- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 4, August 19 - August 25)

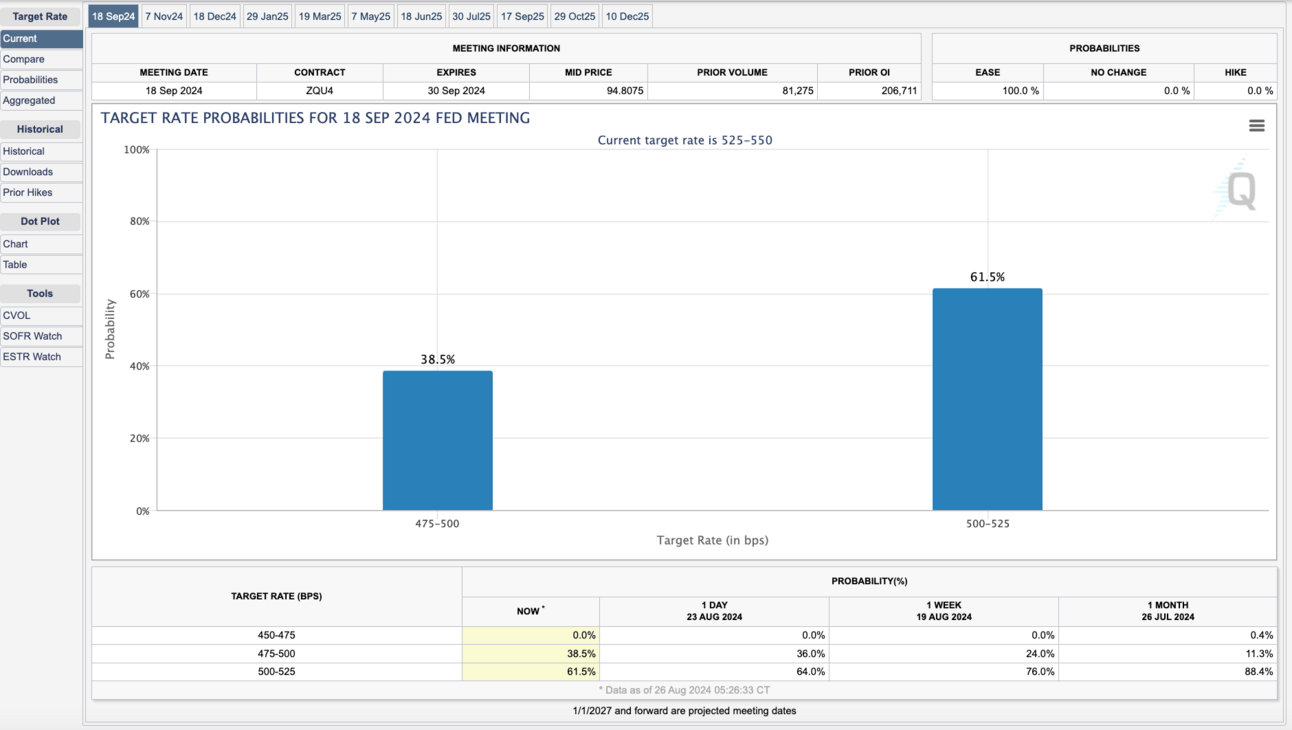

Welcome to Vol. 4 of Keyed In, the official Consortium Key newsletter! Looks like we finally got some clarity from the US Fed, with rate cuts expected to be announced in just a few weeks! It’s time to dive in, so drop your socks and grab your stocks!

Feel free to share this with your fellow degens, looking forward to building it out along with our team and the rest of the CK community. Plenty more to come so be sure to stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or anything else you’d like to see us dive into.

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

Don’t forget to subscribe! 👇

https://consortiumkey.beehiiv.com/subscribe

ZOOMING OUT:

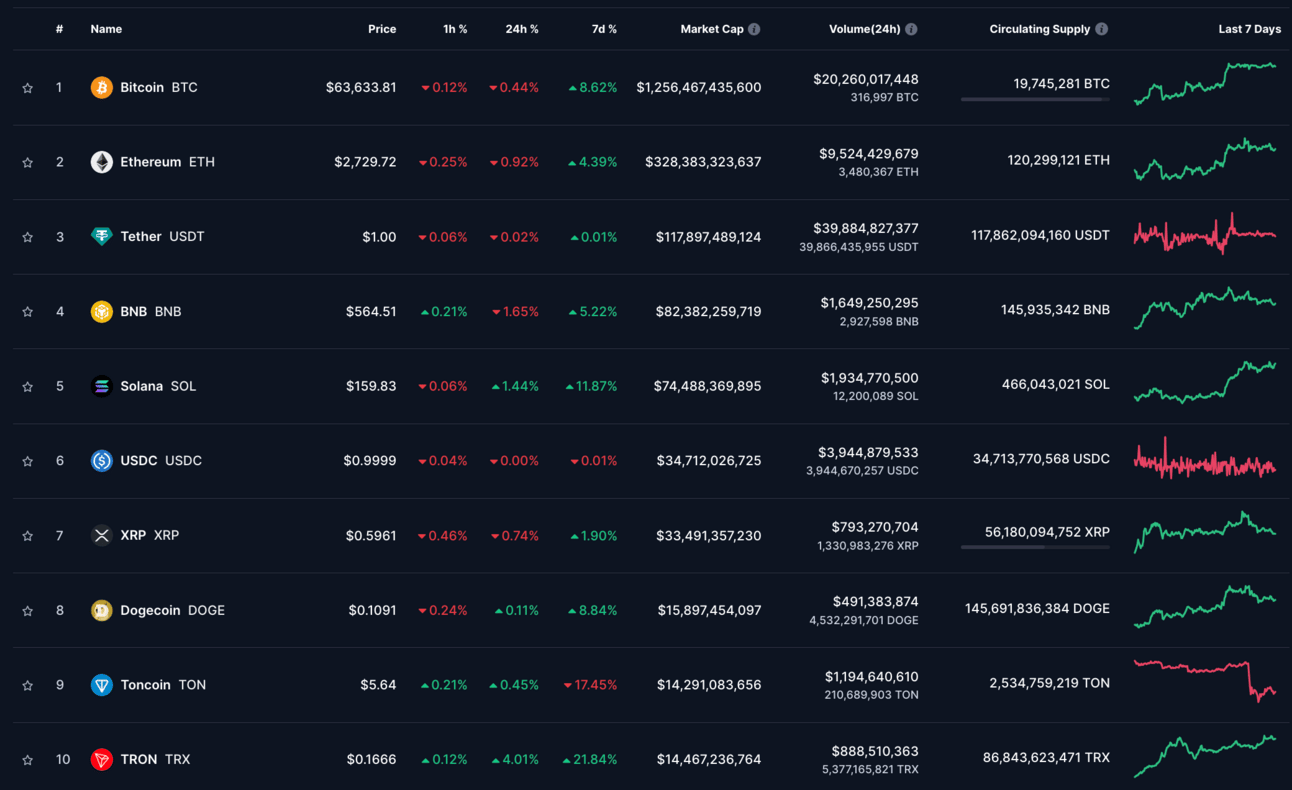

CTMC O:2.027T H:2.241T L:2.004T C:2.207T +180.006B (+8.88%) V:91.942B

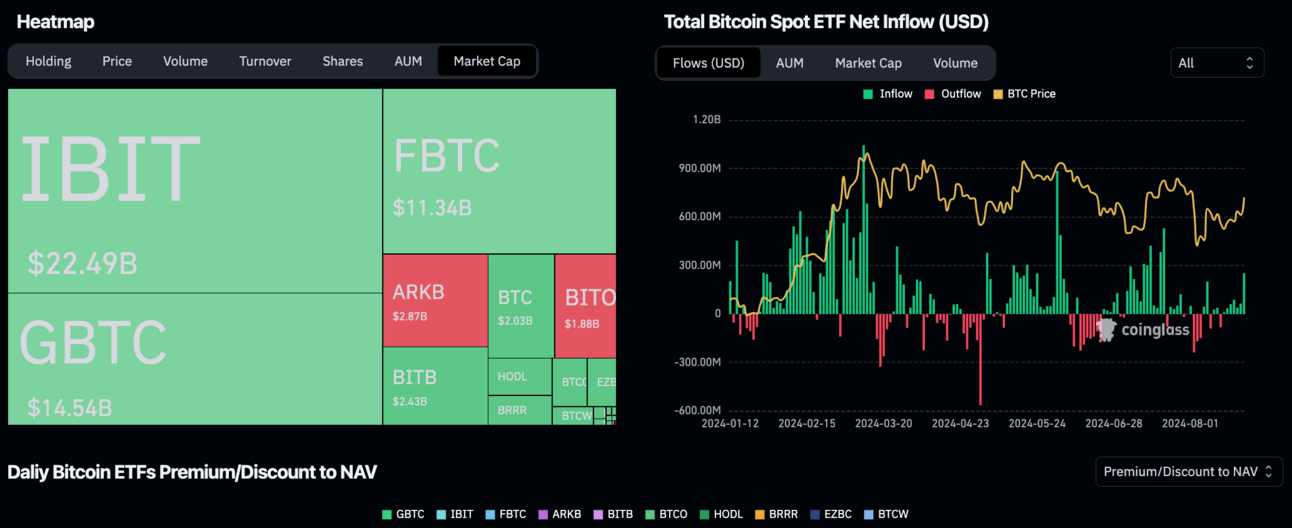

CTMC got a major boost last week, gaining nearly 9% off the back of a long awaited rate cut announcement from US Fed Chair Powell in Jackson Hole. BTC ETFs managed to log 7 straight days of positive net inflows, capping the week off with a monthly high—adding $252M across the funds by session close. Also adding to CTMCs gains was SunPump, TRON’s brand new meme coin deployer. After facilitating thousands of meme coin deployments on TRON, the network generated $3.8M in revenue on 8/21.

In other crypto related news, Toncoin’s price crashed double digits following news regarding the arrest of Telegram’s Founder/CEO Pavel Durov in Paris, who authorities allege was complicit in allowing criminal activity on the platform. Kraken and Binance also continue dealing with legal woes, with a class-action lawsuit being filed against CZ in the same week a US district judge rejected Kraken’s motion to dismiss the charges brought up against it by the SEC. Polymarket bets on the US presidential election saw a 50/50 split following the DNC as the Harris team doubled down on promises to back the growth of crypto friendly policies in the US.

"The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks."

LOCKING IN:

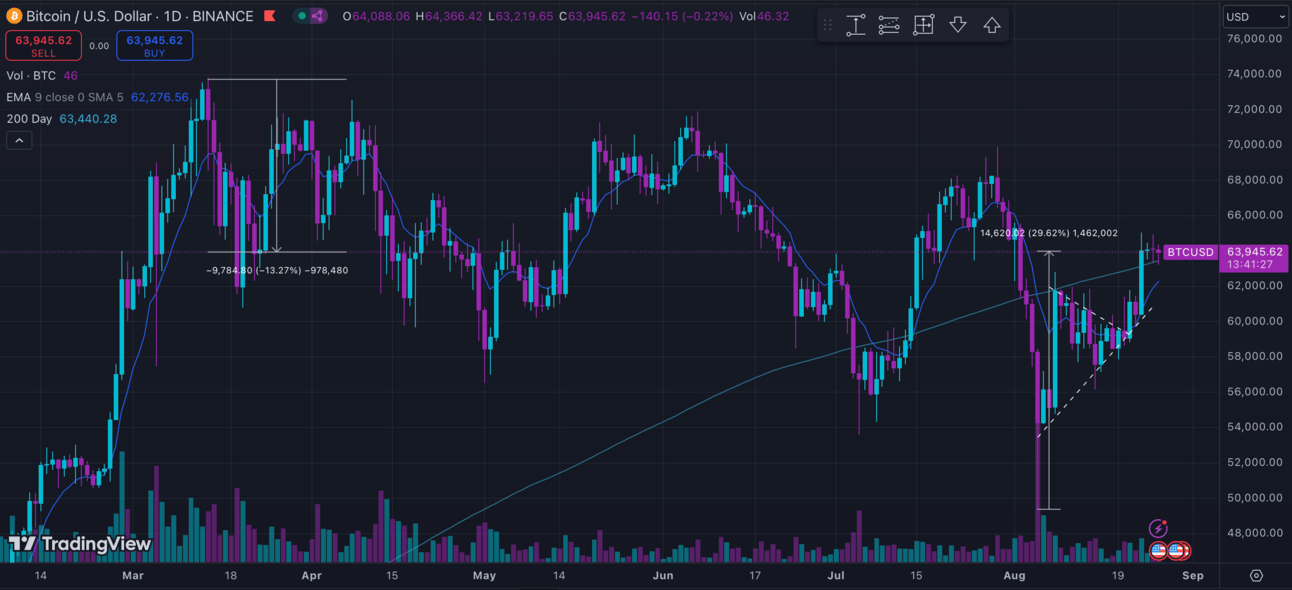

BTC/USD (BINANCE) O:58507 H:65054 L:57879 C:64085 +5593.37 (+9.56%) V:1.672K

BTC fell just short of a double digit gain last week, briefly cresting above 65K for the first time since Monthly open amid a market wide rally following US rate cut announcements. ETFs added over $500M by weekly close, bringing the win streak into its 7th consecutive session with the help of monthly highs seen in Friday’s trading. Major coin movements continue, with Mt. Gox recently transferring over $700M in BTC to a cold wallet in its’ first movement since July, according to data from Arkham Intelligence. With relative strength seen against both CTMC and US indices, BTC has successfully flipped the script after struggling throughout the recent downturn.

Looking at the technicals, last week’s calls for solid gains above $61,800 proved well advised. Symmetrical triangles seen on the daily have broken decisively north, though clear technical/psychological resistance remains in play above 65K. There is certainly no shame in some light profit taking for those who were able to catch the move, as missed money is always better than lost money! Traders can expect higher confidence entries meaningfully above resistance while avoiding any potential chop in the interim. Looking south, any decisive moves below $62,800 would suggest further consolidation on the table at minimum, likely worth avoiding as markets move further into the honeymoon phase of the easing cycle.

ETH/USD (BINANCE) O:2613 H:2820 L:2538 C:2749 +136.542 (+5.21%) V:163.542K

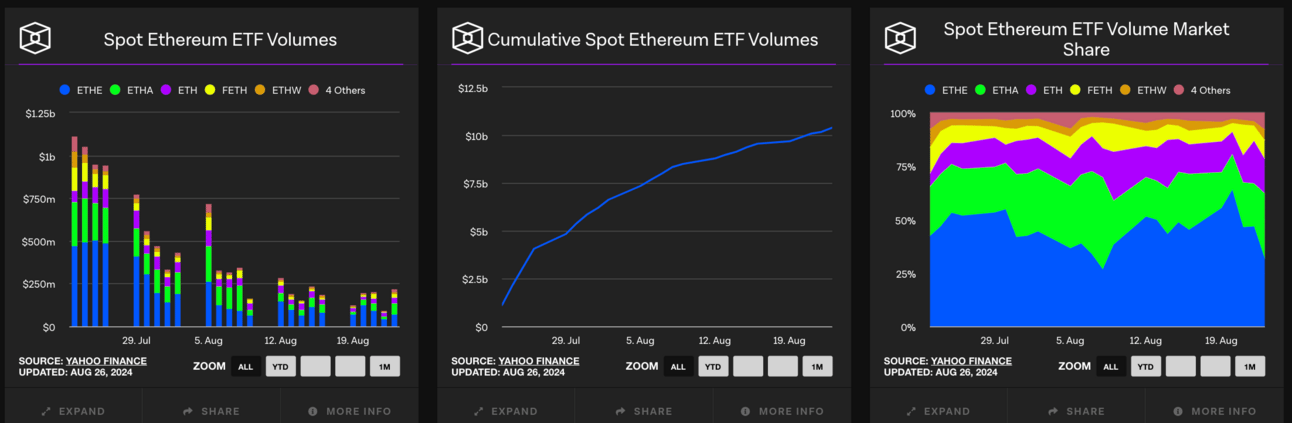

Despite notable relative weakness against both BTC and CTMC, ETH managed to gain over 5% last week—briefly reclaiming key support at $2800 on Saturday before retreating slightly into weekly close. In clear contrast to its eldest sibling, ETH ETFs saw 5 straight days of outflows, totaling $44M by Friday evening. The move remains largely due to continuous outflows from Greyscale’s ETHE, whose higher fees and trading premiums have resulted in a decline to the tune of $2.5 billion since inception. Network fees remain historically low, with a 22% decrease in TX fees and a 89% decrease in gas fees YTD. NFTs have seen a slight resurgence with a 24% uptick in weekly volume and a 42% gain in number of buyers, with ETH leading in sales at $36.6M.

Technically speaking, ETH’s recent relative strength seems to have run its course. While we’ve seen marginal upside above last week’s call at $2700, the drivers of ETH’s price action largely appear agnostic to the platform. Despite its gains, ETH has largely underperformed amid a clear risk-on rally, highlighted by an 11% move seen in SOL and a 22% move for TRON since last week’s open. ETH.D has begun trending once again towards yearly lows below 15%, a level that will remain well worth our attention as traders (including many in the CK community) continue migrating towards faster, cheaper blockchains and L2 solutions.

DXY O:102.403 H:102.484 L:100.602 C:100.677 -1.725 (-1.68%)

DXY saw its largest weekly drop since last November, shedding over 1.5% off the back of revised jobs data and impending US rate cuts. Inverse correlation continues to play out against US indices, with SPX (+1.45%) and NDQ (+1.09%) both sitting just below ATHs after printing the third straight week of gains. Underscoring waning faith in USD, Gold CFDs saw fresh ATHs for the second consecutive week, topping out just above $2500/OZ. Expecting an interesting week ahead with US GDP and PCE data dumps, and major earnings including Nvidia, which has recently been referred to as “the most important tech earnings in years.”

Technicals have begun to creep back towards the driver’s seat, with DXY looming precariously just above the critical 100 level, last seen just prior to the bounce in December 2023. Many analysts (including our own at CK) anticipate significant downside potential should DXY fall meaningfully below. With a rate cut almost certain to be announced at the September meeting, traders have begun to direct their focus towards the size of the drop, and what to expect regarding monetary policy moving forward. As mentioned in last weeks report, the upcoming cut has largely been priced in, and the price of goods and services is unlikely to change overnight. That being said, we can certainly look towards a fresh chapter in the monetary cycle after markets have suffered under the boot of multi-decade highs in borrowing costs for far too long.

WEEKLY POLL:

CHEEZY CHARTS:

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_