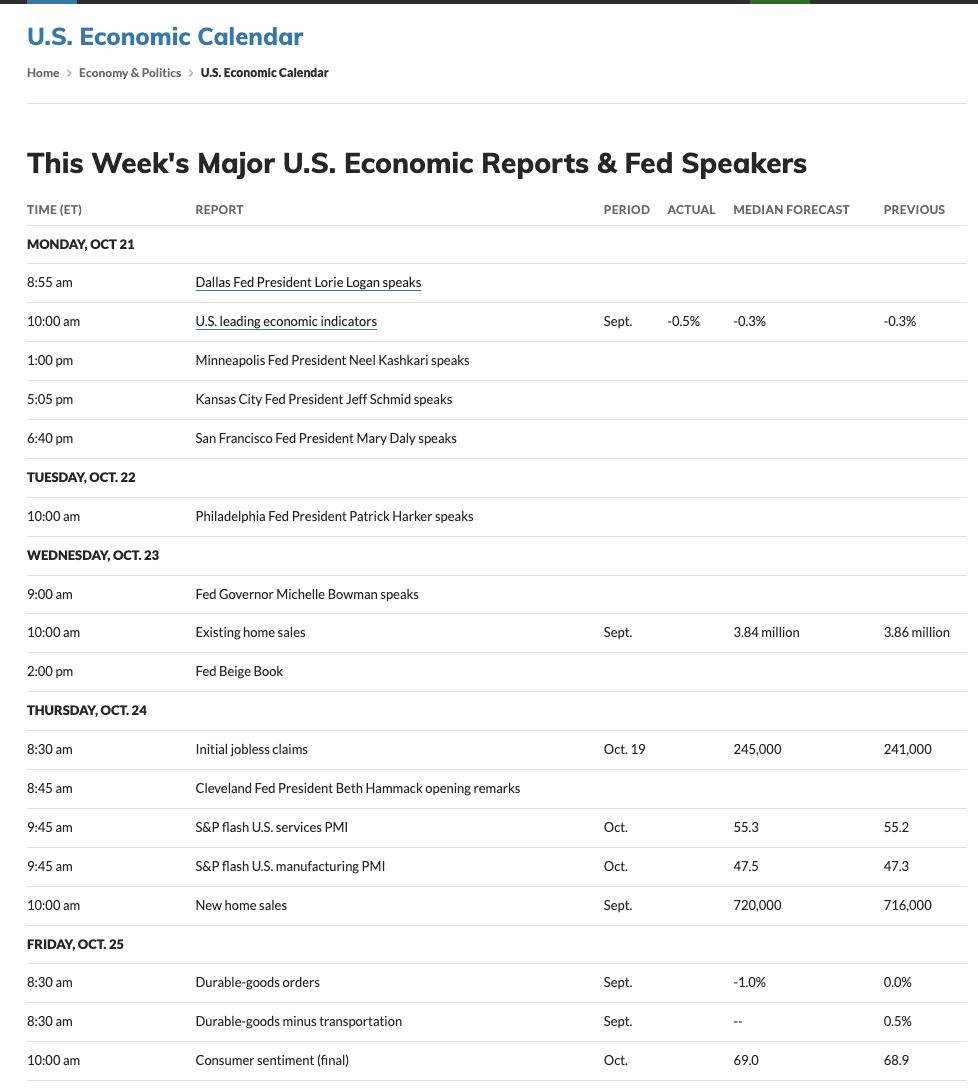

According to data from CME FedWatch, traders anticipate an 88% chance of easing in the November meeting, up slightly from last week despite somewhat hawkish Fed speak since the report. 50bps bets remain largely nonexistent. Interestingly, Polymarket seems to be reflecting recent changes much more drastically. The prediction market is currently showing a 61% chance of 100bps worth of cuts this year, up from just 38% at the beginning of October but down 6% from this time last week. Expecting a busy week ahead with speeches from the ECB and BOE and major corporate earnings. The Fed Beige Book will also be well worth our attention, released ahead of the FOMC. The book relies much more on anecdotal evidence, often presenting a more nuanced view of the economy beyond traditional statistics.

If you’ve made it this far congratulations, hope you’ve enjoyed the read and looking forward to hearing your thoughts! Feel free to leave a comment below and don’t forget to vote in this week’s poll! Stay tuned for next week and—in the meantime—consider yourself Keyed In!

WEEKLY POLL:

CHEEZY CHARTS:

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

KEY READS

Bitcoin ETFs have crossed $20b in total net flows (the most imp number, most difficult metric to grow in ETF world) for first time after huge week of $1.5b. For context, it took gold ETFs about 5yrs to reach same number. Total assets now $65b, also a high water mark.

— Eric Balchunas (@EricBalchunas)

12:05 PM • Oct 17, 2024

Over the last few months we’ve been highlighting integrations from industry leading protocols ON APECHAIN, but there’s more…

Our commitment to bringing distribution opportunities to the community means worldwide visibility for developers and creators in the APE ecosystem.

— ApeCoin (@apecoin)

8:08 PM • Oct 19, 2024

Hey you 🫵

Did you know @apecoin by @yugalabs just launched its own mainnet Apechain and Apecoin skyrocketed 100% in the last 24 hours.

Here’s your ultimate guide to making the most out of it 👇

Before getting started bookmark 🔖 this post so you don't lose it.

🟪What Is… x.com/i/web/status/1…

— Elena🌸 (@ElenaaETH)

7:48 PM • Oct 20, 2024

No surprises here — once again it’s been made clear. The Court’s ruling that “XRP is not a security” is NOT being appealed. That decision stands as the law of the land.

Stay tuned for Ripple’s Form C to be filed next week.

— Stuart Alderoty (@s_alderoty)

12:00 AM • Oct 18, 2024