- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 5, August 26 - September 1)

Welcome to Vol. 5 of Keyed In, the official Consortium Key newsletter!

This week’s theme is FOOD 🍏 !

TODAY’S MENU:

🍲 Market corrections stirring the pot

🥩 Beef between the SEC and OpenSea

🍴 Cardano’s hard fork

☕️ Piping hot T/A, and more!

Decided to try dishing out some quick bites of our top stories for easy consumption—bit more to digest than usual, but I trust it will satisfy!

As my father used to say, “eat what you want and leave the rest!” 👨🍳

P.S be sure to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

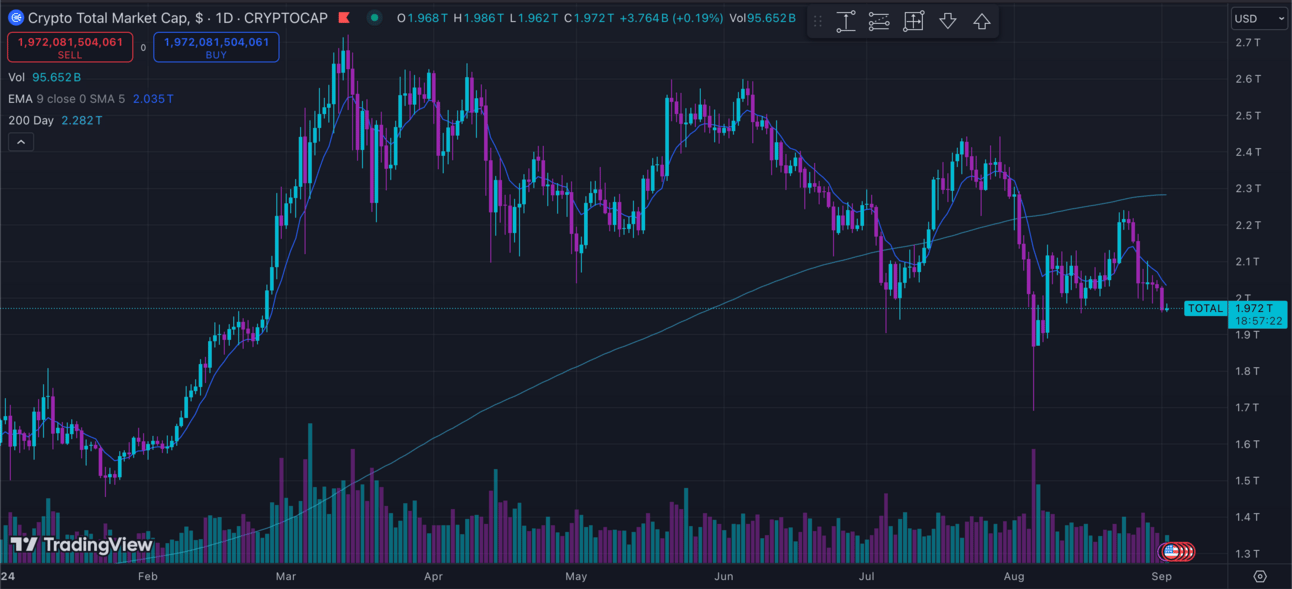

CTMC O:2.207T H:2.219T L:1.96T C:1.968T -238.608B (-10.81%) V:97.645B

CTMC struggled to find its footing last week, falling below key support at $2T and engulfing the entirety of last week’s gains with a double-digit correction. Volume continued its’ weeks long decent, returning to relative lows for the first time since early July. ETFs were unable to avoid the fallout, with major outflows from BTC’s and notably low demand for ETH’s. Retracement remains minimal. A clear descending triangle continues to form on the weekly, with coiling price and volume both appearing increasingly suggestive of wide range moves just around the corner.

Moving beyond the technicals, beef is heating up between the SEC and OpenSea, with the former issuing a Wells Notice alleging that the NFTs on the platform are securities. While the notice falls short of levying any formal charges, OpenSea CEO Devin Finzer signaled the firm is “ready to stand up and fight” the allegations, committing $5M to a legal fund supporting creators and devs affected by the notice.

Binance remains in the spotlight this week ahead of CEO CZ’s release, and amid rumors surrounding the seizure of funds linked to wallets of Palestinian users. Binance responded with a statement that “only a small number of user accounts, linked to illicit funds, were blocked from transacting.” Notably, both the exchange and CZ pled guilty to charges of money laundering and sanctions violations in February. Questions certainly remain regarding the safety of our coins on exchanges, underlining the importance of understanding self custody when navigating the crypto space.

Additionally, the exchange finally declared its intent to support Cardano’s Chang hard fork. Initially slated for August 27, the fork ultimately went live on Sunday after delays related to a lack of readiness from several top exchanges. The much anticipated upgrade converts ADA into a governance token, marking a long-planned shift towards decentralization and allowing holders to elect governance representatives and vote on development protocols.

Telegram founder Pavel Duvov remains in hot water following his arrest and indictment in France. The founder could be facing up to 12 charges, leading to another 5% drop in TON and bringing the total value lost in TG’s native token to 26% in the past two weeks. The court granted Duvov a $5M bail, releasing him under judicial supervision.

TON’s troubles continue building with significant network outages seen after the DOGS airdrop. Claims from over 10 million users resulted in nearly 7 hours of halted block production and a disruption of services on Telegram wallet along with other exchanges.

"We should not regulate art in the same way we regulate collateralized debt obligations."

LOCKING IN:

BTC/USD (BINANCE) O:64219 H:64481 L:57201 C:57301 -6918.14 (-10.77%) V:177.992K

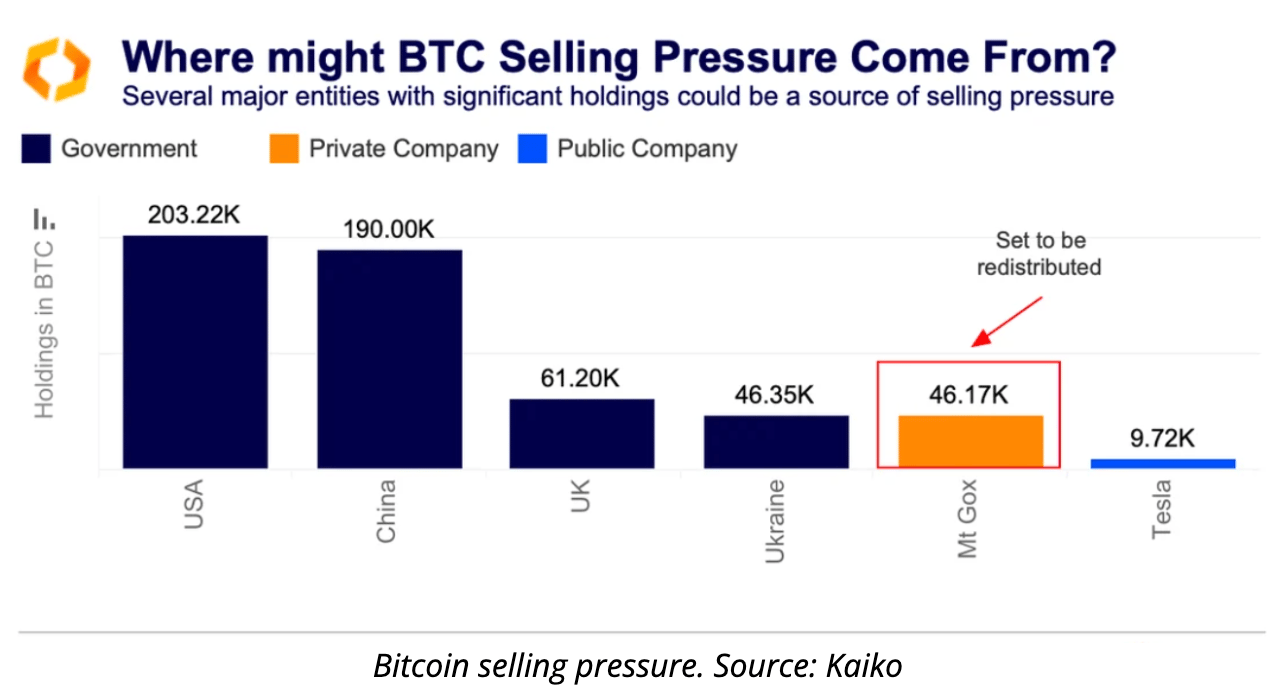

BTC saw its own engulfing correction last week, entering a “sell the news” event as the honeymoon phase of last week’s rate cut announcements begins to wear off. Liquidations totaled just over $277M. ETF’s snapped an 8 day win streak with outflows totaling $278M throughout the week—$175M of which was seen in Friday’s session alone. Volume descended marginally, and BTC.D remained largely unchanged despite larger selloffs throughout the market. Significant sell pressure continues looming, with over 203K BTC ($12.1B) in US govt. wallets, and 46K BTC ($2.7B) still awaiting distribution from Mt. Gox by the end of 2024. Notably, Mt. Gox creditors have largely held on to the BTC received so far, according to a Glassnode report from July 29th.

Looking at the technicals, last week’s calls for profit taking around 64K have proven extremely well-advised. As stated in the previous report, “there is certainly no shame in some light profit taking for those who were able to catch the move, as missed money is always better than lost money!” Similar to CTMC, BTC continues forming a large descending triangle on the weekly. Lower trend support exists just south of our current position around $56,500, a level well worth our attention with both price and volume coiling remaining suggestive of wide range moves still very much on the horizon. Entries can certainly be found here, though tight stops and early targets will remain highly recommended as we wait for the dust to settle.

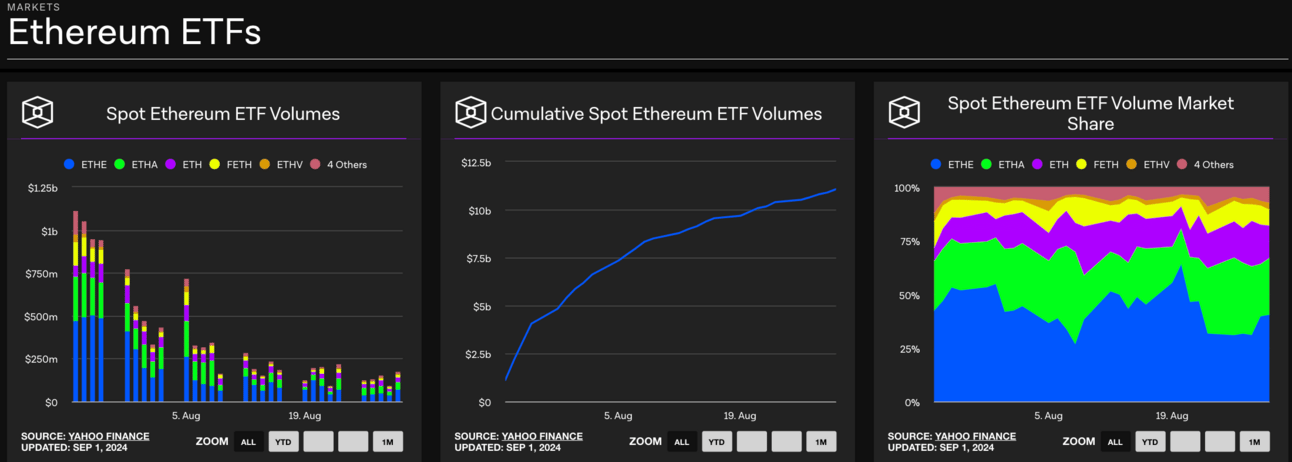

ETH/USD (BINANCE) O:2749 H:2763 L:2397 C:2428 -320.33 (-11.85%) V:160.391K

With slight relative weakness still in play vs. both BTC and CTMC, several concerns remain on the table for ETH as markets begin trending in a risk-off direction post US rate cut announcements. ETH tends to play the part of BTC’s dramatic younger sibling, with price action often heightened during times of increased volatility. ETFs have fallen notably short of meeting expectations in volume, and continuous outflows from Greyscale’s ETHE have made expansion difficult—totaling well over $2.5B since inception. Despite last weeks meaningful uptick in NFT sales, potential SEC lawsuits, increasing market share in competing networks, and inflated supply issues all remain clear negatives for ETH moving forward.

Technically speaking, last weeks profit taking recommendations proved very well advised for ETH, which has printed a double digit correction since the previous report. Underperformance amid a risk-on rally highlighted potential issues moving forward, culminating in 1 year lows for ETH’s dominance (ETH.D) at 14.4%. Unlike its largest counterpart, ETH’s descending triangle on the weekly has broken down several weeks prior, bringing our focus to lower trend support last seen in February. Sitting just above $2400, a sustained drop below could easily lead to deeper corrections, well worth avoiding considering the lack of retracement throughout the most recent downturn.

DXY O:100.678 H:101.783 L:100.514 C:101.732 +1.055 (+1.05%)

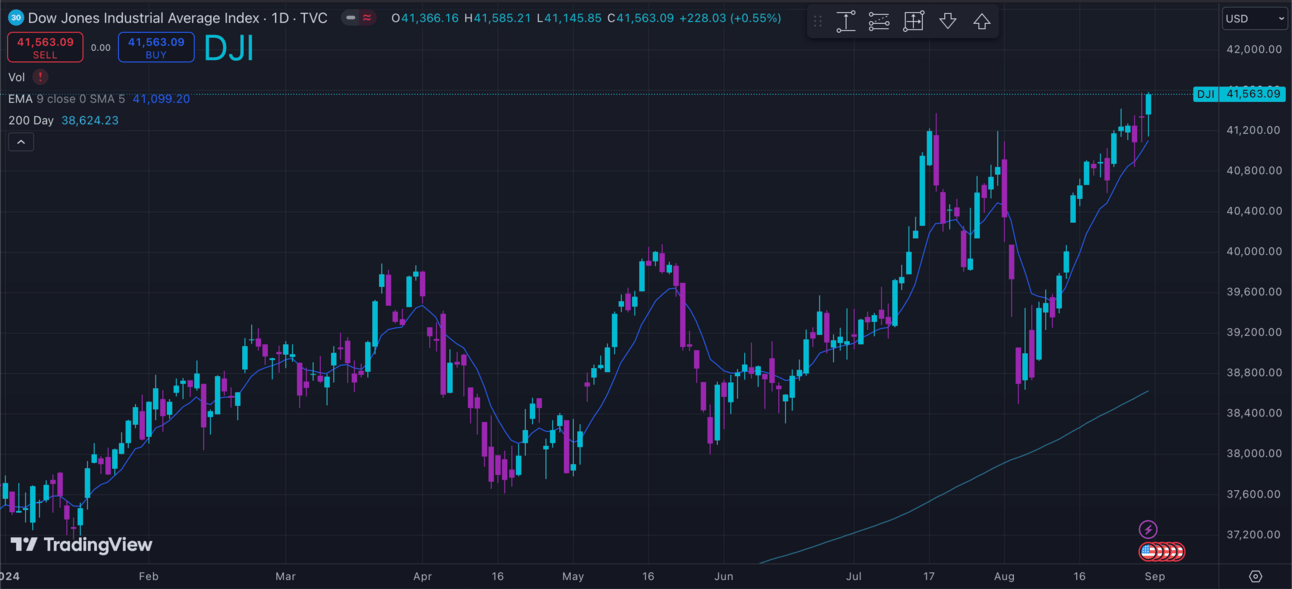

DXY saw a significant reversal last week, gaining over 1% amid risk-off trading and a solid bounce at long term technical/psychological support just above the 100 level. US GDP saw a 3% growth, beating estimates and contributing largely to the move by dampening fears surrounding an impending recession. Inverse correlation continues to ramp up on the higher ends of the risk curve, with both NDQ and CTMC posting losses as DJI prints fresh ATHs with retracement essentially nonexistent. That being said, SPX and NDQ both remain within striking distance of price discovery, well worth our attention with official rate cuts just around the corner.

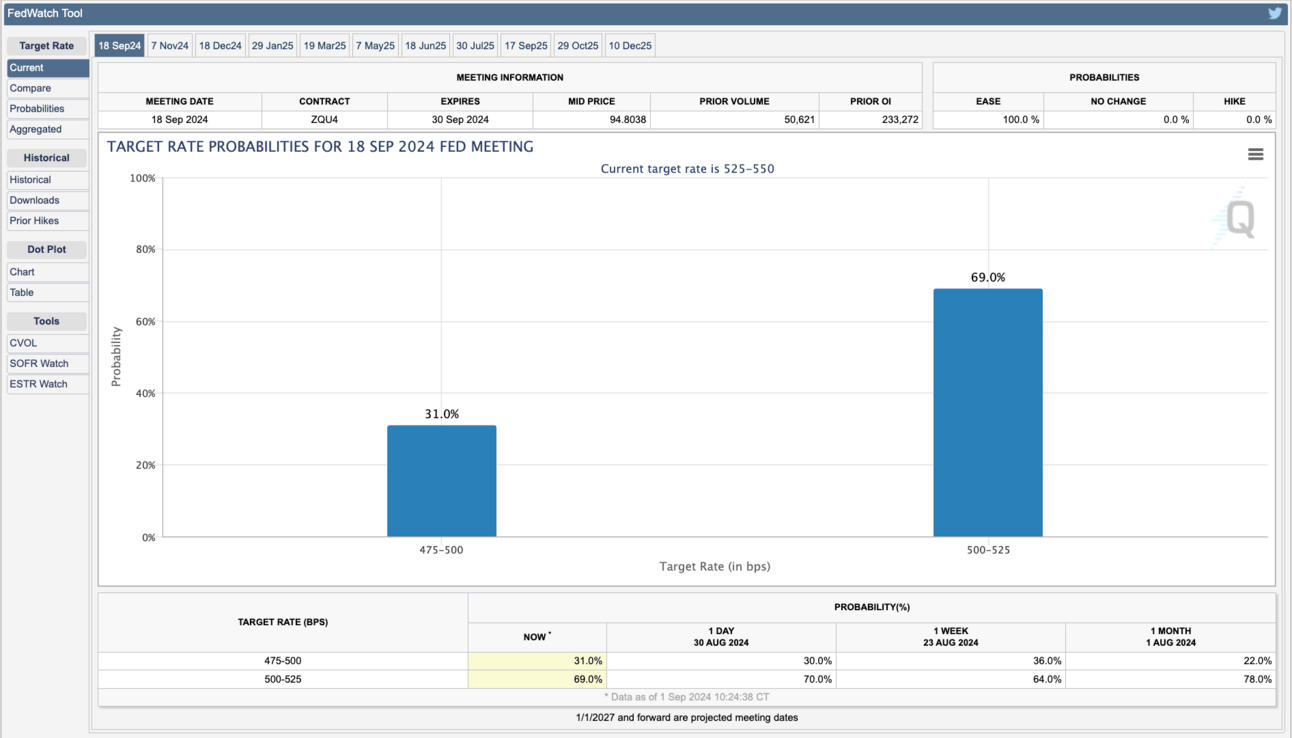

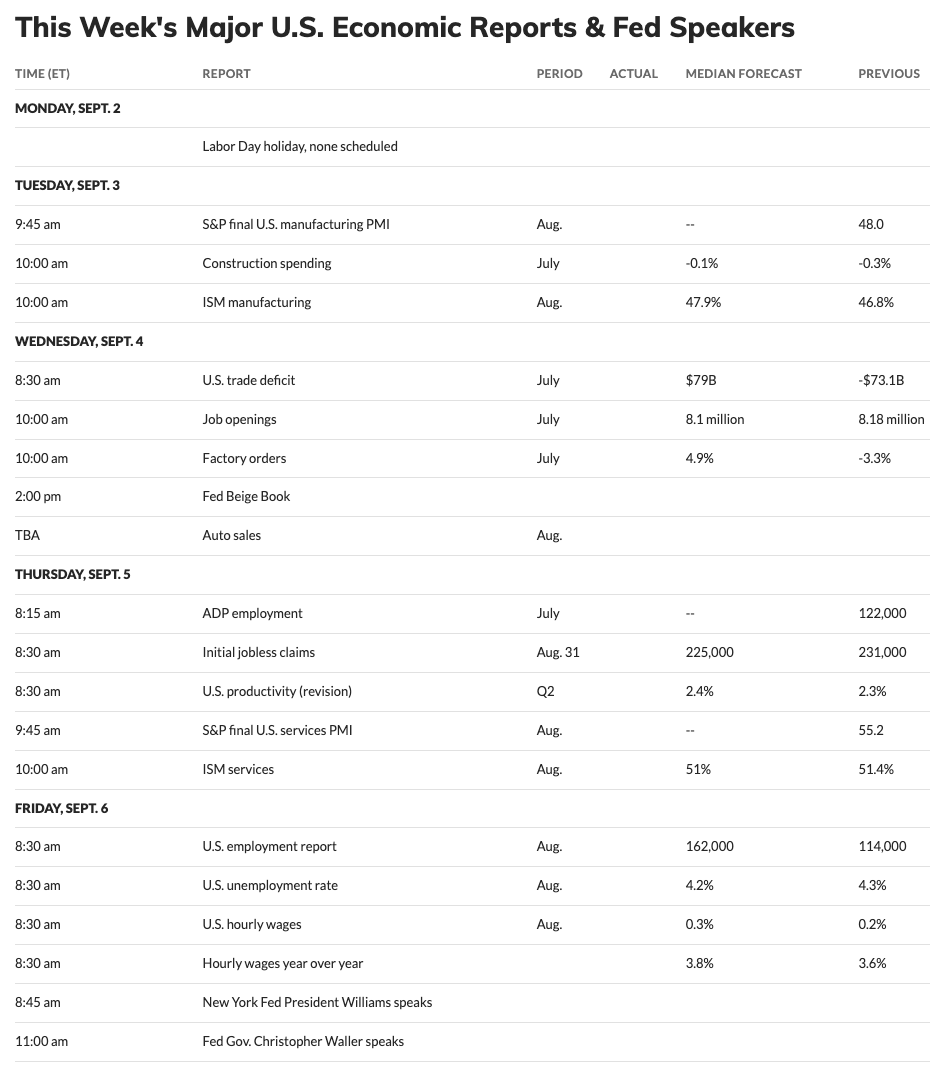

Technically speaking, DXY certainly seems to have put in a local bottom. Having just barely avoided a dip below trend support, the index has since seen a near 75% retracement of the previous week’s losses—snapping a month-long losing streak with its largest weekly rally since early April. Continued support above 101 could easily open the door for further gains, putting additional pressure on risk assets despite the upcoming cuts. Traders anticipate a near 100% chance cuts to begin in September, the size and frequency of which, however, remains up for debate. Considering the GDP beat and solid Jobs reports, it wouldn’t surprise us to see the Fed take a more measured approach in curbing inflation—potentially leading to less cuts than the market anticipates, and with it continued pressure on risk assets. Expecting a light week ahead regarding further inflation data, but keeping a close eye on Friday’s employment and wage reports as we do our best to sniff out the most likely path the US Fed will take from here.

WEEKLY POLL:

CHEEZY CHARTS:

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_