- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 7, September 17 - September 23)

Welcome to Vol. 7 of Keyed In, the official Consortium Key newsletter!

Quite the week for risks markets after the rate cut! Reversal calls from Vol. 5 have certainly paid off over the last two weeks, glad to be winding down and expecting more cuts ahead! Planning on dropping new editions on Tuesdays moving forward so we can get a sense of how markets look after Monday’s bell before dishing out the report.

TODAY’S MENU:

🎬 US rate cuts

💸 Global stablecoin adoption

💰 Microstrategy $1B BTC raise

👶 Vitalik Buterin @ TOKEN2049

☕️ Fresh T/A, and more!

As my father used to say, “eat what you want and leave the rest!” 👨🍳

P.S be sure to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:2.014T H:2.192T L:1.961T C:2.166T +151.674B (+7.53%) V:116.342B

CTMC saw a major uptick last week, gaining 7.5% off the back of risk-on trading following the long awaited rate cut from the US Fed. Volume ascended marginally, remaining in relatively average levels despite clear rallies across the board. That being said, MoM volume across exchanges has seen a 30% rise in August. ETFs broke their recent losing streak, adding $353M in net inflows by week’s end. Digital asset funds continue to garner major attention, highlighted by a fantastic breakdown from Coinshares that can be viewed here. Liquidations totaled $779M with the help of $120M in shorts cleaned up in Thursday’s trading alone. While CTMC has yet to break its descending triangle, a two week reversal has provided us with significant profits since our reentry reversals in Vol. 5 of Keyed In.

Moving beyond the technicals, US rate cuts stole the show last week after announcing an unexpected 0.5% rate cut. The first since 2020, the cut led to a near immediate BTC pump, along with major upticks in risk assets across the board. While many market participants believe the move will allow the US to avoid a recession with a ‘soft landing’, history would suggest we could just be kicking the can down the road. That being said, the move has certainly been welcome considering how long we’ve been grappling with multi-decade highs in borrowing costs.

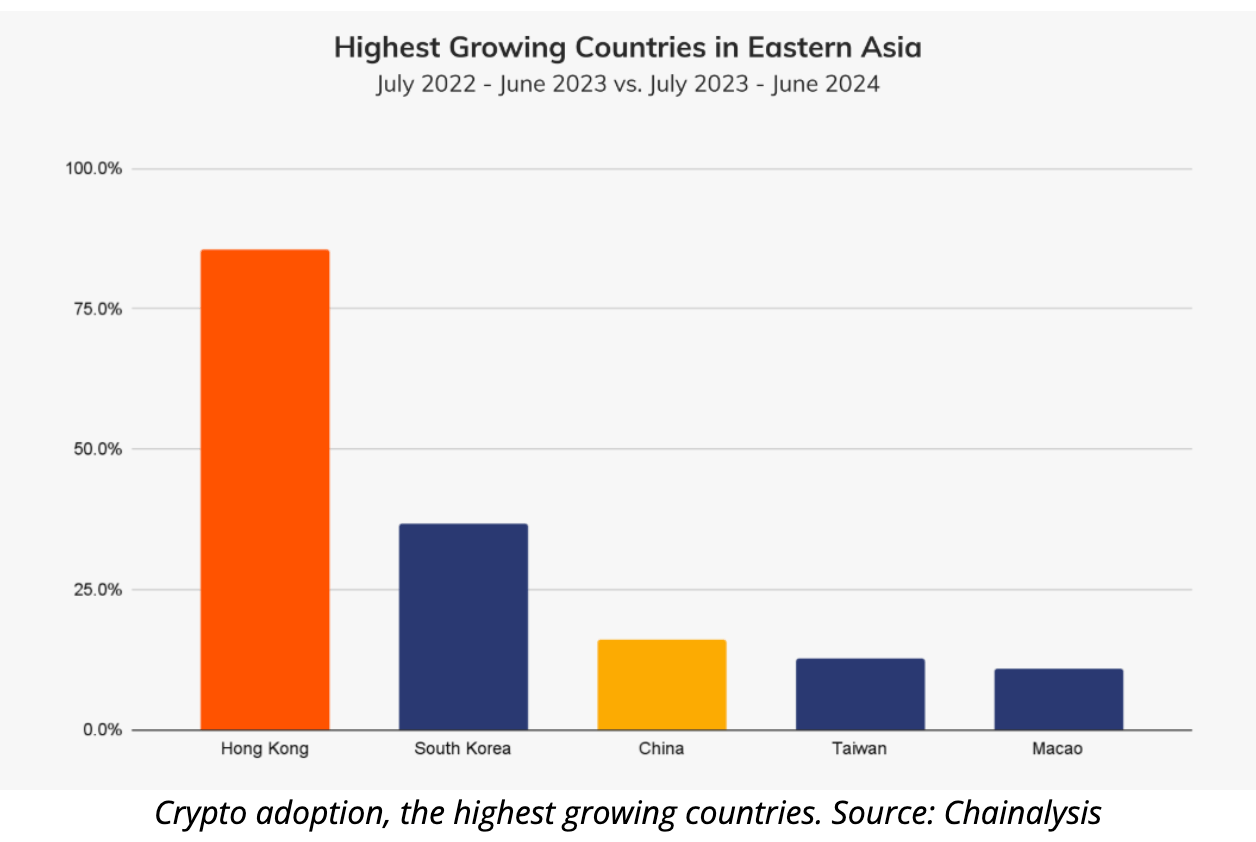

Stablecoin adoption continues to ramp up, putting pressure on fiat currencies across the globe. Particularly in countries with major inflationary pressures and currency devaluation, stablecoins offer a compelling alternative outside of traditional monetary networks. In East Asia, stables have captured a significant share of dominance. Highlighting this, Hong Kong has emerged as a leader in adoption, with a staggering 40% of the regions value received in stablecoins. The country has seen an 85% increase in crypto adoption YoY, taking first place in East Asia just ahead of South Korea.

Microstrategy made headlines this week after announcing a $1B BTC raise and a $458M BTC purchase. The company now owns over 1% of BTC’s total supply, with 252,000 BTC and an unrealized profit of roughly $6B. To fund the purchases, the company completed a $1.01 billion sale of convertible notes, due for 2028 with a 0.625% conversion rate. As far as corporate hodlers are concerned, Microstrategy leads the pack by miles, followed by Marathon Digitial Holdings (MARA) at 26K BTC according to data from BitcoinTreasuries.net.

Singer, songwriter, and crypto enthusiast Vitalik Buterin made quite an appearance at TOKEN2049, dropping a hot new single and highlighting the steep drop in L2 network fees while calling for a push towards mainstream adoption. Buterin noted that the industry needs to cater to the needs of mainstream users while upholding the ethos of decentralization. He argued that expensive NFTs do not add real value to the ecosystem and called for less attention to the asset class. The conference was filled with 7000 companies and over 20,000 attendees — numbers that exceed the daily active users of ETHs L1/L2 chains.

“We need to satisfy the needs of mainstream adoption, and we need to hold on to open source and decentralization values, at the same time.”

LOCKING IN:

BTC/USD (BINANCE) O:59157 H:64481 L:57465 C:63586 +4421.36 (+7.47%) V:1.426K

BTC continued its two week win streak, gaining nearly 7.5% after rejecting just above the 5D SMA at 64K. The move was largely spurred by the US Fed’s rate cut, leading to a near 6% move within hours of the announcement. Liquidations totaled just over $217M. ETF’s snapped the recent losing streak, with $377M of net inflows by week’s end. Volume rose marginally, maintaining relatively average levels and largely descending on the daily. Concerns surrounding Mt. Gox bankruptcy distributions and the German government’s $3B BTC sale continue to ease. Market tensions surrounding Kamala Harris’ potentially strict crypto regulation have also softened after recent comments signaled a more measured approach.

Looking at the technicals, our reversal calls in Vol. 5 have proven extremely well advised, providing over 15% worth of profits over the last two weeks. There’s certainly no shame in some profit taking for those who caught the entries in anticipation of higher confidence positions above 64K. BTC has yet to break north of its' descending triangle, and assets often need time to rest after going on such significant runs. Looking south, a move below the SMA 5 at $60,500 would suggest deeper corrections in play, well worth avoiding considering the depth of our recent run.

ETH/USD (BINANCE) O:2316 H:2632 L:2254 C:2583 +264.92 (+11.43%) V:200.729K

ETH turned the tables with a solid display of relative strength last week after largely struggling to keep pace over recent months. A double digit rally put the asset back in the spotlight, a refreshing moment for its traders off the back of a solid return to risk on post rate cuts. Liquidations totaled $140M. Despite ETH’s success, ETFs continue to underperform—still bleeding $16M in net outflows with an additional $80M drained in the Monday session. Network fees are virtually nonexistent relative to this time last year, continuing to raise concerns regarding inflationary pressures. Adding to concerns are significant coin movements from ETHs whales, including a $9M Kraken transfer from an ICO whale with an 838,000% profit.

Technically speaking, our reversal recommendations two week’s ago have provided double digit profits. We can begin to consider profit taking strategies in anticipation of higher confidence reentries above resistance and avoidance of potential corrections in the interim. ETH arguably has more room to run here, highlighted by its outperformance in Monday’s trading—though the asset has quite a ways to go before reentering its previous range. ETH.D has potentially bottomed out for the time being, though it remains to be seen whether or not the asset can continue trending higher against its bellwether after largely declining since early June. A confident break above $2700 would open the door for further gains, though clear resistance remains ahead. We will continue to recommend tighter stops and earlier targets until ETH can successfully return to its previous channel.

DXY O:101.035 H:101.474 L:100.215 C:101.738 -0.376 (-0.37%)

DXY continued its decline last week, unsurprising considering the rate cut announcements and a clear return to risk on trading. The index remains just above the critical 100 level. Despite briefly engulfing last week’s losses in Monday’s trading, DXY was unable to sustain its momentum— conceding 75% of the move ahead of the closing bell. US equities saw major gains post rate cut, with both SPX and DJI printing fresh ATHs in last week’s trading. DXY has since engulfed the entirety of its early week gains.

Dovish speeches from Fed officials early in the week have made a palpable difference in post cut sentiments. On Tuesday, Chicago Fed President Austan Goolsbee said just rates need to be lowered significantly to protect US labor markets, and that he looks for may more rate cuts over the next year. RSI has risen with an interim double bottom appearing to form. Resistance remains at 101.2, with support worth watching at 100.2/50. Market participants expect a near 100% chance of further cuts in November, the size of which is still up for debate. We have a heavy week ahead on the economic calendar. Jobless data, PCE, and several more Fed speeches remain on the docket including a prerecorded speech from J. Powell himself. All of these will be well worth our attention in figuring out where the Fed will go from here, now that markets are done wrestling with extended multi-decade highs in borrowing costs.

WEEKLY POLL:

CHEEZY CHARTS:

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_