- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 9, October 1 - October 7)

Welcome to Vol. 9 of Keyed In, the official Consortium Key newsletter!

Rising geopolitical tensions and a blowout jobs report led to another bearish storm last week across CTMC. Profit taking calls in Vol. 8 have certainly proven well advised. The storm has begun to clear, leaving us with plenty to cover, so let’s dive in!

TODAY’S MENU:

📉 Iranian missiles & market instability

💈 FTX repayment approval

🕵️♂️ HBO DOXumentary—Satoshi reveal??

📝 BitWise XRP ETF filing

☕️ Fresh T/A, and more!

P.S be sure to share this with your fellow degens—looking forward to building out with our team and the rest of the CK community. Plenty more to come so stay tuned! Don’t hesitate to reach out with any questions, comments, suggestions, or to pay your compliments to the chefs!

NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local (Formerly) Starving Chartist.

https://x.com/CHEEZKING_WSK

Don’t forget to subscribe to Keyed In, and join us on Telegram! 👇

https://consortiumkey.beehiiv.com/subscribe

t.me/consortiumkey

ZOOMING OUT:

CTMC O:2.254T H:2.259T L:2.028T C:2.138T -116.059B (-5.15%) V:129.967B

CTMC struggled to find its footing last week. Ultimately printing an engulfing candle on the weekly, CTMC failed to reverse its early losses after rising geopolitical tensions led to a near 7.5% drop by Tuesday’s close. Blowout jobs data to the tune of 100,000 has begun to make the case for less rate cuts than anticipated. Volume descended marginally, falling just short of 2 month highs on Wednesday and dropping throughout the remainder of the week. ETFs shed $286M, finishing the week up with a 3 day losing streak for both BTC and ETH funds. Liquidations fell just short of $1.5Bm, with a staggering $500M+ seen in Monday’s trading, the highest daily levels throughout September. While CTMC has largely continued to move through its descending channel, higher highs and lower lows would suggest the formation of a symmetrical triangle, potentially leading to wide range moves upon completion.

Looking past the technicals, an Iranian missile strike in Israel on Monday triggered a flash crash across risk markets. Despite its desire to act as a safe haven asset, BTC was unable to weather the storm—posting a near 5% drop within hours of the strikes. Often likened to gold in regards to its hedging power against global instability, last week’s price action underscores the markets sensitivity to geopolitical and otherwise external shocks. Highlighting further instability relative to the risk curve, ETH and SOL posted 6% and 8% losses over the same timeframe. While this certainly presented buying opportunities throughout the market, many traders will likely remain on the sidelines as they wait for the dust to ultimately settle.

FTX creditors are now officially poised to take a significant haircut after a Delaware judge approved the estate’s bankruptcy plan. While 98% of creditors are expected to receive an average of 118% worth of their previous balances, the payout will be tied to the value of wallets at the time of bankruptcy in November 2022. For perspective, BTC was trading around $16K, equating to a near 75% loss for those who held the bellwether asset within the FTX exchange. While the SEC has come out against it, FTX lawyers are also exploring plans to allow for payments to also be received in stablecoins. FTT saw a 55% jump in value following the approval, though the asset remains down nearly 90% since the 2022 filing.

An HBO doXumentary™ airing Tuesday claims to reveal the truth behind finance’s greatest modern mystery—the identity of BTC creator Satoshi Nakamoto. Satoshi, who published the BTC whitepaper in 2008, vanished from the internet just two years later and has yet to be identified despite many claims throughout the 14 years that have followed. The true decentralization of BTC and the lore behind the anonymity of its’ creator are, in my opinion, the fundamental strengths of crypto’s most valuable asset. With an estimated net worth of $66B (1.1M BTC), a concrete revelation regarding Satoshi’s true identity could easily send shockwaves throughout the ecosystem. Polymarket bets behind HBO’s reveal favor Nick Szabo at 25%, though 38% of bettors believe it will be an “Other/Multiple” creator(s). The doXumentary™, titled “Money Electric: The Bitcoin Mystery”, is scheduled to air on Tuesday at 8 p.m. EST

Lastly, BitWise officially filed an S-1 registration statement with the SEC in the hopes of offering an XRP ETF. We’ve covered several S-1 registrations here in the past for both BTC and ETH, and its’ certainly worth noting that it can take years to get approved with many changes along the way. VanEck’s own S-1 filing for an ETH ETF was made in 2021, 3 years prior to hitting the market. XRP remains the 7th largest crypto by market cap. Despite the news of the filing, XRP was unable to survive last week’s fallout, posting a near 17% loss by Sunday’s close.

"Looking at the market strength evident in September’s employment report, the real debate at the Fed should be about whether to loosen monetary policy at all….Any hopes of a [50 basis point] cut are long gone."

LOCKING IN:

BTC/USD (BINANCE) O:65650 H:65650 L:59907 C:62813 -2821.44 (-4.30%) V:1.165K

BTC saw an engulfing correction last week, dropping nearly 4.5% off the back of rising tensions in the Middle East and risk-off trading throughout the market. ETFs saw $262M of net outflows by Sunday’ close, marking the worst performing week for the funds in a month. Liquidations totaled $359M, nearly a third of which came from longs wiped out in Monday’s trading alone. Volume rose marginally, remaining locked in relatively average levels with minimum deviation over the last several weeks. Interestingly, the BTC stored on exchanges tanked to 2.8M, the lowest levels seen since 2018 according to data from CryptoQuant. Historically, record lows on exchanges precede major swings to the upside, well worth our attention considering the current coiling on the HTFs.

Looking at the technicals, our profit taking calls in Vol. 8 remain well advised. While BTC posted its best September performance since 2013, clear resistance remains at the 64.5K level, highlighted by the rejection seen just below in Monday’s trading. A break north of this level would certainly open the door for higher confidence reentries. BTC remains largely locked in a descending channel, though Septembers’ higher highs are well worth noting. Looking south, a breach of BTC’s 5D SMA at $61,900 would suggest deeper corrections on the table, heightened significantly with a loss of last week’s lows at $59,900.

ETH/USD (BINANCE) O:2659 H:2663 L:2311 C:2440 -219.79 (-8.23%) V:143.587K

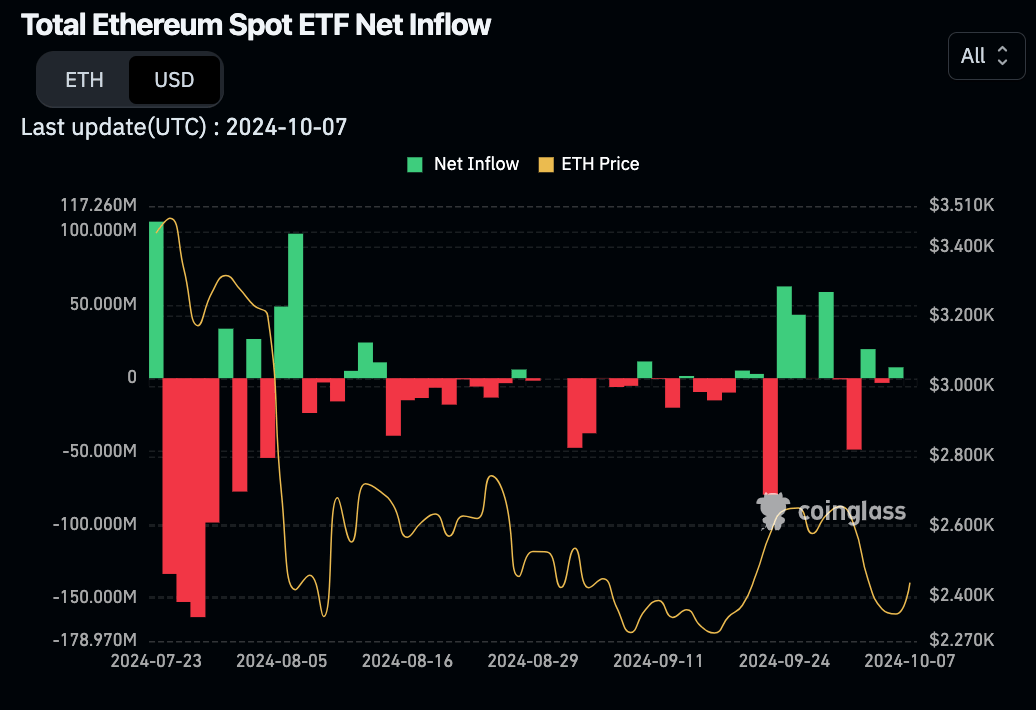

ETH displayed clear relative weakness against its bellwether amid last week’s downturn. After a near 300% engulfing correction on the weekly, ETH saw losses largely relative to its position on the risk curve, highlighting the macro’s position in the driver’s seat. Liquidations totaled $305M. ETFs saw about $25M of net outflows, returning immediately to the red off the back of the first weekly gain since inception. Developers remain focused on improving ETH’s network at the base layer, highlighted by the new improvement proposal (EIP-7781) which aims to slash block times by 33%. Hoping to reduce layer 2 network fees, the proposal would increase ETH’s throughput by 50%—an interesting offer off the heels of Vitalik Buterin recommending lower staking requirements just several days ago.

Technically speaking, we recommend sidelining capital for those who were able to benefit from last week’s profit taking calls. Macro movements remain clearly in the drivers’ seat, though technicals would suggest wide rage moves on the horizon considering recent coiling. Clear resistance remains at September’s highs just below $2750, though a breach of ETH’s 5D SMA at $2640 would certainly read bullish in the short term. Looking south, a decisive loss of last week’ lows at $2300 would suggest deeper corrections still very much in play, well worth our attention considering ETH’s recent coiling and the trepid nature of the market as it relates to current events.

DXY O:100.418 H:102.687 L:100.179 C:102.487 +2.070 (+2.06%)

DXY saw quite the reversal last week, bouncing firmly off the critical 100 level and maintaining its role as a flight to safety amid clear geopolitical tensions. Blowout jobs data certainly served to prop up the index, 100,000 higher than estimates and immediately repricing the odds of another 50bps November cut from 30% to near zero. The reversal engulfed six week’s worth of negative price action, squeezing shorts which had been sitting at $12.9B, the highest levels in over a year. Despite the bounce, all 3 US equity indices saw positive returns, still hovering within striking distance of fresh ATHs.

Looking back at J. Powell’s comments regarding a “data driven approach”, it is unsurprising to see some traders begin to question whether or not we will even see another cut in November. Current odds have a 25bps cut priced in at about 87%. RSI, MAs and MACD are all flashing buy signals, foreshadowing further potential pressure on risk assets with DXY having made a triumphant return to its two year channel. We have a heavy week ahead on the Econ calendar with several Fed speeches leading up to Thursday’s PPI and CPI on Friday. Further beats would likely serve to continue propping up the index, well worth our attention considering the coiling we'‘re beginning to see in both BTC and CTMC.

WEEKLY POLL:

CHEEZY CHARTS:

CK LINKS

/https://consortiumkey.beehiiv.com/subscribe

https://linktr.ee/ConsortiumKey

https://x.com/ConsortiumKey

https://x.com/KeyedIn_

KEY READS

Today we filed an S-1 for a Bitwise XRP ETP!

For more than a decade, XRP has been an enduring crypto asset that many investors want exposure to.

Over the past 6+ years we’ve worked to pioneer investment vehicles that provide access to the emerging opportunities in the space.… x.com/i/web/status/1…

— Hunter Horsley (@HHorsley)

1:47 PM • Oct 2, 2024

There's a new EIP to increase Ethereum's throughput by 50%.

- 12 second block times -> 8 seconds

- 6 data blobs per block -> 9 blobs per block

- DEXes become around 1.22x more efficientIf approved, this would be a huge first step in improving Ethereum L1's performance.

— cygaar (@0xCygaar)

5:48 PM • Oct 6, 2024