- Consortium Key

- Posts

- CONSORTIUM KEY

CONSORTIUM KEY

KEYED IN (Vol. 1, July 29 - August 4)

Welcome to the very first edition of Keyed In, the official Consortium Key newsletter—looks like we picked a hell of a week to get started! The importance of a level headed, unbiased, data driven approach to the market is particularly clear on days like today, and I’m looking forward to building this out along with our team and the rest of the CK community! Plenty more to come so be sure to share and stay tuned, and feel free to reach out with any questions, comments, suggestions, or anything else you’d like to see us dive into. NFA as always—and as always—hope you guys enjoy!

- CHEEZKING, Your Local Starving Chartist.

Click the link below to subscribe!

https://consortiumkey.beehiiv.com/subscribe

ZOOMING OUT:

CTMC O:2.373T H:2.442T L:1.975T C:2.012T -360.813B (-15.21%) V:104.483B

CTMC cratered last week, posting its largest drop in nearly 2 years amid heightened geopolitical tensions in the Middle East and significant risk-off trading throughout the global markets. Initially, trend support was largely maintained, with BTC hovering just above the CME futures gap before entering a wide range selloff Sunday following a cratering of Japan’s Nikkei 225 and US futures at Asia’s weekly open. An intensification of the Yen/USD rally boiled over throughout markets globally, leading to the largest drop in European stocks in 2 years and the worst day for MSCI Asia Pacific index since 2008. If that wasn’t enough to grab our attention, Nikkei itself saw its highest single day drop since 1987. Ramping tensions in the Middle East have also served to exacerbate the move, creating a perfect storm that has absolutely pummeled assets across the risk curve.

BTC and ETH ultimately posted their biggest weekly drops since the FTX collapse in 2022, while CTMC itself saw a clean drop below the key $2T mark. Liquidations spiked, ultimately totaling just under $2B across the index—nearly 3X from the previous week with $430M in longs wiped out in Sunday’s trading alone. Traders have since priced a 60% chance of the Fed cutting rates prior to the upcoming meeting, a move that would mark the first emergency intra-meeting cut since March 2020. Stablecoins hit 2 year highs, and BTC and ETH have since continued cratering—dropping double digits since weekly open with a whopping cascade of liquidations totaling $700M over the last 24 hours.

LOCKING IN:

BTC/USD (BINANCE) O:68173 H:69911 L:57425 C:58301 -9952.97 (-14.58%) V:1.672K

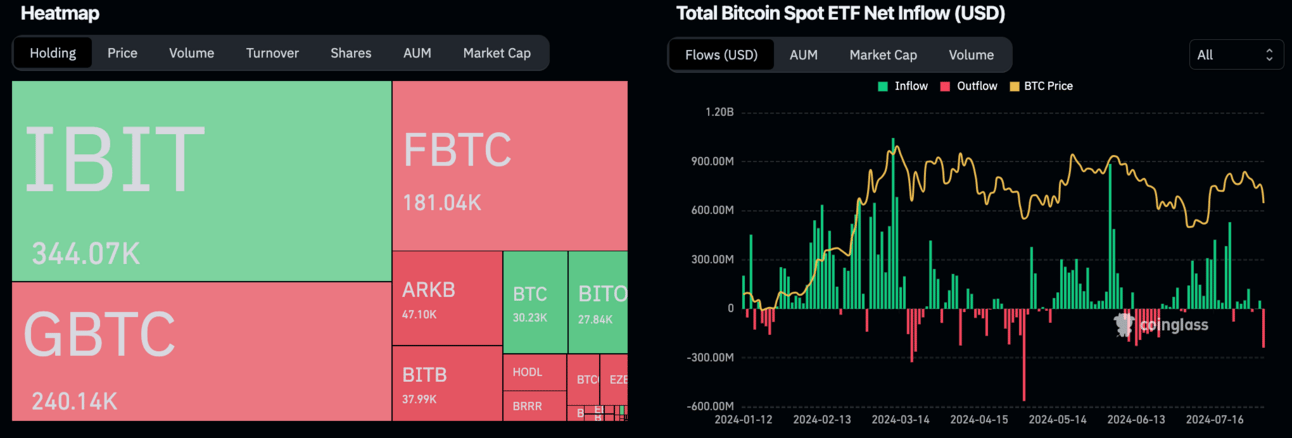

BTC enjoyed considerable success over the last several weeks amid positive press and major political endorsements surrounding the Bitcoin 2024 conference in Nashville. Some degree of correction was certainly to be expected considering the depth of the move, and any potential upwards momentum has been drowned out as crypto specific catalysts take the backseat in lieu of major macro movements. Cascading liquidations are certainly worth noting, with over $385M wiped out over the past 24 hours alone. A major unwinding of market leverage is taking place after an injection of fresh, lower conviction capital into the market tied to ETFs and institutional capital.

Looking at the technicals, BTC has broken decisively below the lower bands of its Q2 range. The asset has reached 6 month lows, briefly conceding critical psychological support at 50K before reclaiming the key level over the last several hours. Our previous profit taking recommendations have proven extremely well advised, and higher risk traders can certainly begin to nibble on reentries here. An extended move below $50K would suggest further downside in play, and sizable positions are likely best served awaiting the dust to settle.

ETH/USD (BINANCE) O:3273 H:3399 L:2635 C:2688 -583.77 (-17.84%) V:270.027K

ETH often takes the role of the dramatic younger sibling in times of increased volatility, and recent trading has only served to underscore this process. Unable to avoid the fallout, ETH ultimately shed nearly 20% by Sunday’s close. Despite the positive press surrounding their launch, ETH’s ETFs continued bleeding out throughout the week. Grayscale’s recently converted ETHE topped $2B in outflows, contributing significantly to ETH’s relative weakness. Volume has seen a decisive spike on the daily, reaching 2 month highs with over half the session remaining. ETH’s liquidations have largely kept pace with BTC, totaling $360M in the last 24 hours. The asset rests just below $2300, down 15% in Monday’s trading as we prepare the rest of our report.

With relative weakness on full display, we can anticipate increased volatility for ETH still very much on the horizon as markets continue to crater across the higher ends of the risk curve. The hype surrounding ETF launch will likely continue to be drowned out by the macro as risk off trading continues to take hold. Similar to BTC, profit taking recommendations have proven extremely well advised, and we can certainly begin to eyeball lighter entries as we begin to hedge our bets in the event of a meaningful retracement. Down over 35% since last week’s open, some degree of retracement can be expected, though tight stops and earlier targets will remain recommended as we wait for the dust to ultimately settle.

DXY O:104.328 H:104.799 L:103.125 C:103.220 -1.107 (-1.06%)

Even DXY was unable to avoid the recent fallout, breaking inverse correlation with CTMC and US markets amid concerns that the US Fed is behind the curve after failing to cut rates at July’s meeting. Markets bets have quickly gone from near zero to a 60% chance of an emergency intra-meeting rate cut, a move that hasn’t been seen since March 2020. In my humble opinion, the odds of this occurring are still unlikely despite market predictions. Signaling a cut would likely be just as effective, and the Fed would almost certainly prefer to avoid spooking markets by likening the recent selloff to such a devastating black swan event as seen in 2020. Regardless, NDQ futures suggest the index is poised for its worst open in 4 years. Berkshire Hathaway has recently unloaded 50% of its Apple position, highlighting institutional risk-off trading as we approach weekly open. While last weeks jobs report certainly left much to be desired, it would seem recent catalysts are much more related to a global unwinding than dollar specific issues. That being said, the potential of a feedback loop certainly exists here, and will continue to be well worth our attention as we head further into the rest of this week’s trading.

CHEEZY CHARTS

TLDR:

Wide range selloffs across markets globally following a cratering of Japan’s Nikkei 225 and US futures at Asia’s weekly open. Largest drop in European Worst day for MSCI Asia Pacific index since 2008, and largest single day drop for Nikkei since 1987. NDQ futures looking brutal. Traders now betting on a 60% chance of an emergency intra-meeting cut just around the corner, though the move seems unlikely considering the Feds desire to avoid further spooking markets. Previous profit taking strategies continue to prove extremely well advised. Reversal nibbles are certainly on the table here for higher risk traders, though tight stops and early targets will remain highly recommended. Staying cool, calm, and collected. Keeping a very close eye on retracement levels and broader markets as we wait for the dust to settle. Missed money is ALWAYS better than lost money! Hope you guys have enjoyed, and feel free to place your bets down below on where you think we’ll be at come next week! NFA as alway and hope you degenerates enjoy!